Teck Resources Ltd

TECK

has lowered the annual steelmaking coal and refined Zinc production guidance 2021, due to the forest fire incident in British Columbia, which hurt the company’s third-quarter operations.

In August, Teck’s Trail Operations metallurgical facility was impacted by wildfire smoke following which, Trail’s oxygen plant was temporarily shut down due to the poor air quality. On Aug 13, Trail’s oxygen plants resumed operations. However, the plant closure negatively impacted the company’s zinc production, as a result of which, the company now expects 2021 zinc production to be between 285,000 tons and 290,000 tons, lower from the prior range of 290,000 to 300,000 tons.

The refined zinc production for the third quarter is expected between 72,000 tons and 75,000 tons. The company produced 76,000 tons refined zinc in third-quarter 2020.

On Aug 14, Teck suspended its Highland Valley Copper (HVC) operations for a period of four days due to the wildfire evacuation order issued by the District of Logan Lake. As copper production was not impacted significantly, the company maintained its HVC annual contained copper production guidance at 128,000 to 133,000 tons. However, the shipment timing of copper concentrate from HVC has been impacted due to the wildfires and logistics troubles.

The wildfire mishap has also impacted the company’s steelmaking coal business. Teck, hence, had incorporated the impact in the steelmaking coal segment’s third-quarter sales volume and annual production guidance provided in the second-quarter’s earnings call. The segment’s sales are expected between 5.7 million tons and 6.1 million tons for the third quarter.

The company projects steelmaking coal production between 25 million tons and 26 million tons in 2021. Additionally, the annual steelmaking coal production at the Elk Valley operation is likely to be impacted by the incident, coupled with increased labor absence related to the COVID-19 protocols.

Teck has lowered the third-quarter sales guidance for zinc concentrate at Red Dog operation, due to the weather and ice situations as well as weather-induced shipping delays in July and August. The company now expects third-quarter contained zinc sales in the band of 145,000-155,000 tons, down from the prior estimate of 180,000-200,000 tons. Though the company is facing shipping shortages in the third quarter, management expects to ship all Red Dog zinc concentrates during the current shipping season assuming normal weather conditions.

Teck continues to implement its innovation-driven efficiency program, RACE21, which is expected to improve proficiency and productivity across the business. Savings from this program will likely offset cost inflation, supply-related challenges, higher labor costs and lower production.

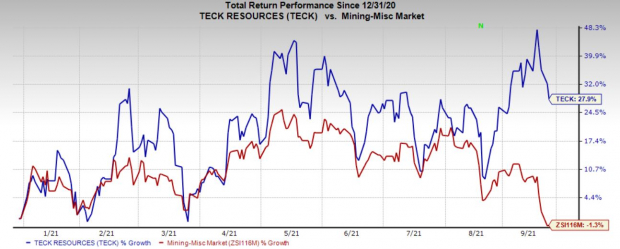

Price Performance

The company’s shares have gained 27.9% so far this year, as against the

industry

’s decline of 1.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Teck currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

Avient Corp.

AVNT

,

The Mosaic Co.

MOS

and

Veritiv Corp.

VRTV

, each sporting a Zacks Rank #1 (Strong Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Avient has a projected earnings growth rate of 75% for 2021. The company’s shares have gained 17.7%, so far this year.

Mosaic has an estimated earnings growth rate of 472.9% for the current year. So far this year, the company’s shares have appreciated 40.1%.

Veritiv has an estimated earnings growth rate of 215% for the current year. The company’s shares have soared 320.1%, year to date.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report