Teck Resources Ltd

TECK

updated the current-year steelmaking coal sales and production guidance as heavy rainfall, flooding and landslides in British Columbia (B.C) affected its logistics chain between west coast terminals and B.C operations.

Recent heavy downpours and floods in southern B.C have forced to shut down rail services in Canada’s largest port of Vancouver.

Canadian National Railway

CN

and

Canadian Pacific Railway

CP

networks has been operating at reduced levels following service disruptions, due to which shipments to Neptune and Westshore terminals in the Lower Mainland has been affected.

Teck Resources now expects fourth-quarter steelmaking coal sales between 5.2 and 5.7 million tons compared with the prior estimate of 6.4-6.8 million tons. The company rerouted some shipments to Ridley Terminals in Prince Rupert to maximize sales during the quarter, which will impact its transportation costs for the quarter.

Given heavy downpour-led rail line disruptions, previously-occurred forest fires in B.C and escalating cost pressures, Teck Resources expects its transportation costs to increase. For the current year, transportation cost is expected to lie between $44 per ton and $46 per ton compared with $42 per ton expected earlier.

CN & CP are working on returning its service capacity, while continuing to increase Teck Resources’ shipments to Lower Mainland terminals. The company is optimistic about recovering delayed fourth-quarter sales in the first half of 2022.

Teck Resources anticipates steelmaking coal production in the band of 24.5-25 million tons for the current year compared with 25 million tons expected in the earlier guidance. Adjusted site cash cost of sales for the current year is expected between $64 per ton and $66 per ton, slightly above the upper end of its prior expectation of $59 to $64 per ton.

Teck Resources is witnessing higher steelmaking coal prices through the second half of the current year. It will keep benefiting from the record increase in FOB Australia steelmaking coal prices, CFR China prices and strong demand from steelmakers. The company’s Neptune Bulk Terminals facility upgrade project strengthens the performance of the steelmaking coal-supply chain, increases terminal loading capacity and enhances the capability to meet delivery commitments to customers, while lowering overall logistic costs.

CN and CP help the company ship steelmaking coal from its four B.C. operations between Kamloops and Neptune Terminals, and other west coast ports. This significantly enhances Teck Resources’ shipment volumes through the expanded Neptune Terminals.

Even though production at the Highland Valley Copper has not been impacted, management estimates up to 4,500 tons contained copper in concentrate sales might be delayed into the first quarter of 2022 due to logistics challenges.

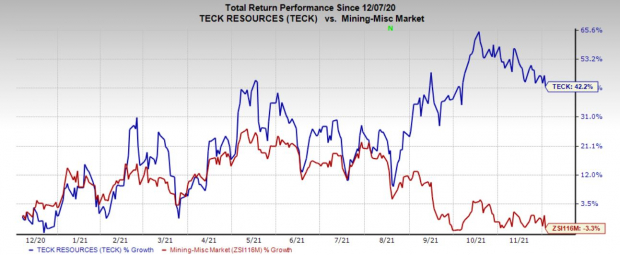

Price Performance

Teck Resources’ shares have soared 42.2% in the past year compared with the

industry

’s decline of 3.3%

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Teck Resources currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the basic materials space is

Olin Corporation

OLN

, flaunting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Olin’s third-quarter 2021 adjusted earnings beat the Zacks Consensus Estimate, while revenues missed the same. It has an expected earnings growth rate of around 740% for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has been revised 20.5% upward in the past 60 days.

Olin’s shares have surged 229% in the past year. The company has a long-term earnings growth of 56%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report