Yamana Gold Inc.

AUY

has announced the repurchase of an initial 1,736,776 common shares outstanding for roughly C$10 million (around $8 million). The buyback is under normal course issuer bid as part of its share repurchase program for up to 5% of the outstanding shares. The company has not yet defined any formulae or price ranges under its normal course issuer bid since it plans to be selective and opportunistic as it intends to enter market when allowed, and when the trading range of its shares do not reflect the underlying value.

It is dedicated to further increasing shareholder returns through its capital returns program. Further share repurchases under the normal course will be based on market conditions, share price, cash availability and other considerations. Common shares that are purchased under the normal course issuer bid will be cancelled. Yamana believes common share purchase is a lucrative investment and a component of its capital returns program, which includes cash returns through its dividends, cumulatively increased 500% since the second quarter of 2019.

The company also recently bolstered its financial strength by reducing outstanding debt through the completion of $500 million 10-year unsecured senior notes offering and redemption of existing notes. Lower interest carrying costs to the tune of $21.6 million annually add to its robust cash flows and cash balances, thereby supporting capital costs and amounts available for dividends and share repurchases.

Additionally, Yamana has organic growth projects with high returns, including the Jacobina Phase 2 expansion, the Wasamac project and the Odyssey underground project at Canadian Malartic, which it plans to fund with the free cash generated and cash on hand. It is also advancing the development of the MARA copper-gold project with average annual production totaling 556 million pounds of copper over the first 10 years.

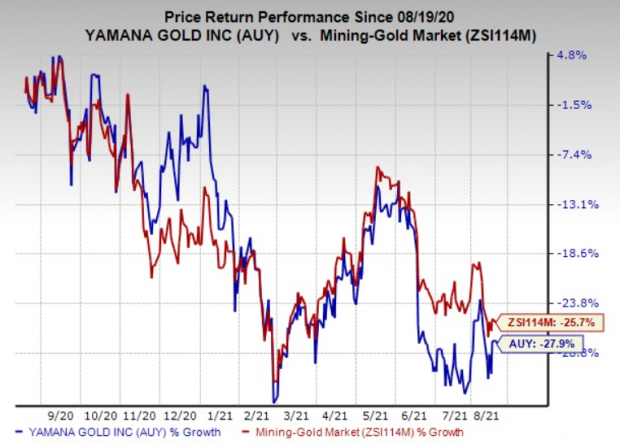

Shares of Yamana have lost 27.9% in a year compared with the

industry

’s decline of 25.7%. The estimated earnings growth rate for the company for the current year is pegged at a negative 3.1%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Yamana carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

ArcelorMittal

MT

,

National Steel Company

SID

and

Aperam

APEMY

, each sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

ArcelorMittal has a projected earnings growth rate of 1,731.2% for the current year. The company’s shares have shot up 191.2% over the past year.

National Steel has a projected earnings growth rate of 443.3.3% for the current year. The company’s shares have skyrocketed 184.4% over the past year.

Aperam has a projected earnings growth rate of 429.8% for the current year. The company’s shares have grown 114.6% over the past year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report