Copper demand is only expected to rise. For one, “More than 700 million mt of copper will need to be mined in the next 22 years to maintain 3.5% GDP growth, without taking into account the electrification of the global economy, which is the same volume of copper ever mined, Ivanhoe Mines Founder & Co-Chair Robert Friedland,” as noted by S&P Global. In addition, the world could run into a 9 million mt copper deficit by 2030, as noted by BMO Capital. All while demand increases for electric vehicles, solar and wind-power technology, and power grids. In fact, as also noted by S&P Global, “All power grids globally were unreliable, with huge investment needed to upgrade aging grids — in the US alone, he said investment of about $208 billion was needed by 2029 and around $338 billion by 2039.” All could drive significant interest to companies, such as

CopperCorp Resources Inc.

(TSXV: CPER) (OTCQB: CPCPF),

Freeport-McMoRan

(NYSE: FCX),

Southern Copper Corporation

(NYSE: SCCO),

Teck Resources Ltd.

(NYSE: TECK), and

Turquoise Hill Resources

(NYSE: TRQ).

Look at

CopperCorp Resources Inc. (TSXV: CPER) (OTCQB: CPCPF), For Example

CopperCorp Resources Inc.

announced that it has received preliminary assay results for a further two drill holes from the Alpine Stellar Zone located in the Company’s AMC Project, western Tasmania, Australia.

Highlights

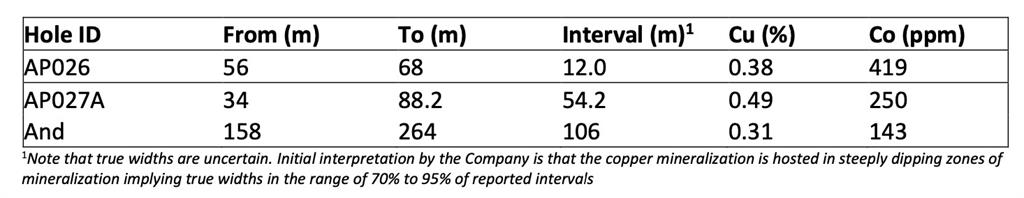

1. Significant mineralized intercepts include:

2. These results continue to confirm the Company’s interpretation of multiple continuous, broad zones of copper mineralization at the Alpine Stellar Zone, defined to date

over a strike length of 700m and open and to a vertical depth of 300m and open.

3. These results are also encouraging in further confirming the trend of these mineralized zones towards the yet untested Alpine West target, scheduled to be drilled in the next several months. Including Alpine West the prospective strike length is approximately 2.2km.

4. CopperCorp is now drilling holes to test continuity of the interpreted zones of copper mineralization to depth. Drilling is also planned to step out on these zones along strike.

Stephen Swatton, President and CEO of CopperCorp, stated, “Drill confirmation of the continuation of wide zones of copper mineralization in these drill holes is very encouraging and confirms our initial interpretation that the copper rich mineralized system hosted in multiple broad, sub-parallel steeply dipping zones is robust. This bodes well for finding further copper mineralization at Alpine Stellar Zone and other identified targets in the West and North Zones which lie adjacent to Stellar (as reported in the May 11 News release). Further drill results are expected to be released within the next 30 days as the laboratory catches up on the recent backlog of samples submitted for analysis.”

Other related developments from around the markets include:

Freeport-McMoRan

reported

first-quarter 2022 net income

attributable to common stock of $1.5 billion, $1.04 per share, and adjusted net income attributable to common stock of $1.6 billion, $1.07 per share, after excluding net charges primarily associated with the settlement of an administrative fine and an adjustment to prior-period export duties at PT-FI totaling $38 million, $0.03 per share. Richard C. Adkerson, Chairman and Chief Executive Officer, said, “The strong operational and financial results we are reporting today reflect our long-term, ongoing focus on solid execution of our plans and the achievements of our committed global team. As a premier global leader in producing copper responsibly, with large-scale, long-lived reserves and an attractive portfolio of organic growth opportunities, we are strongly positioned to benefit from increasing global copper demand for infrastructure development and accelerating clean energy investments. We have created a durable foundation for long-term success supported by a portfolio of world class copper assets, an experienced and highly motivated global team and a strong financial base. Freeport is focused on delivering value to all our stakeholders and approaching the future with confidence and excitement.”

Southern Copper Corporation

recently posted

fourth quarter earnings

. 2021 marked another important year in Southern Copper’s history. This year, net sales, net income, adjusted EBITDA and cash from operations hit record highs. 4Q21 net sales were $2,823.7 million, which represented a 20.1% increase with regard to 4Q20’s figure. Growth was primarily fueled by higher metal prices for our main products, which was partially offset by a decrease in the sales volume at our Peruvian operations due to bi-annual maintenance at the Ilo smelter. Metal prices increased for copper (+35.4%, LME); molybdenum (+107.5%); and zinc (+28.6%). 2021 net sales hit a record high of $10,934.1 million, which represented an increase of 36.9% over the figure reported in 2020. This growth was mainly driven by higher market metal prices for all our main products. Metal prices increased for copper (+51.1%, LME); molybdenum (+81.0%); zinc (+32.0%); and silver (+22.1%). The cooper sales volume decreased 11% for the year due to a drop in sales of copper supplied from third parties and shipment delays; the latter was attributable to the COVID 19 pandemic. Net income in 4Q21 was $833.0 million, which represented a 41.1% increase with regard to the $590.2 million registered in 4Q20. The net income margin in 4Q21 was 29.5%, versus 25.1% in 4Q20.

Teck Resources Ltd.

announced that its Board of Directors has

declared an eligible dividend

of $0.125 per share on its outstanding Class A common shares and Class B subordinate voting shares, to be paid on June 30, 2022 to shareholders of record at the close of business on June 15, 2022.

Turquoise Hill Resources

announced its

financial results

for the period ended March 31, 2022. “Oyu Tolgoi’s first quarter again demonstrated the operational excellence of the Oyu Tolgoi workforce. The OT team achieved an All Injury Frequency Rate (AIFR) of 0.09 per 200,000 hours worked, one of the lowest in recent years while keeping the Company on track to meet its guidance for the year. First quarter in-line production of 30.3 thousand tonnes of copper and 59 thousand ounces of gold has allowed us to maintain our 2022 copper production guidance of 110,000 to 150,000 tonnes, and to revise the gold production guidance range upward from 115,000 – 165,000 ounces to 135,000 – 165,000 ounces, with production trending toward the higher end of the range.” said Steve Thibeault, Turquoise Hill’s Interim Chief Executive Officer.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for CopperCorp Resources Inc. by CopperCorp Resources Inc. We own ZERO shares of CopperCorp Resources Inc.

Please

click here

for full disclaimer.

Contact Information:

2818047972

ty@LifeWaterMedia.com