Silver had witnessed overall weak demand last year amid the COVID-19 pandemic, which crippled the industrial sector that accounts for roughly 60% of the global silver consumption. Demand from jewelers was also muted. Investment demand was the only saving grace with the metal gaining on its safe-haven demand. However, with the resumption of businesses and the ongoing economic recovery this year, silver demand has picked up in industrial, photography, jewelry, and silverware. Investment purposes have been contributing to the momentum as well. The Silver Institute anticipates global silver demand to increase 15% year over year to 1.029 billion ounces in 2021 — crossing the 1 billion ounces threshold for the first time since 2015. It also expects a deficit in the silver market this year — the first time since 2015.

This scenario bodes well for silver prices and consequently for the Zacks

Mining – Silver

industry. We suggest keeping an eye on some companies like

First Majestic Silver Corp.

AG

,

Hecla Mining Company

HL

and

MAG Silver

MAG

, which are poised to benefit from these trends and their efforts to increase efficiency and cost management.

US & India to Fuel Investment Demand Growth

Per the Silver Institute, investment demand is expected to attain a six-year high of 263 million ounces (Moz) this year, backed by growth in the United States and India. This indicates year-over-year growth of 32% — the highest across the board. Coin and bar demand is expected to surpass 100 million ounces in the United States for the first time since 2015. Improved sentiment toward the silver price and a recovering economy is expected to fuel demand in India. Total holdings in Exchange-traded products are projected to increase 150 Moz.

Industrial Demand to Set New Highs

Silver’s unrivaled characteristics make it an indispensable component for several industrial products. With the ongoing expansion in manufacturing activity, industrial demand for silver will be around 525 Moz. This suggests growth of 8% from 2020 levels.

Demand for silver jewelry is expected to go up 18% year over year to 173 Moz, while the same for silverware fabrication will be up 25% to 40 Moz. This will be aided by recovery in all key countries, particularly in India with the ongoing wedding and festive season.

Silver Market Headed for Deficit

Last year, global silver mine production fell 7% to 780 million ounces — the most significant drop in the last decade and also the fourth consecutive annual decline. This was primarily due to temporary mine closures at several major silver producing countries in the first half of 2020 due to the pandemic. However, with most of the mines currently operating at full capacity, mined silver production is expected to improve 6% to 829 Moz this year. With this projection, the silver market is heading for a deficit of 7 Moz — the first since 2015.

Meanwhile, average margins in the industry are currently at their highest since 2012. This is due to strong silver and by-product metal prices this year, which have improved profitability in the industry despite rising input costs. Last year, average silver prices had gained 27% and per Metals Focus, it is expected to rise 24% year over year to $25.40 in 2021. This will be the highest annual average since $31.15 in 2012.

The Way Ahead

The ongoing revolution in green technologies, aided by exponential growth of new energy vehicles and investment in solar photovoltaic energy, will act as a major catalyst for silver in the days ahead. Jewelry fabrication, which accounts for approximately one-fifth of total silver demand, is expected to be a key growth driver. India is likely to emerge as a major consumer courtesy of increasing investor interest and growth in jewelry, decorative items and silverware fabrication. Silver serves as a safe haven asset in times of uncertainty. Meanwhile, absence of development of new projects, declining ore grades and depleting reserves remain headwinds. While demand remains strong, shortage in supply will drive silver prices in the days ahead.

In a year’s time, the Mining – Silver industry has declined 1.8%, against the S&P 500’s growth of 30.3%. The industry falls under the broader

Basic Materials

sector, which gained 10.6% in the same time frame. Amid the pandemic induced uncertainty, the mining industry has been resorting to technological innovations targeted at nearly every level of operation to increase efficiency, sustain growth and keep costs low.

Image Source: Zacks Investment Research

3 Silver Stocks to Watch

Image Source: Zacks Investment Research

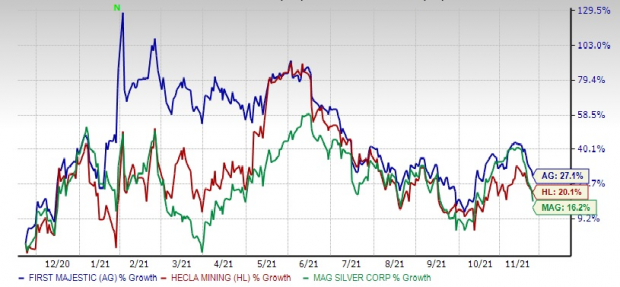

First Majestic

: The acquisition of the Jerritt Canyon Gold mine earlier this year enhanced its geographic operating platform while adding a producing asset in a world-class jurisdiction as Nevada is considered one of the most attractive jurisdictions for mining operations. The company achieved a new record of 7.3 million silver equivalent ounces in the third quarter of 2021, reflecting an increase 14% from the prior quarter due to having a full quarter of production from the Jerritt Canyon operation, and continued strong performance at San Dimas and La Encantada. Backed by this performance, the company’s shares have appreciated 27% in a year’s time. The company expects higher grades to drive production growth at San Dimas, Jerritt Canyon and Santa Elena in the fourth quarter and into 2022. The company has also been making investments that will aid in cost reduction starting in the fourth quarter, driven by higher production, lowered capital costs and continued improvements in operating efficiencies.

The Zacks Consensus Estimate for First Majestic’s fiscal 2021 earnings suggests year-over-year growth of 5.6%, while the same for 2022 indicates an improvement of 160%. It currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Hecla Mining

: Backed by its solid operational performance, the company has enhanced its silver-linked dividend for the second time this year and returned around 20% of its free cash flow to shareholders. Concurrently, the company executed the largest exploration program in its history. Hecla Mining has a diverse asset portfolio in mining friendly jurisdictions. Its mines have the highest reserve grades, long mine lives and are low risk. The company is one of the lowest-cost U.S. silver producers and produces about 43% of the silver mined in the country. This is expected to grow as Lucky Friday Mine in Idaho ramps up. Testing of a new drill and blast mining method at the Lucky Friday is exhibiting good performance in controlling seismicity and improving safety with the potential to increase productivity. The stock has surged 20% in the past year.

The Zacks Consensus Estimate for Hecla Mining’s fiscal 2021 earnings suggests growth of 175% year over year. The estimate for 2022 indicates year-over-year growth of 123%. The company has a long-term estimated earnings growth rate of 1%. The Zacks Ranked #3 stock has a trailing four-quarter earnings surprise of 13%, on average.

MAG Silver

: The company engages in the exploration and development of silver mining properties. It explores for gold, lead, and zinc deposits. It primarily holds 44% interest in the high-grade silver Juanicipio project located in the Fresnillo District, Zacatecas State, Mexico. The company is currently constructing and developing the surface and underground infrastructure on the property to support a 4,000 tons per day mining operation, with the operational expertise of its joint venture partner. The Juanicipio Project is a robust, high-grade, high-margin underground silver project with low development risks. Juanicipio plant is expected to be commissioned by year end, subject to timely connection to the power grid. Shares of the company have gained 16% over the past year.

The Zacks Consensus Estimate for MAG Silver’s earnings for fiscal 2021 is currently pegged at a loss of 1 cent per share, indicating an improvement from the loss of 8 cents in 2020. The consensus mark for the company’s earnings for 2022 is pegged at $1.22, suggesting a substantial improvement from fiscal 2022. The company has a trailing four-quarter earnings surprise of 29%, on average. It currently carries a Zacks Rank #3.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report