UGI Corporation

UGI

has been gaining from systematic investments to modernize and replace the aging infrastructure. Strategic acquisitions that are accretive to earnings, efficient debt management and the expansion of its customer base are likely to drive its performance over the long run.

UGI Corporation currently carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for fiscal 2023 earnings per share of UGI has moved up 14.2% year over year. The company’s long-term (three to five years) earnings growth is currently pegged at 8%. Moreover, UGI’s current dividend yield of 3.4% is better than the

industry

average of 2.6%. You can see

the complete list of today’s Zacks #1Rank (Strong Buy) stocks here

.

Tailwinds

UGI continues to expand the customer base and added more than 8,400 customers year to date in fiscal 2022. The company continues to make systematic capital investments for increasing the safety and reliability of natural gas production and storage facilities and replacing the aging infrastructure for modernizing the system. UGI spent $674 million in fiscal 2021 and plans to invest $500 million in fiscal 2022. UGI invested $345 million in the first six months of fiscal 2022.

UGI is being rewarded by the recent strategic acquisitions of Stonehenge and Mountaineer. On Jan 27, 2022, UGI completed the Stonehenge Acquisition, which is consistent with the utility’s growth strategies, including the expansion of midstream natural gas gathering assets within the Appalachian region. In February, UGI entered an agreement with Global Clean Energy Holdings to purchase and distribute renewable LPG in California. Also, in April, the utility acquired a 33% equity interest in Ag-Grid Energy, a renewable energy producer with projects in the United States. These initiatives are helping UGI expand its renewable and environmentally-friendly products.

UGI reported total debt of $6,390 million as of Mar 31, 2022, down from $6,539 million on Dec 31, 2021. As of Mar 31, 2022, UGI’s available liquidity was $1.9 billion, adequate to meet the current debt obligations. UGI’s times interest earned ratio was 7.6 at the end of the second quarter of fiscal 2022, higher than 4.6 in the year-ago quarter of 2021. Such a strong ratio is indicative of the company’s adequate financial flexibility to meet debt obligations.

Headwinds

UGI is exposed to several regulatory and environmental issues for domestic and international operations. Its business is highly seasonal and unfavorable weather can dent demand, thereby lowering profitability. The failure of completing capital projects within time and budget will impact its operations and profitability. In addition, UGI is exposed to higher interest rate risks, which can increase UGI’s borrowing cost and can also have an adverse effect on the company’s operating and financial results. The fall in demand due to the price fluctuation of natural gas can lead to lower revenues, which can adversely affect cash flows.

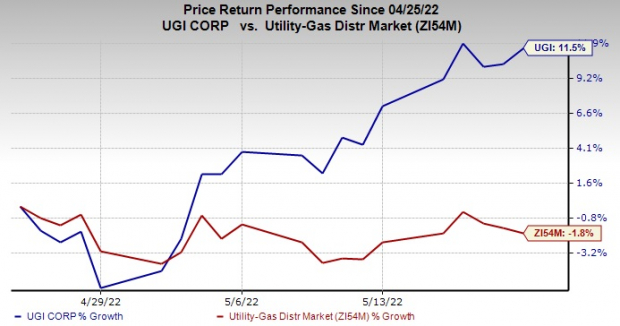

Price Performance

In the past month, shares of UGI have rallied 11.5% against the industry’s 1.8% decline.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same sector are

Dominion Energy

D

,

DTE Energy

DTE

and

Hawaiian Electric Industries

HE

, each currently carrying a Zacks Rank #2 (Buy).

The long-term earnings growth of Dominion Energy, DTE Energy and Hawaiian Electric Industries is projected at 6.3%, 10% and 3.2%, respectively.

Dominion Energy, DTE Energy and Hawaiian Electric Industries delivered an average earnings surprise of 0.65%, 8.97% and 30.8%, respectively, in the last four quarters.

In the past six months, D, DTE and HE shares have surged 10.2%, 14.8% and 5.3%, respectively.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report