VANCOUVER, British Columbia, Aug. 25, 2020 (GLOBE NEWSWIRE) — Trevali Mining Corporation (“Trevali” or the “Company”) (TSX: TV, BVL: TV; OTCQX: TREVF, Frankfurt: 4TI) is pleased to announce positive results from the NI 43-101 Pre-Feasibility Study (“PFS”) at its 90%-owned Rosh Pinah mine in Namibia (the “property”). The PFS is based on a scenario to expand the current throughput from 0.7 Mtpa to 1.3 Mtpa through the modification of the processing plant, construction of a paste fill plant, and development of a dedicated portal and ramp to the WF3 deposit. Prior to making an investment decision the Company intends to commence a Feasibility Study of the RP2.0 Expansion in the first quarter of 2021.

All figures are stated in United States dollars on a 100% ownership basis unless otherwise stated. A technical report containing the PFS and prepared in accordance with NI 43-101 will be available on SEDAR within the time frames prescribed under applicable securities laws.

Highlights of the Expansion Pre-Feasibility Study include:

- Post-Expansion Production and Costs (2023 onwards)

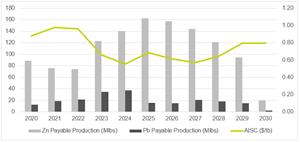

° Average annual zinc payable production of 132 Mlbs;

° Average annual AISC1 of $0.64/lb; and

° Average annual lead and silver payable production of 21.8 Mlbs and 286 koz, respectively.

- Proven and Probable Mineral Reserves: 11.23 Mt of ore (see table 5 for details), containing

° 550 Mlbs of zinc;

° 329 Mlbs of lead; and

° 6,892 koz’s of silver.

- Project Capital Cost: $93 million, including:

° Modifications to the existing process plant to include a single stage SAG mill, crushing and ore blending system with a nominal throughput of 1.3 Mtpa;

° Paste fill plant and reticulation system;

° Dedicated portal and surface material handling and ventilation systems for the WF3 deposit; and

° Mine underground infrastructure.

- Construction Schedule

° Expected to commence in Q1 2022; and

° “Commercial Production” expected in H1 2023.

- Project Economics (after-tax)

° Assumed metal prices: $1.11/lb zinc, $0.93/lb lead and $19.81/oz silver;

° Net Present Value (“NPV”) at 8%: $142 million;

° Free cash flow: $238 million;

° IRR: 65%; and

° Payback: <4 years.

Ricus Grimbeek, President and CEO, commented: “Over Rosh Pinah’s 50-year operating life the mine has processed close to 30 million tonnes and today we have 16 million tonnes in resource, inclusive of reserves, with several advanced exploration targets ready to drill. To match this exceptional ore body, the RP2.0 PFS recommends an 86% expansion to the existing production capacity by sizing the infrastructure to a nominal throughput of 1.3 Mtpa. This yields an 11 year mine life and post expansion, reduces the AISC to an average of $0.64 per pound of zinc. This positions the asset well into the bottom half of the industry’s cost curve and will ensure the operation’s resilience and robustness through the commodity price cycle.”

Mr. Grimbeek continued: “The addition of a new portal, SAG mill, crushing and ore blending system, and a paste fill plant will allow us to modernize the mine and produce more metal faster and at a significantly lower operating cost, all while working more safely and reducing our environmental footprint. This positive study provides a strong financial return on an 11 year mine life, giving us the justification we need to proceed and I am confident, given the geological potential of the asset, that we will be operating well beyond this. We look forward to further enhancements to the study through the feasibility study stage and ultimately recognizing and sharing the social and economic benefits created by the expansion with all stakeholders.”

Figure 1: Rosh Pinah Annual Ore Production1Schedule with Metal Grades is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/18b8d3a4-51bb-4788-9491-777a92a263ec

Figure 2: Rosh Pinah Annual Payable Metal Production2 Schedule and AISC1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4cbfdd35-abf9-4f5e-8586-41eef538a99f

_______________

1 See “Use of Non-IFRS Financial Performance Measures”.

2 2020 forecasted production in Figures 1 and 2 is for the full year whereas the Mineral Reserves in Table 5 excludes Q1-2020

Rosh Pinah Expansion “RP2.0” Pre-Feasibility Study

Processing Plant: The PFS incorporates an upgrade to the comminution circuit to include a new single stage SAG mill and pebble crusher. The upgrade also includes primary crushing upgrades, an ore blending system, along with other circuit modifications to provide increased flotation, thickening, filtration and pumping capacity to achieve the target throughput of 1.3 Mtpa. The upgrade will also include several flowsheet modifications aimed at improving both the concentrate grade and metal recoveries.

Underground Development and Infrastructure: A dedicated portal and decline to the WF3 deposit will be constructed to support the increase to mine production levels and reduce operating costs. The trucking decline is 3.9 km in length, excluding level access and stockpiles. For construction purposes, the decline is separated into five independent legs to enable concurrent development and reduce overall construction time. Internal legs of the trucking decline will be developed off existing development, with take-off positions selected to minimize interaction with the underground operation.

The new trucking decline will act as an additional fresh air intake within the ventilation network and will enable direct ore haulage from the WF3 zone to a new surface primary crusher station utilizing large-scale (60 tonne) trucks. Ore sourced from other areas (EOF, SF3, SOF, and BME) will be transported to the existing underground crushing system using the existing 30 tonne truck fleet and conveyed to surface via the existing conveying system.

Paste Fill Plant: A paste fill plant has been included to modify the mining method which improves both the safety conditions and economics of the mine. Paste filling the stopes rather that leaving them void will improve ground stability, increase ore recovery, and reduce dilution. It will also reduce surface tailings as a portion of new and existing tailings will be redirected underground to be used as paste fill.

Mobile Equipment: The existing small-scale underground trucks and load-haul-dump (LHD) fleet will continue to be used primarily in the current mining areas. This will reduce capital expenditure associated with purchasing new mobile equipment, increasing development profiles and changing the existing underground crushing and conveying system. As mining extends deeper and average haulage distances increase in WF3, new large-scale trucks and LHDs will be purchased for the more efficient transportation of material to surface reducing costs over the life-of-mine.

Onsite Operating Costs: Once the project is commissioned, onsite operating costs are expected to reduce by approximately 28% on a per tonne milled basis. Mining costs per tonne milled will be reduced due to the change in the mining method to include paste fill allowing for increased ore recovery and reduced mining dilution. Mining costs will also benefit from the dedicated underground decline to the WF3 deposit which will allow for more efficient material handling and reduced cycle times. Except for power, the processing unit costs will decrease as a result of treating increased tonnages following the upgrade. Fixed on site costs on a per tonne milled basis will also decrease as the mine ramps up from 0.7 Mtpa to the PFS target of 1.3 Mtpa as a function of higher annual throughput.

Future Study Opportunities

The Company intends to commence a Feasibility Study of the RP2.0 Expansion in the first quarter of 2021. Prior to such commencement, there are several additional optimization opportunities that are being pursued that have the potential to enhance the project’s economics further. The key opportunities are listed below:

- Optimization of critical underground infrastructure placement including the positioning of the decline and the ventilation, electrical substation, and paste fill distribution networks, which may reduce mine design physicals and lower capital and operating costs.

- There is potential for lead recovery improvement with the inclusion of a Jameson flotation cell in a cleaner scalper flotation duty.

- Inferred Mineral Resources have the potential to be converted to Indicated and Measured Mineral Resources via additional infill drilling work and enable additional higher-value ore (above the strategic optimal cut-off value of $80/t NSR) to displace lower-value ore earlier in the mine schedule thereby improving NPV.

- Significant exploration potential exists within the Property with a number of high priority drill targets identified to delineate additional Mineral Resources.

Table 1: Life of Mine and RP2.0 PFS Expansion Economics

| Project Metrics | Unit | LOM (Q1 2020 – 2030) |

Post Expansion (Q1 2023 – 2030) |

| Mine life | Yrs | 11 | 8 |

| Total ore production | Kt | 11,610 | 9,491 |

| Zinc grade (average) | % | 6.3 | 6.2 |

| Lead grade (average) | % | 1.3 | 1.2 |

| Silver grade (average) | g/t | 19.1 | 17.9 |

| Payable Zinc metal | t | 544,789 | 436,260 |

| Payable Lead metal | t | 92,606 | 71,836 |

| Payable Silver metal | Oz | 2,685,176 | 2,074,261 |

| Capital costs – project | US$M | 93 | – |

| Capital costs – sustaining | US$M | 132 | 78 |

| Capital costs – closure | US$M | 7 | 7 |

| C1 cash costs1 | US$/lb | 0.58 | 0.56 |

| All-In-Sustaining-Cost “AISC”1 | US$/lb | 0.70 | 0.64 |

| Post-tax free cashflow | US$M | 238 | 316 |

| Post-tax NPV (8%) | US$M | 142 | – |

| Post-tax IRR | % | 65 | – |

| Payback Period post-tax | Yrs | 3.9 | – |

Table 2: Expansion Capital Cost Summary in US$M

| Item Description | 2021 (USD) |

2022 (USD) |

2023 (USD) |

Total (USD) |

| Processing | ||||

| Processing plant upgrade | 4.1 | 36.5 | 4.8 | 45.4 |

| Mine Infrastructure – Underground | ||||

| Electrical | 0.5 | 0.4 | 0.1 | 0.9 |

| Dewatering | 0.1 | 0.8 | – | 0.9 |

| Ventilation | 0.4 | 1.6 | – | 2.0 |

| Other | – | 0.4 | – | 0.5 |

| Mine Infrastructure – Surface | ||||

| Boxcut / Portal (WF3) | 0.6 | – | – | 0.6 |

| Paste fill plant | – | 18.7 | – | 18.7 |

| Paste fill reticulation | – | 3.5 | – | 3.5 |

| Batching plant (Shotcrete) | – | 0.8 | – | 0.8 |

| General upgrade infrastructure | – | 2.2 | – | 2.2 |

| EPCM | 0.7 | 6.4 | – | 7.1 |

| Sub-Total | 6.4 | 71.3 | 4.9 | 82.6 |

| Contingency (13%) | 1.4 | 8.5 | 0.6 | 10.4 |

| Total | 7.8 | 79.8 | 5.5 | 93.0 |

Table 3: Zinc Price Sensitivity Estimates

| Financial Metric | Unit | $0.90/lb | $1.00/lb | $1.11/lb | $1.20/lb | $1.30/lb |

| Post-tax free cashflow | US$M | 95 | 160 | 238 | 293 | 363 |

| Post-tax NPV (8%) | US$M | 45 | 90 | 142 | 183 | 231 |

Mineral Resources and Reserves

The Mineral Resource estimate for the Rosh Pinah deposit covers numerous lenses. A total of seven mineral lenses are included in the updated mineral resource estimate as of 30 June 2020.

To convert Mineral Resources to Mineral Reserves, mining cut-off grades were applied, mining dilution was added, and mining recovery factors were assessed. Only Measured and Indicated Mineral Resources were used for Mineral Reserve estimation.

A cut-off value of US$50.0/t was used to estimate the Mineral Reserves. The selected cut-off value is above the projected full breakeven cut-off value.

Updated Mineral Resource and Mineral Reserve estimates are planned as part of the Company’s annual year end process. The successful conversion of additional resources and further optimizations are expected to be included and will further enhance the project economics.

Table 4: Mineral Resources

| Classification | Tonnes | Grade | Contained Metal | |||||

| (Mt) | Zn (%) | Pb (%) | Ag (g/t) | ZnEq (%) | Zn (M lbs) | Pb (M lbs) | Ag (k oz) | |

| Measured | 8.13 | 7.38 | 2.11 | 25.7 | 9.49. | 1,323 | 378 | 6,727 |

| Indicated | 7.97 | 7.08 | 1.22 | 19.8 | 8.52 | 1,245 | 215 | 5,082 |

| M&I | 16.10 | 7.23 | 1.67 | 22.8 | 9.01 | 2,567 | 593 | 11,809 |

| Inferred | 3.43 | 6.71 | 1.34 | 23.2 | 8.07 | 508 | 102 | 2,557 |

- CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) were used for reporting of Mineral Resources.

- The Mineral Resources are stated inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic value.

- Mineral Resources are reported at an ZnEq cut-off grade of 4.0%Zn which approximates a Net Smelter Return (NSR) value of $40/t. Zinc equivalency was estimated as ZnEq = Zn (%) + Pb (%) + [Ag (g/t) * 0.028)].

- Effective date of Mineral Resources is 30 June 2020.

- The QP for the Mineral Resource estimate is Mr Rodney Webster, MAIG, of AMC.

- Mineral Resources are stated on a 100% ownership basis. Trevali’s ownership interest is 90%.

Table 5: Mineral Reserves

| Classification | Tonnes | Grade | NSR | Contained Metal | ||||

| (Mt) | Zn (%) | Pb (%) | Ag (g/t) | NSR (US$/t) | Zn (M lbs) | Pb (M lbs) | Ag (k oz) | |

| Proven | 4.24 | 7.32 | 1.99 | 23.7 | 130 | 684 | 186 | 3,221 |

| Probable | 6.99 | 5.62 | 0.93 | 16.2 | 88 | 866 | 143 | 3,671 |

| Total | 11.23 | 6.26 | 1.33 | 19.0 | 104 | 1,550 | 329 | 6,892 |

- CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) were used for reporting of Mineral Reserves.

- Mineral Reserves were estimated at an NSR cut-off value of US$50.0 per tonne.

- The NSR values were calculated based on average metal prices of US$1.11/lb Zn, US$0.93/lb Pb, and US$19.81/oz Ag.

- The average processing recoveries used were 88.0% for Zinc, 65.8% for Lead, and 43.5% for Silver.

- Dilution (Inferred and unclassified material set to zero grade) assumed as a minimum of 1.0 m on each hangingwall and 0.5 m on each footwall.

- Mining recovery factors assumed as a minimum of 95%.

- Mineral Reserves are reported based on mined ore delivered to the plant as mill feed.

- The average exchange rate used was N$ 16.69 = US$ 1.00.

- Effective date of Mineral Reserves is 30 June 2020.

- The QP for the Mineral Reserve estimate is Mr Andrew Hall, MAusIMM (CP), of AMC.

- Rounding of some figures may lead to minor discrepancies in totals.

- Mineral Reserves are stated on a 100% ownership basis. Trevali’s ownership interest is 90%.

Qualified Persons and Technical Information

The written technical disclosure and data in this news release was approved by Yan Bourassa, P.Geo, Vice-President Exploration & Mineral Resources of the Company and Nick Espenberg, P.Eng, Manager Planning & Supply Chain of the Company, both of whom are non-independent Qualified Persons within the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), together with the following independent qualified persons:

- Andrew Hall, MAusIMM (CPP), AMC Consultants Pty Ltd., responsible for mining and Mineral Reserve estimation.

- Rodney Webster, MAIG, AMC Consultants Pty Ltd., responsible for geology and Mineral Resource estimation.

- Louise Lintvelt, PrEng, DRA Projects (Pty) Limited, responsible for metallurgical and ore processing aspects.

- Rob Welsh, PrEng, DRA Projects (Pty) Limited, responsible for metallurgical, ore processing and surface infrastructure aspects.

- Mo Molavi, P. Eng, AMC Mining Consultants (Canada) Ltd., responsible for underground infrastructure aspects.

The Mineral Resource and Mineral Reserve estimates have been estimated and compiled in accordance with definitions and guidelines set out in the Definition Standards for Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining, Metallurgy, and Petroleum and as required by NI 43-101. Mineral Reserve estimates reflect the Company’s reasonable expectation that all necessary permits and approvals will be obtained and maintained, mining dilution and mining recovery have been applied in estimating the Mineral Reserves.

ABOUT TREVALI

Trevali is a global base-metals mining company, headquartered in Vancouver, Canada. The bulk of Trevali’s revenue is generated from base-metals mining at its three operational assets: the 90%-owned Perkoa Mine in Burkina Faso, the 90%-owned Rosh Pinah Mine in Namibia, and the wholly-owned Santander Mine in Peru. In addition, Trevali owns the Caribou Mine, Halfmile and Stratmat Properties and the Restigouche Deposit in New Brunswick, Canada, and the past-producing Ruttan Mine in northern Manitoba, Canada. Trevali also owns an effective 44%-interest in the Gergarub Project in Namibia, as well as an option to acquire a 100% interest in the Heath Steele deposit located in New Brunswick, Canada.

The shares of Trevali are listed on the TSX (symbol TV), the OTCQX (symbol TREVF), the Lima Stock Exchange (symbol TV), and the Frankfurt Exchange (symbol 4TI). For further details on Trevali, readers are referred to the Company’s website (www.trevali.com) and to Canadian regulatory filings on SEDAR at www.sedar.com.

Investor Relations Contact:

Brendan Creaney – Vice President, Investor Relations

Email: bcreaney@trevali.com

Phone: +1 (778) 655-6070

Use of Non-IFRS Financial Performance Measures

This press release refers to C1 Cash Cost and All-In Sustaining Cost (“AISC”). These measures are not recognized under IFRS as they do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Trevali uses these measures internally to evaluate the underlying operating performance of the Company. The use of these measures enables the Company to assess performance trends and to evaluate the results of the underlying business. Trevali understands that certain investors, and others who follow the Company’s performance, also assess performance in this way. The Company believes that these measures reflect our performance and are useful indicators of our expected performance in future periods. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

C1 Cash Cost

This measures the estimated cash cost to produce a pound of payable zinc. This measure includes mine operating production expenses such as mining, processing, administration, indirect charges (including surface maintenance and camp), and smelting, refining and freight, distribution, royalties, and by-product metal revenues divided by pounds of payable zinc produced. C1 Cash Cost per pound of payable zinc produced does not include depreciation, depletion, and amortization, reclamation expenses, capital sustaining and exploration expenses.

All-In Sustaining Cost (“AISC”)

This measures the estimated cash costs to produce a pound of payable zinc plus the estimated capital sustaining costs to maintain the mine and mill. This measure includes the C1 Cash Cost per pound and capital sustaining costs divided by pounds of payable zinc produced. All-In Sustaining Cost per pound of zinc payable produced does not include depreciation, depletion, and amortization, reclamation and exploration expenses.

Cautionary Note Regarding Forward-Looking Information and Statements

This news release contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Forward-looking statements are based on the beliefs, expectations and opinions of management of the Company as of the date the statement is published, and the Company assumes no obligation to update any forward-looking statement, except as required by law.

Forward-looking statements relate to future events or future performance and reflect management’s expectations or beliefs regarding future events including, but not limited to, statements with respect to the results of the Rosh Pinah Expansion “RP2.0” Pre-Feasibility Study, including the expansion of the existing production capacity to up to 1.3Mtpa; the timing and commencement of the Feasibility Study; the timing, commencement and results of any optimization opportunities identified by the Company in respect of the Property; the timing of commencement of construction of the expansion project and achievement of commercial production; estimates of project capital costs; future production forecasts and projects, including average annual production of payable zinc, lead and silver; estimates of cash costs including C1 cash costs and All-in Sustaining Cost; estimates of mineral reserves and mineral resources; ability to extend the mine life beyond the current reserve life; future exploration results; estimates of average zinc, lead and silver grades and mineral recoveries over the mine life and post-completion of the expansion project; estimates of internal rate of return, payback period and net present value; and other information contained in the PFS. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, risks related to changes in project parameters as plans continue to be refined; future prices of zinc, lead, silver and other minerals and the anticipated sensitivity of our financial performance to such prices; possible variations in ore reserves, grade or recoveries; the adequacy of underground development infrastructure; unforeseen changes in geological characteristics; changes in the metallurgical characteristics of the mineralization; the availability to develop adequate processing capacity; the availability of equipment necessary to complete development; the size of future processing plants and future mining rates; increased operating and capital costs, including with respect to consumables and mining and processing equipment; unforeseen technological and engineering problems; dependence on key personnel; potential conflicts of interest involving our directors and officers; labour pool constraints; labour disputes; delays or inability to obtain governmental and regulatory approvals for mining operations or financing or in the completion of development or construction activities; counterparty risks; foreign currency exchange rate fluctuations; operating in foreign jurisdictions with risk of changes to governmental regulation; risks relating to widespread epidemics or pandemic outbreak ; land reclamation and mine closure obligations; challenges to title or ownership interest of our mineral properties; maintaining ongoing social license to operate; impact of climatic conditions on the Company’s mining operations; corruption and bribery; limitations inherent in our insurance coverage; compliance with debt covenants; competition in the mining industry; our ability to integrate new acquisitions into our operations; cybersecurity threats; litigation and other risks and uncertainties that are more fully described in the Company’s most recent annual information form and management’s discussion and analysis filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. In addition, there can be no assurance regarding the achievement or timing of the Company’s exploration, development, construction or commercial production objectives. The information in the PFS Technical Report is presented with an effective date of June 30, 2020, unless otherwise indicated in the PFS Technical Report.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Trevali provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events may differ from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Source: Trevali Mining Corporation