Franco-Nevada Corporation

FNV

reported adjusted earnings of 86 cents per share in fourth-quarter 2021 compared with the year-ago quarter’s 85 cents. The bottom line came in line with the Zacks Consensus Estimate.

The company generated revenues of $328 million in the reported quarter, reflecting year-over-year growth of 8%. The upside was driven by higher realized oil and gas prices from its Energy assets and revenues from the recently-acquired

Vale S.A.

VALE

Royalty. The top-line figure surpassed the Zacks Consensus Estimate of $316 million. During the December-end quarter, 76.1% of revenues were sourced from gold and gold equivalents (60% gold, 11.8% silver and 4.3% platinum group metals).

Last April, Franco-Nevada acquired Vale Royalty interest. This buyout has contributed to the company’s Diversified assets revenues in the fourth quarter.

The company sold 138,799 Gold Equivalent Ounces (GEOs) from precious metal assets in the reported quarter, down from the prior-year quarter’s 142,380 GEOs. Higher contributions from Cobre Panama, Candelaria and the recently-acquired Condestable stream were partly offset by lower deliveries from the Hemlo, Antapaccay and Guadalupe-Palmarejo.

During the reported quarter, adjusted EBITDA rose 6% to $269.8 million year over year.

Financial Position

The company had $539.3 million cash in hand at the end of 2021, up from $534 million reported as of the end of 2020. It recorded an operating cash flow of $955 million in 2021, up from the $804 million witnessed in 2020.

Franco-Nevada is debt-free and uses its free cash flow to expand the portfolio and payout dividends. FNV now has available capital of $1.6 billion.

2021 Results

Franco-Nevada reported record adjusted EPS of $3.52 in 2021 compared with $2.71 reported in the prior year. Earnings beat the Zacks Consensus Estimate of $3.51.

Sales were up 27% year over year to a record $1.30 billion. The top line surpassed the Zacks Consensus Estimate of $1.29 billion.

Guidance

Franco-Nevada expects total GEOs between 680,000 and 740,000 GEOs for the current year. Of this, GEOs from precious metal assets are expected between 510,000 and 550,000 GEOs. The outlook reflects an expected lower contribution from the Guadalupe-Palmarejo stream and anticipated lower grades at Antamina and Antapaccay in the current year. Given the higher oil and gas prices, Franco-Nevada expects its Energy assets to contribute between 125,000 and 145,000 GEOs compared with 117,256 GEOs in 2021. In the current year, the company anticipates generating 35,000-55,000 GEOs from its Diversified Mining assets, driven by higher iron ore and oil and gas prices.

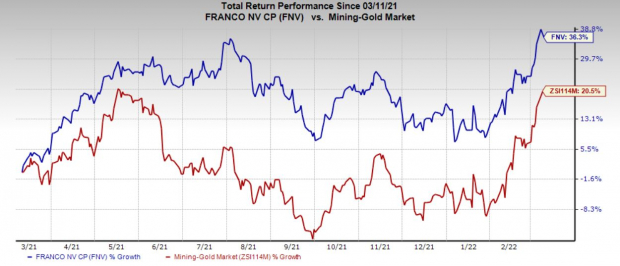

Price Performance

Franco-Nevada’s shares have gained 36.3% in the past year compared with the

industry

’s growth of 20.5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Franco-Nevada currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include

Teck Resources

TECK

and

Cabot Corporation

CBT

, both sporting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Teck Resources has a projected earnings growth rate of 26.1% for the current year. The Zacks Consensus Estimate for TECK’s current year earnings has been revised upward by 33% in the past 60 days.

Teck Resources beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 13%. TECK’s shares have surged around 95% in a year.

Cabot has a projected earnings growth rate of 15.5% for fiscal 2022. The Zacks Consensus Estimate for CBT’s fiscal 2022 earnings has been revised upward by 8% in the past 60 days.

Cabot beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 21.6%. CBT has rallied around 49% in a year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report