Westlake Chemical Company

WLK

is set to release

third-quarter 2021

results before market open on Nov 2. The company’s earnings are likely to have benefited from higher demand for polyethylene and polyvinyl chloride (“PVC”) resin. However, higher feedstock costs might have been a headwind.

Westlake Chemical beat the Zacks Consensus Estimate for earnings in all the last four quarters. It has a trailing-four quarter earnings surprise of 21.1%, on average. The company posted an earnings surprise of 6.3% in the last reported quarter.

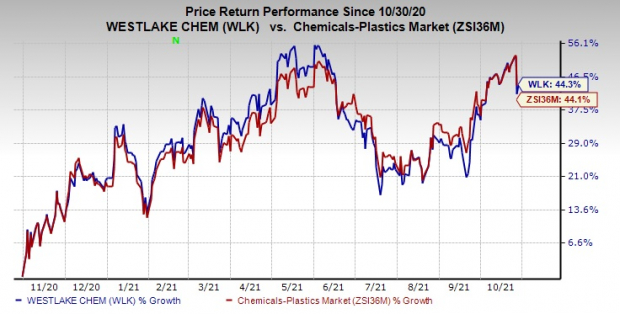

Shares of Westlake Chemical are up 44.3% in the past year compared with a 44.1% surge of its

industry

.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What do the Estimates Say?

The Zacks Consensus Estimate for Westlake Chemical’s third-quarter revenues is currently pinned at $2,716 million, which indicates a 43.1% year-over-year increase.

The Zacks Consensus Estimate for the Olefins division’s revenues is pegged at $587 million, suggesting a 59.1% rise year over year.

The consensus estimate for Vinyls unit’s revenues is at $1,592 million, indicating an increase of 4.1% year over year.

Factors to Watch for

Westlake Chemical is likely to have benefited from higher demand for polyethylene in the third quarter, aided by its focus in specialty applications that include food packaging and healthcare.

The company is likely to have gained from higher demand for PVC resin and construction-related downstream building products with the easing of pandemic-induced restrictions. Demand in the downstream building products business is expected to have remained strong in the third quarter on new housing starts and spending on repair and remodeling activities.

However, it is likely to have been impacted by an upswing in feedstock costs. Continued impacts of feedstock cost inflation are expected to get reflected on margins.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Westlake Chemical this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat. But that’s not the case here.

Earnings ESP:

Earnings ESP for Westlake Chemical is -0.95%. The Zacks Consensus Estimate for third-quarter earnings is currently pegged at $4.01. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Westlake Chemical currently flaunts a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

B2 Gold Corp.

BTG

, scheduled to release earnings on Nov 2, has an Earnings ESP of +0.53% and carries a Zacks Rank #3.

The Chemours Company

CC

, scheduled to release earnings on Nov 4, has an Earnings ESP of +1.26% and carries a Zacks Rank #2.

Albemarle Corporation

ALB

, scheduled to release earnings on Nov 3, has an Earnings ESP of +8.73% and carries a Zacks Rank #3.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report