Vale S.A

.’s

VALE

iron ore production for the second quarter of 2021 was 75.7 million tons (Mt), which came in 12% higher than the year-ago quarter and 11.3% higher than the first quarter of 2021. The company’s 2021 iron ore production guidance of 315-335 million tons remains unchanged, but the nickel and copper outlook are under review, as labor stoppages at the Sudbury mine in Ontario and a flood at Voisey’s Bay in Labrador hurt output.

The sequential improvement in iron ore production in the quarter was aided by higher volumes from Brucutu, improvement of weather-related conditions in Serra Norte and a strong performance in Serra Leste. Increased productivity in Itabira Complex, higher third-party purchase and wet processing production in Fábrica during the tests to resume beneficiation plant operations contributed to the improvement as well. These gains were partially offset by the interferences caused by the installation and commissioning of the first of four jaspilite crushers in S11D.

Vale’s pellet production was up 13.3% year over year and 27.4% sequentially to 8 Mt in the second quarter. Second-quarter sales volume of iron ore fines and pellets was 74.9 Mt, up 22% year on year and 14% from the first quarter of 2021.

Production of nickel declined 15.3% year over year to 41.5 kt in the June-ended quarter. Compared to the first quarter of 2021, nickel production was down 14.3% due to labor disruption at Sudbury and unscheduled maintenance in Clydach Nickel Refinery. Copper production was 73.5 kt in the quarter, down 13% year over year and 4% down from the first quarter of 2021. The drop in production was due to labor disruption in Sudbury and delays in mining at Voisey’s Bay, partially mitigated by a more robust performance in Salobo owing to the ramp-up of mine maintenance activities and better performance at Sossego operations.

Cobalt production reached 754 metric tons in the quarter, up 34.2% from the prior-year quarter and up 6% from the first quarter of 2021. Manganese ore production totaled 113 kt in the April-June period, 24.2% lower than the prior-year quarter due to adjustments in the mining plan to ensure the safety and sustainability of underground operations at the Urucum mine. On a year-over-year basis, production was up 24.2% primarily due to the end of the rainy season and improved performance at the beneficiation plant in Morro da Mina.

Coal production was 2.1 Mt in the second quarter, up 63% from the prior-year quarter and 92% higher than the year-ago quarter. This was mainly due to improved productivity after the major plant revamp concluded last quarter. The revamp removed important bottlenecks in the processing plants by increasing equipment availability and productivity. Gold production was down 15.8% year over year to 96,000 troy ounces in second-quarter 2021. Compared to the first quarter, gold production was up 11.6%.

Among other developments, Vale has resumed loading activities at ship loader 6 at the Ponta da Madeira Maritime Terminal, in São Luís, Maranhão, after five months of maintenance due to a fire in the equipment. The maintenance of ship loader 6, which involved the substitution of over 60% of its components, did not impact Ponta da Madeira Maritime Terminal’s monthly iron ore shipment schedule for the year.

Vale’s iron ore production guidance for 2021 remains at 315 to 335 Mt. The company stated that it has achieved a production capacity of 330 Mtpy. If sustained, this would allow for an average of 1 Mt per day production in the second half of 2021, due to better weather conditions in the period. Citing uncertainties concerning the labor situation in Ontario, and the ramp-up of the safety and maintenance process implementation in Sossego and Salobo, the company has placed the guidance for nickel and copper for the year under review.

The company’s efforts to improve productivity, introducing more high-quality ore in the market and cutting costs will drive margins. Investment in growth projects and efforts to lower debt will aid growth. Vale will also gain on the rally in iron ore prices this year. Iron ore prices have gained around 40% so far this year and are currently trending at around $220 per ton, fueled by high demand from China amid concerns over supply from the major iron producers. While Vale’s production in the second quarter has improved year on year, it lagged expectations of 78 Mt.

Last week,

Rio Tinto plc

RIO

reported a 9% drop in second-quarter iron ore production to 75.9 Mt due to above average rainfall in the West Pilbara, shutdowns to enable replacement mines to be tied in, processing plant availability and cultural heritage management. Iron ore shipments in the second quarter of 2021 declined 12% year over year to 76.3 Mt. Due to this underperformance, Rio Tinto now expects to ship near the lower end of its range of its previous guidance of 325 Mt to 340 Mt in 2021.

BHP Group

’s

BHP

iron ore production was down 2% year over year to 65.2 Mt in the April-June quarter. On a sequential basis, production improved 9% primarily due to improved performance at Western Australia Iron Ore (WAIO). The company anticipates producing between 249-259 Mt of iron ore in fiscal 2022.

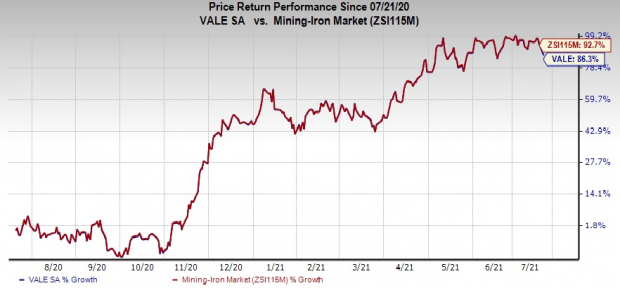

Price Performance

Image Source: Zacks Investment Research

Shares of Vale have surged 86.3% in a year compared with the

industry

’s rally of 92.7%.

Zacks Rank & Another Stock to Consider

Vale currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Another top-ranked stock in the basic materials space is

FreeportMcMoRan Inc

.

FCX

. FreeportMcMoRan has a projected earnings growth rate of 475% for the current fiscal year. The company’s shares have soared 142% in the past year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report