Newmont Corporation

NEM

is scheduled to report

third-quarter 2021

results before the opening bell on Oct 28.

The gold miner surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missed once. For this timeframe, the company delivered an earnings surprise of roughly 7.1%, on average. Newmont posted an earnings surprise of 9.2% in the last reported quarter. The company’s third-quarter results are expected to reflect the impacts of lower year-over-year gold prices.

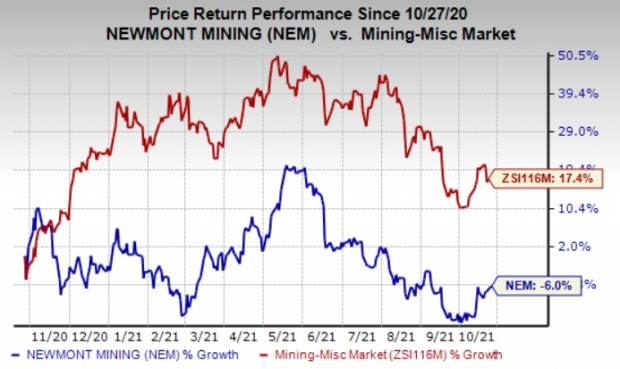

The stock has declined 6% in the past year compared with the

industry

’s 17.4% rise.

Image Source: Zacks Investment Research

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter consolidated revenues for Newmont is currently pegged at $3,232 million, which calls for a rise of around 2% year over year.

Some Factors at Play

The company’s results in the to-be-reported quarter are likely to reflect the weakness in gold prices. Apprehensions regarding the global economic growth fueled safe haven demand for gold last year. The ultra-low interest rate environment, geopolitical tensions and fears over supply crunch stemming from suspensions of operations by miners amid the pandemic also spurred up demand for gold in 2020.

However, gold lost the momentum this year, largely due to vaccine rollouts and optimism over an economic recovery. The metal came under pressure in the third quarter, especially in September, from a stronger dollar, higher U.S Treasury yields and the U.S. Federal Reserve’s tapering jitters. Prices of the yellow metal declined around 4% in September 2021 and were also down roughly 1.1% in the third quarter. Lower year over year average realized gold prices are expected to have affected Newmont’s performance in the third quarter.

Meanwhile, strong performance across Akyem and Ahafo is expected to have driven results in the company’s Africa operation in the third quarter. Performance at Penasquito in North America is also likely to have been supported by an improvement in recovery rates. In Australia, production is likely to be have been affected by the company’s move to place the Tanami mine in care and maintenance as a result of the coronavirus. Challenges (including severe weather, shovel reliability and operational delays) while commissioning the Autonomous Haulage System project at Boddington are also expected to have impacted production at the mine in the September quarter. Some pandemic-induced impacts are also likely to have continued in its South American operations in the third quarter.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Newmont this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP:

Earnings ESP for Newmont is -1.43%. The Zacks Consensus Estimate for earnings for the third quarter is currently pegged at 75 cents. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Newmont currently carries a Zacks Rank #4 (Sell).

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Tronox Holdings plc

TROX

, scheduled to release earnings on Oct 27, has an Earnings ESP of +0.38% and carries a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Chemours Company

CC

, scheduled to release earnings on Nov 4, has an Earnings ESP of +5.70% and carries a Zacks Rank #2.

Albemarle Corporation

ALB

, scheduled to release earnings on Nov 3, has an Earnings ESP of +8.73% and carries a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report