Fortuna Silver Mines Inc.

FSM

and Roxgold Inc. recently completed the previously announced business combination, which has resulted in a low-cost intermediate gold and silver producer with four operating mines in Americas and West Africa — two of the world’s fastest growing precious metals producing regions. The combined company has a projected annual gold equivalent production profile of approximately 450,000 ounces. It has one of the best organic growth pipelines among any of the intermediate precious metal producers as well as peer-leading free cash flow generation, increased scale and diversification, and lower costs.

Canada-based Fortuna Silver had three mines — San Jose mine in Mexico, Lindero Mine in Argentina and Caylloma Mine in Peru. Following the combination with RoxGold, it now has operations in West Africa with the addition of Roxgold’s high-grade Yaramoko Gold Mine located in Burkina Faso and its advanced development project Séguéla Gold Project located in Côte d’Ivoire.

Financials Details

Fortuna acquired all of Roxgold’s shares in exchange for 0.283 of a common share of Fortuna and C$0.001 (0.00081) in cash for each Roxgold Share held. Roxgold is now a wholly-owned subsidiary of Fortuna. Following both the companies’ shareholder approval, the British Columbia Supreme Court granted a final order on Jun 30, 2021 approving the arrangement.

Rationale of the Deal

Following the merger, Fortuna Silver’s is expected to produce approximately 450,000 gold equivalent ounces, which is expected to increase further once the Séguéla comes online. Roxgold’s Yaramoko and Séguéla are low-cost assets with low technical complexity contributing meaningfully to growth, while reducing overall costs. Fortuna Silver’s All-In Sustaining Cost (AISC) is projected at approximately $950 per gold equivalent ounce, lower than nearest peers like

Coeur Mining, Inc.

CDE

,

Pan American Silver Corp.

PAAS

,

First Majestic Silver Corp.

AG

, Hochschild Mining and Hecla Mining Company.

It will have an extensive brownfield and greenfield organic growth potential supported by a large base of mineral reserves and mineral resources in Latin America and West Africa. Backed by a strong balance sheet, significantly higher liquidity will provide the company the flexibility to pursue other organic and external growth opportunities. The combined company will have a projected EBITDA of around $487 million in 2021 and free cash flow of $211 million — outperforming peers like Hecla Mining, Hochschild, Coeur Mining and First Majestic. Over the time span of 2021 to 2023, the company is expected to generate pro forma average annual EBITDA of more than $500 million. Silver will continue to be a meaningful contributor to revenues.

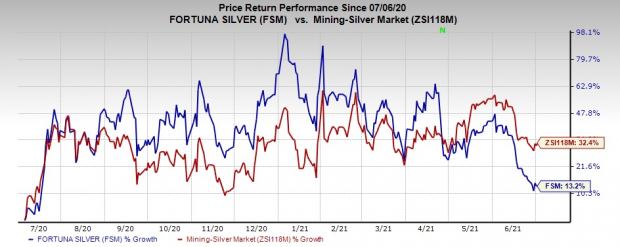

Price Performance

Image Source: Zacks Investment Research

Shares of the company have gained 13.2% over the past year compared with the

industry

’s rally of 32.4%.

Zacks Rank

Fortuna Silver currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report