With just a day of trading left in June, Wall Street is on the verge of closing an impressive first half of 2021. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have rallied 12%, 14.3% and 12.7%, respectively, year to date. The small-cap centric Russell 2000 has surged 16.9% year to date. The mid-cap specific S&P 400 has climbed 17% in the same period.

The effect of a robust U.S. economic recovery, supported by nationwide COVID-19 vaccination, a stiff reduction in new coronavirus cases and faster-than-expected reopening, was so impactful on market participants’ sentiment that growing concerns of an impending inflation failed to deter Wall Street’s northward journey.

U.S. stock markets are set to continue their strong performance on the back of solid consumer and business confidence, solid improvement in GDP growth and corporate profits.

Consumer Confidence Soars in June

The Conference Board reported that the U.S. consumer confidence index jumped to 127.3 points in June from an upwardly revised 120 in May, marking its highest level since February 2020. The consensus estimate was 118.7.

The present situation sub-index increased from 148.7 in May to 157.7 in June. More importantly, the expectation sub-index (based on consumers’ outlook for the economy in the next six months) improved to 107.0 in June from 100.9 last month.

Although there is no direct relation between any kind of consumer satisfaction optimization index and consumer spending, strong consumer confidence clearly indicates that Americans are more confident about recovering from pandemic-led devastations.

M&A Activities and IPO Flourish in 1H

The first half of 2021 was extremely favorable for mergers and acquisitions (M&A) and initial public offerings (“IPO”).

Reuters

reported citing Dealogic data that the size of U.S. IPOs in 2021 already crossed $171 billion, exceeding the previous year’s $168 billion. Several investment bankers have estimated that the U.S. IPO size may go up to $250-$300 billion by the end of this year.

Dealogic also reported that globally more than 15,500 M&A deals worth $2.9 trillion have been signed so far in 2021. Of these, a large number of deals worth at least $10 billion involving U.S. corporates have already been signed in 2021.

A massive surge IPO is indicates ample investor appetite for new stocks and growing confidence for risky assets like equities. Likewise, the impressive performance of Wall Street and the stable fundamentals of the U.S. economy are the major drivers of strong M&A deals.

Despite the Fed’s sooner-than-expected rate hike signal, the yield on the benchmark 10-Year U.S. Treasury Note is hovering around 1.5%, much lower than its recent high of 1.778% recorded on Mar 30. This indicates that the market is not expecting the central bank to start tapering the $120 billion per month bond-buying program anytime soon.

Strong Projections for GDP and Corporate Profits

The Federal Reserve raised the U.S. GDP growth rate for 2021 to 7% in June from 6.5% in March. On Jun 24, CNBC/Moody’s Analytics survey of economists’ forecasts reported that the U.S. economy is expected to grow by 7.2% in 2021, marking the highest yearly GDP growth in 38 years.

Consumer spending, the major driver of the U.S. economy is expected to remain firm buoyed by around $2.6 trillion of savings. The consumer confidence data in June has shown that the number of Americans planning to purchase homes, automobiles, and major appliances in the next six months saw a solid rise. This will likely support consumer spending in the second half of 2021.

Per our projections on Jun 23, total earnings of the market’s benchmark — the S&P 500 Index — are expected to climb 35.3% year over year on 10.6% higher revenues in 2021. Moreover, in 2022, total earnings of the S&P Index are forecast to grow 11.2% year over year on 8.3% higher revenues.

Our Top Picks

We have narrowed down our search to five corporate bigwigs (market capital > $50 billion) that popped more than 20% year to date and still have strong upside left. These stocks have seen solid earnings estimate revisions within the last 60 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

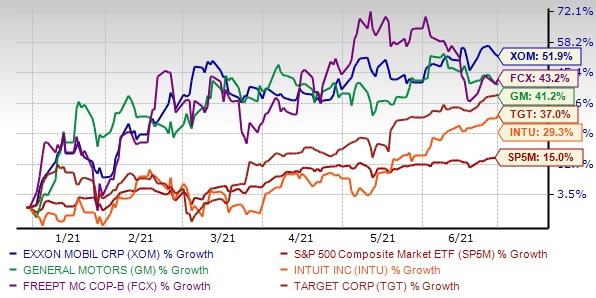

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Exxon Mobil Corp.

XOM

made multiple world-class oil discoveries at the Stabroek Block, located off the coast of Guyana. It recently announced another significant oil discovery at the Longtail-3 well, offshore Guyana which added to the prior estimate of gross recoverable resource of 9 billion barrels of oil equivalent. Moreover, the company also has a strong presence in the prolific Permian where it continues to lower its fracking & drilling costs.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for the current year has improved 0.8% over the last 7 days. The stock price has soared 51.9% year to date.

Freeport-McMoRan Inc.

FCX

is conducting exploration activities near its existing mines with a focus on opportunities to expand reserves. The company is optimistic about automotive electrification, which is a positive for copper as electric vehicles (EV) consume more of this commodity. It anticipates a strong potential for the EV market and expects rapid growth over the next decade.

The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for the current year has improved 1.9% over the last 7 days. The stock price has jumped 43.2% year to date.

General Motors Co.

GM

has been witnessing strong demand for profitable trucks and SUVs. The company’s hot-selling brands in America like Chevrolet Silverado, Equinox and GMC Sierra are driving the top line. General Motors’ big push toward EV is commendable. The automaker plans to roll out 30 fresh EV models by 2025-end.

The company has an expected earnings growth rate of 24.9% for the current year. The Zacks Consensus Estimate for the current year has improved 15.7% over the last 30 days. The stock price has climbed 41.2% year to date.

Target Corp.

TGT

has undertaken several strategic initiatives to boost performance. It has been deploying resources to enhance omni-channel capacities, including same-day delivery of in-store purchases and accelerate technology improvements. Target has been aggressively adopting strategies to provide a seamless shopping experience through miscellaneous channels.

The company has an expected earnings growth rate of 25.6% for the current year (ending January 2022). The Zacks Consensus Estimate for its current-year earnings has improved 36.6% over the last 60 days. The stock price has rallied 37% year to date.

Intuit Inc.

INTU

provides financial management and compliance products and services for small businesses, consumers, self-employed and accounting professionals. The space in which Intuit operates has huge growth opportunity. Moreover, for the last few years, Intuit is trying to shift its business model from selling software to cloud-based subscription providers.

The company has an expected earnings growth rate of 19% for the current year (ending July 2021). The Zacks Consensus Estimate for its current-year earnings has improved 12% over the last 60 days. The stock price has surged 29.3% year to date.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report