Wall Street is reeling under volatility as the Russia-Ukraine conflict has shown no sign of an amicable solution even after a month. The IMF has warned of a significant negative impact of the ongoing geopolitical conflict on global economic growth. Moreover, market participants are uncertain about the Fed’s policy toward interest rate amid the war and mounting inflation.

At this stage, it will be fruitful to invest in large-cap high-yielding stocks that have strong upside left for 2022. A handful of stocks with a favorable Zacks Rank are available with current dividend yield significantly higher than the yield of the benchmark 10-Year U.S. Treasury Nolte. Five such are —

Chevron Corp.

CVX

,

Devon Energy Corp.

DVN

,

International Business Machines Corp.

IBM

,

Southern Copper Corp.

SCCO

and

W. P. Carey Inc.

WPC

.

Russia-Ukraine Conflict Continues

The war between Russia and Ukraine continues despite several round of peace talk. On Mar 29, the first negotiations meeting in two weeks between Russia and Ukraine was held in Turkey. In the meeting, Russia said that it would significantly reduce its military operations around the Ukraine’s capital of Kyiv and the northern city of Chernihiv.

Instead, Russian troops will concentrate more on the eastern part of Ukraine. On the other hand, Ukraine has decided to follow the path of neutrality and will not join the U.S.-led alliance of NATO.

However, on Mar 30, Russian troops continued shelling around Kyiv and other cities neighboring the capital of Ukraine. Consequently, the price of the U.S. benchmark — West Texas Intermediate — crude futures for May delivery rose 3.4% to settle at $107.82 per barrel. The WTI crude price fell below $100 per barrel during intraday trading on Mar 29.

Concerns on Government Bond Yield Curve

Wall Street ended the session on Mar 28 with a partial inversion of the term structure of the sovereign bonds. The yield spread between the 5-year and 30-year U.S. Treasury Notes inverted for the first time since March 2006.

Inversion in government yield curve is considered as a sign of an upcoming economic recession. However, a more visible sign of an upcoming recession is the yield inversion of the 2-Year and 10-Year U.S. Treasury Note. Although, that yield spread remained positive, it has significantly narrowed this week.

Fed Chairman Jerome Powell said that the central bank would not hesitate to take further harsh measures if its proposed interest rate hike fails to control inflation. Several economists and financial researchers have said that in the next two FOMC meetings, the Fed may increase the interest rate by 50 basis point as inflation is likely to be elevated due to the ongoing Russia-Ukraine war.

Our Top Picks

We have narrowed our search to five large-cap (market capital >$15 billion) stocks with current dividend yield of more than 3.5%. These stocks have solid growth potential for 2022 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

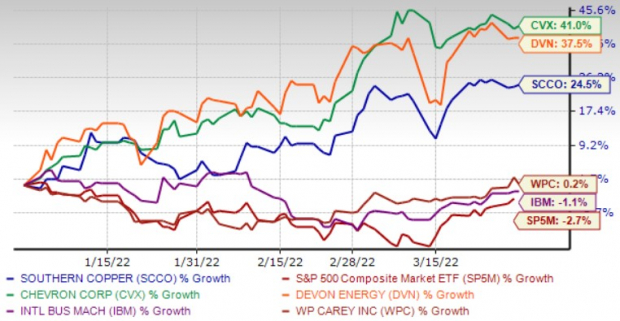

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Devon Energy

aims for strong oil production from the Delaware Basin holdings. Devon Energy’s presence in Delaware has expanded due to its all-stock merger deal with WPX Energy. DVN is using new technology in the production process to lower expenses.

Devon Energy’s divestiture of Canadian and Barnett Shale gas assets will allow it to focus on its five high-quality oil-rich U.S. basins assets. DVN’s stable free cash flow generation allows it to pay dividend and buy back shares. Devon Energy has ample liquidity to meet near-term debt obligations.

The Zacks Rank #1 Devon Energy has an expected earnings growth rate of 88.7% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.1% over the last 7 days. DVN has a current dividend yield of 6.6%.

Chevron

is one of the best-placed global integrated oil firms to achieve a sustainable production ramp-up. CVX’s existing project pipeline is one of the best in the industry, thanks to its premier position in the lucrative Permian Basin. The WTI crude oil price is hovering well above $100 per barrel. The price is likely to remain elevated as the Russia-Ukraine conflict has intensified.

Chevron’s Noble Energy takeover has expanded its footprint in the region and the DJ Basin. CVX now has access to Noble Energy’s low-cost, proven reserves along with cash-generating offshore assets in Israel — particularly the flagship Leviathan natural gas project — thereby boosting its footing in the Mediterranean.

The Zacks Rank #2 Chevron has an expected earnings growth rate of 57.4% for the current year. The Zacks Consensus Estimate for current-year earnings improved 14.6% over the last 30 days. CVX has a current dividend yield of 3.5%.

International Business Machines

is likely to witness growth driven primarily by analytics, cloud computing, and security in the long haul. Synergies from the Red Hat buyout are boosting the competitive position of IBM in the hybrid cloud market.

International Business Machines is likely to benefit from the robust adoption and broad-based availability of IBM Blockchain World Wire — a blockchain driven global payments network aimed at accelerating and optimizing cross-border payments. IBM is also poised to gain from the spin-off of the legacy infrastructure services business as it focuses on the hybrid cloud strategy.

The Zacks Rank #2 International Business Machines has an expected earnings growth rate of 27.2% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.1% over the last 60 days. IBM has a current dividend yield of 5%.

Southern Copper

is engaged in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. SCCO is well-poised to deliver improved results in the forthcoming quarters backed by its commitment to increase low-cost production and growth investments. For 2022, Southern Copper anticipates producing 922,000 tons of copper, 4% less than 2021.

High metal prices and demand bode well for SCCO’s top-line performance. Going forward, copper prices will be supported by growth in public infrastructure investment in the United States as well as the global initiatives to address climate change. This will support Southern Copper’s top-line performance.

The Zacks Consensus Estimate for Southern Copper’s current-year earnings improved 4.5% over the last 7 days. Zacks Rank #2 SCCO has a current dividend yield of 5.2%.

W. P. Carey

is a real estate investment trust engaged in providing long-term sale-leaseback and build-to-suit financing for companies. WPC primarily invests in commercial properties that are generally triple-net leased to single corporate tenants including office, warehouse, industrial, logistics, retail, hotel, R&D, and self-storage properties.

The Zacks Rank #2 W. P. Carey has an expected earnings growth rate of 3% for the current year. The Zacks Consensus Estimate for current-year earnings improved 2.2% over the last 30 days. WPC has a current dividend yield of 5.1%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report