Income investing is a popular way to take advantage of companies with firm financial footing, but with so many companies distributing dividends, it can be hard to choose the best ones for your portfolio.

Thankfully, we can utilize the Zacks Premium Growth and Income Screener to find companies with a high dividend yield paired with a strong Zacks Rank #1 (Strong Buy) or #2 (Buy).

For the sake of this article, I utilized the screener and chose three stocks with a dividend yield higher than 10%, a Zacks Rank of #1 or #2, and stocks residing in industries outperforming the market year-to-date. Let’s analyze these three high-yield dividend distributors and find the one I believe is best suited for your portfolio.

ZIM Integrated Shipping

ZIM Integrated Shipping Services

ZIM

provides container shipping and other related services. It currently resides in the Zacks Transportation – Shipping Industry, which has a year-to-date return of nearly 29%.

ZIM recently declared a dividend of $17 per share, effective March 22

nd

, and payable to shareholders of record on April 4

th

. The company’s annual dividend yield is currently 11.5%, much higher than the S&P 500’s 1.35% yield, with a dividend payout ratio of roughly 26%. There have been two dividend increases in the last five years.

The company’s annual free cash flow was $4.9 billion in 2021, representing a massive 490% increase from 2020, and has grown by a remarkable 1100% since 2019. Free cash flow per share has also seen a steep climb since 2019, increasing by 950%. Additionally, the FCF margin has increased from 12.1% to 46.4% since 2019.

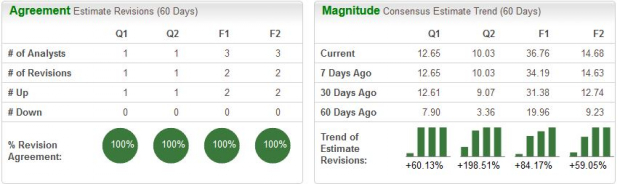

The consensus estimate trend has increased across all timeframes over the last 60 days. Next quarter’s EPS estimate has increased 60%, now forecasting earnings of $12.65 per share, and for the following quarter, it has increased by a staggering 200% to $10.03 per share. The trend has increased nearly 85% to $36.76 per share for the current year and has increased roughly 60% to $14.68 per share for the following year.

Image Source: Zacks Investment Research

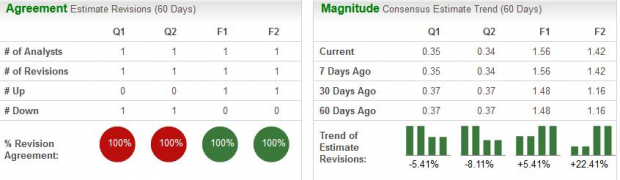

Shares of ZIM, up 75% over the last year, have far exceeded the S&P 500’s 15% return. Year-to-date, ZIM shares have continued to display notable strength and defense, increasing nearly 44% in value and easily outpacing the S&P 500’s decline of 7%. Below is YTD performance compared between the two.

Image Source: Zacks Investment Research

ZIM is currently a Zacks Rank #1 (Strong Buy) and has an overall VGM Score of an A.

Golden Ocean Group Limited

Golden Ocean Group Limited

GOGL

is a shipping company engaging in the transportation of dry bulk cargoes. Similar to ZIM, it’s in the Zacks Transportation – Shipping industry, which ranks in the top 37% of all industries.

The company’s annual dividend yield is much higher than the S&P 500’s at 30.3%, its dividend payout ratio is 131%, and its five-year annualized dividend growth rate is 36.5%. GOGL has increased its dividend eight times in the past five years.

Annual free cash flow for GOGL increased by a respectable 47% from 2020 to 2021, consecutively growing each year since 2019. The free cash flow margin decreased 5% from 2020 to 2021 and is slightly lower (14%) than the 16% value in 2019. Additionally, free cash flow per share has increased from $0.79 to $0.81 since 2019.

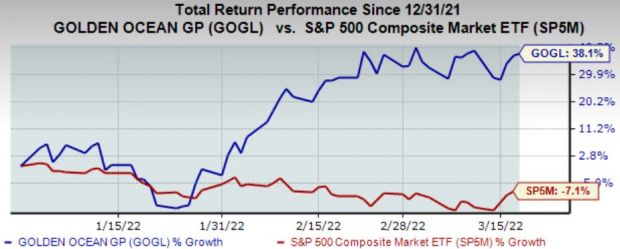

Analysts have made four estimate revisions (two up, two down) over the last 60 days. The consensus estimate trend for the next and following quarter has been affected by two downwards revisions, causing declines of 5.4% and 8.1%. Two upwards estimate revisions have come in for the current and next year, increasing full-year earnings by 5.4% to $1.56 per share and next year’s earnings by 22.4% to $1.42 per share.

Image Source: Zacks Investment Research

GOGL shares have been on fire over the last year, providing investors with a nearly 100% return and easily outperforming the S&P 500. Year-to-date, the story has been the same; GOGL shares have vastly exceeded the S&P 500’s return and have increased almost 40%. Below is YTD performance compared between the two.

Image Source: Zacks Investment Research

GOGL is currently a Zacks Rank #2 (Buy) and has an overall VGM Score of an A.

Rio Tinto

Rio Tinto

RIO

is an international mining company extracting gold, diamonds, titanium, and other precious resources. The company resides within Zacks Mining – Miscellaneous industry, which has posted a 20% return year-to-date.

The company declared a $4.79 per share dividend in February, with an ex-dividend date of March 10

th

and a payable date of April 21

st

. RIO’s annual 11.1% dividend yield pays investors $8.33 per share and has a dividend payout ratio of 74%. Additionally, Rio Tinto has a five-year annualized dividend growth rate of roughly 23.5%, uplifted by six dividend increases over the last five years.

RIO’s annual free cash flow grew 72% from 2020 to 2021 and has increased nearly 90% since 2019. The free cash flow margin has steadily increased from 34% to 44% since 2019, and free cash flow per share has nearly doubled from $9 per share to $17.3 per share.

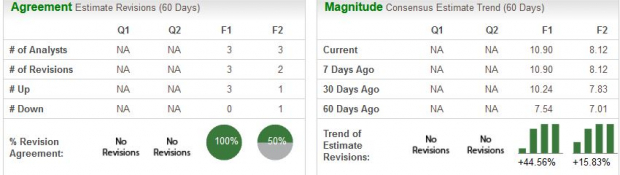

Four of the five estimate revisions that have come in over the last 60 days have been upwards, and there have been no revisions concerning the next and following quarter. However, the consensus estimate trend has increased by 44.6% to $10.90 per share for the current year and 16% to $8.12 per share for FY23.

Image Source: Zacks Investment Research

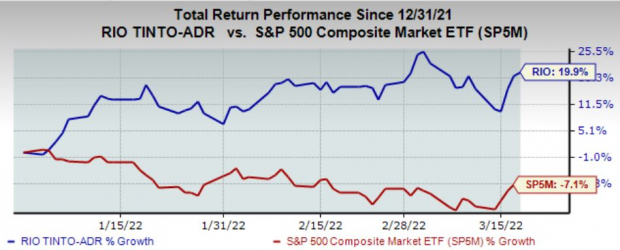

RIO shares have underperformed relative to the S&P 500 over the last year, scratching in a 12% return. The share price took a deep plunge last November but seems to have recovered in 2022, rising by nearly 20% year-to-date and easily outpacing the S&P 500. Below is YTD performance compared between the two.

Image Source: Zacks Investment Research

RIO is currently a Zacks Rank #2 (Buy) and has an overall VGM Score of an A.

Bottom Line

After analyzing a few key metrics and future growth outlook, I believe that ZIM would be the best choice for your portfolio. RIO has an unsustainable dividend payout ratio, and GOGL’s free cash flow metrics were the weakest of the three. ZIM’s rapidly increasing free cash flow and high dividend yield go hand in hand, and the outlook concerning next year’s earnings has increased significantly over the last 60 days.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report