Carpenter Technology Corporation

CRS

announced that its 4500-ton press at the Reading, PA facility has undergone repairs and is back in operation. In December last year, the company had announced an unplanned outage at the press, which is a piece of highly specialized equipment that plays a key role in the production of materials for Aerospace and a few other end-market applications. Citing the impact of the outage and cost inflation pressures and labor shortages, CRS had guided a wider-than-expected loss for the second quarter of fiscal 2022.

The repairs were carried out within the targeted timeline. During this time, Carpenter Technology concurrently carried out certain maintenance activities that were planned for the balance of the year. This move will help the company eliminate 14 days of planned maintenance downtime for the press for the balance of the current fiscal year.

Carpenter Technology had cautioned that the adjusted loss per share in the second quarter of fiscal 2022 to be 60-65 cents taking the impact of the outage and inflationary cost pressures into account. Last month, the company reported an adjusted loss per share of 58 cents for the quarter, which came in narrower than the guidance. It compared favorably with the Zacks Consensus Estimate of a loss of 63 cents and the adjusted loss per share of 61 cents in the year-ago quarter. Carpenter Technology reported an adjusted operating loss of $29.8 million, faring better than its estimate of an overall adjusted operating loss of $32-$35 million.

Carpenter Technology expected the Specialty Alloys (“SAO”) segment to bear the brunt of the outage and deliver an operating loss of $20 million to $22 million in the second quarter of the fiscal year 2022. The segment posted an operating loss of $20.3 million compared with $11.6 million in the prior-year quarter.

The Performance Engineered Products (“PEP”) segment continues to benefit from improving demand conditions and was expected to generate operating income in the range of $1 million to $2 million in the second quarter of the fiscal 2022. The segment’s operating profit was $3 million, higher than the guidance and marked an improvement from the prior-year quarter’s operating loss of $7.2 million.

The unplanned outage of the press limited the company’s ability to meet production targets in the quarter. With the press back in operation, Carpenter Technology is now in a position to fulfill customer demand in the Aerospace supply chain, which is currently witnessing a broad-based recovery. The company is witnessing recovery in the defense and medical end-use markets. Its industrial and consumer end-use market will continue to gain from strong demand for semiconductor applications for its ultra-high-purity materials and electronics submarket in fiscal 2022. In the transportation end-use market, demand in the light-duty submarket remains strong on increased customer spending. Also, demand for heavy-duty truck, off-road, watercraft and aftermarket submarkets continue to grow with an increased market share. In the Energy-end use market, demand for the oil and gas submarket will be strong as North America continues to witness steady recovery with year-over-year higher rig count and growing capital expenditures.

The company’s financial position remains strong, which provides it the strategic flexibility to strengthen its long-term growth profile by investing in emerging technologies like additive manufacturing and soft magnetics while providing direct returns to shareholders through quarterly dividends.

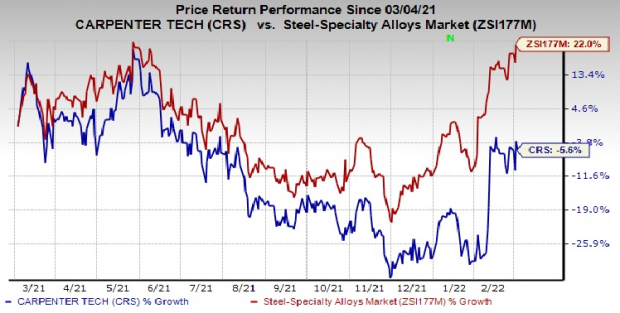

Price Performance

Image Source: Zacks Investment Research

Carpenter Technology’s shares have declined 5.6% year-to-date against the

industry

‘s growth of 22%.

Zacks Rank & Stocks to Consider

Carpenter Technology currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space include

Teck Resources

TECK

,

Cabot Corporation

CBT

and

Allegheny Technologies Incorporated

ATI

. While TECK and CBT sport a Zacks Rank #1 (Strong Buy), ATI carries a Zacks Rank #2, at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Teck Resources has a projected earnings growth rate of 21.5% for the current fiscal year. The Zacks Consensus Estimate for TECK’s current fiscal year earnings has been revised upward by 28% in the past 60 days.

Teck Resources beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 13%. TECK’s shares have surged around 95% in a year.

Cabot has a projected earnings growth rate of 7.6% for the current year. The Zacks Consensus Estimate for CBT’s current-year earnings has been revised upward by 8% in the past 60 days.

Cabot beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 21.6%. CBT has rallied around 49% in a year.

Allegheny has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised upward by 46% in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 127.2%. ATI has rallied around 32% over a year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report