Teck Resources Limited

TECK

announced a Carbon Capture Utilization and Storage (CCUS) pilot project at its Trail Operations metallurgical facility in southern British Columbia. This pilot project is likely to start operation in the second half of 2023.

CCUS pilot project supports Teck’s Net-Zero Climate Change Strategy in addition to the company’s goal to reduce the carbon emission of its operations by 33% by 2030 and achieve net-zero emissions by 2050. Also, this project will help the company for the application of carbon capture, utilization and storage as an emissions reduction solution.

CCUS will capture CO2 from the Acid Plant flue gas at Trail Operations at a rate of three tons per day. The company will assess options for the utilization of the captured CO2. TECK is committed to lower greenhouse gas releases across its operations. Moreover, this pilot project will enable its steelmaking coal customers in substantially reducing the carbon exposure of their steel production.

If successful, the project can scale up its industrial CCUS plant with the potential to capture more than 100 thousand tons of CO2 annually at Trail Operations, equivalent to the carbon emissions of more than 20,000 cars.

Teck has a portfolio of world-class assets in stable jurisdictions and a solid pipeline of projects. Higher prices of the company’s principal products and better-than-expected performance of its mine operations contributed to first-quarter 2022 results. During the quarter, the Steelmaking coal segment benefited from the record increase in FOB Australia steelmaking coal prices, CFR China prices and strong demand from steelmakers. The segment will continue to perform well in the current year with higher mine site steelmaking coal inventories. The company expects steelmaking coal sales of 6.3-6.7 million tons in second-quarter 2022, as it captures deferred sales from the previous two quarters.

Teck expects the 2022 production of zinc in concentrate (including co-product zinc production from Antamina) to be 630,000-665,000 tons, higher than the 2021 production of 607,400 tons. Contained metal production from the Red Dog mine is expected in the band of 540-570 thousand tons for 2022, up from 2021 production of 503.4 thousand tons. Sales of Red Dog zinc in concentrate are expected in between 50,000 and 70,000 tons in the second quarter of 2022, reflecting the regular seasonal pattern of Red Dog sales. The refined zinc market continues to strengthen on improving demand for manufacturing, automotive, construction and infrastructure sectors.

The company expects 2022 refined zinc production from trail operations to be between 270,000 tons and 285,000 tons. In 2021, it produced 279,000 tons. The trail has major maintenance activities planned from September to November, which are expected to impact production in the current year.

Teck continues to face inflationary cost pressures, particularly in diesel prices and transportation costs. Increased steel, crude oil and natural gas prices are driving prices for certain key supplies like mining equipment, fuel, tires and explosives. These factors will continue to put pressure on the company’s margin in the second quarter. Copper and steelmaking coal segments are likely to be unfavorably impacted by these factors.

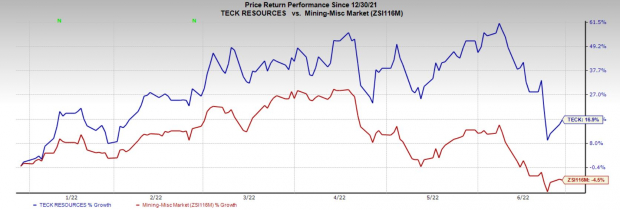

Price Performance

Teck’s shares have gained 16.9% in the past six months, against the

industry

’s loss of 4.5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Teck currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Inc.

ATI

,

Nutrien Ltd

NTR

and

Albemarle Corporation

ALB

, each flaunting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Allegheny has a projected earnings growth rate of 869.2% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 27.3% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI has gained around 3% in a year.

Nutrien has a projected earnings growth rate of 163.2% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 27.5% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 5.8%. NTR has gained roughly 29% in a year.

Albemarle has a projected earnings growth rate of 203.7% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 100.4% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 22.5%. ALB has gained around 28% in a year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report