Freeport-McMoRan Inc.

FCX

recorded net income (attributable to common stock) of $1.1 billion or 74 cents per share in fourth-quarter 2021, up from $708 million or 48 cents per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share came in at 96 cents. The figure missed the Zacks Consensus Estimate of 97 cents.

Revenues rose roughly 37% year over year to $6,164 million. The figure also missed the Zacks Consensus Estimate of $6,226.8 million. The mining giant benefited from higher realized copper prices and sales and in the quarter.

Operational Update

Copper production rose around 20% year over year to 1,033 million pounds in the fourth quarter.

Consolidated sales from mines went up 18% year over year to 1,020 million pounds of copper, driven mainly by the ramp-up of underground mining at PT-FI and higher milling rates across North America and South America. The company sold 395,000 ounces of gold (up around 35%) and 19 million pounds (down roughly 10%) of molybdenum during the quarter.

Consolidated average unit net cash costs per pound of copper were $1.29, up about 0.8% year over year. The figure was higher than the company’s October 2021 estimate of $1.26 per pound, mainly due to nonrecurring labor-related charges at the Cerro Verde mine for collective labor agreements.

Average realized price for copper was $4.42 per pound, up roughly 30% year over year. Average realized price per ounce for gold fell around 3% year over year to $1,808. Average realized price per pound for molybdenum was $19.42, up around 95% year over year.

FY21 Results

Earnings for full-year 2021 were $2.90 per share compared with earnings of 41 cents per share a year ago. Net sales increased 61% year over year to $22,845 million.

Financial Position

Cash and cash equivalents at the end of 2021 were $8,068 million, up 121% year over year. The company’s total debt was $9,450 million, down around 3% year over year.

Cash flows provided by operations were $2.3 billion for the fourth quarter.

Guidance

For 2022, Freeport anticipates consolidated sales volumes to be roughly 4.3 billion pounds of copper.

The company also expects gold sales volumes of 1.6 million ounces for 2022. It also expects sales of 80 million pounds of molybdenum for the year.

For the first quarter of 2022, Freeport expects sales volumes to be 970 million pounds of copper, 380,000 ounces of gold and 20 million pounds of molybdenum.

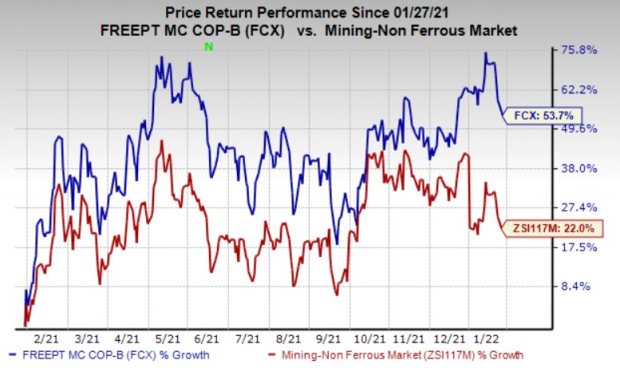

Price Performance

Freeport’s shares have rallied 53.7% in the past year compared with a 22% rise of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Freeport currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the basic materials space include

Commercial Metals Company

CMC

,

Albemarle Corporation

ALB

and

AdvanSix Inc.

ASIX

.

Commercial Metals, sporting a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 62% for the current fiscal year. The Zacks Consensus Estimate for CMC’s current fiscal year earnings has been revised 39.5% upward over the past 60 days. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 13.1%, on average. CMC has rallied around 67% in a year.

Albemarle, carrying a Zacks Rank #1, has an expected earnings growth rate of 51.3% for the current year. ALB’s consensus estimate for the current year has been revised 5.4% upward over the past 60 days.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 22.1%. ALB shares have gained around 22% in a year.

AdvanSix, carrying a Zacks Rank #1, has an expected earnings growth rate of 7.4% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 5.3% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied around 84% in a year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report