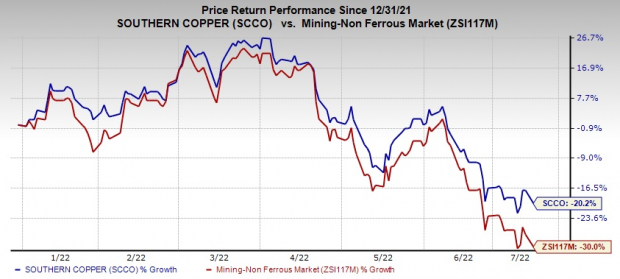

Shares of

Southern Copper Corporation

SCCO

have lost 34% compared with the

industry

’s decline of 40.5% so far this year.

The decrease in share price primarily reflects the lower production expectations for the year as a result of the suspension of operations at its Cuajone mine in Peru earlier this year and the recent downtrend in copper prices and inflationary pressures.

The company has a market capitalization of $38 billion. It currently has a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Factors Impacting the Company

On Feb 28, 2022, a minority group of protesters from the community of Tumilaca, Pocata, Coscore and Tala cut the Cuajone mine’s water supply, which led to the suspension of its operations. Earlier, the railway between Cuajone and Ilohad had been blocked by a group of community members. These events dealt a blow to the company considering that Cuajone is its second-largest mine in Peru. The suspension impacted copper production by 15,278 tons in the first quarter of 2022. Overall, Southern Copper mined 241,480 tons of copper in the first quarter of 2022, which was down 10% year over year, primarily due to the Cuajone incident and lower ore grades and recoveries. Silver production plunged 220,233 ounces year on year. The Peruvian government declared a state of emergency in the Moquegua region on Apr 20, and water and railway connections have since been restored, and the mine is operating as usual.

The company expects copper production in 2022 at 895,800 tons, lower than the 922,000 tons predicted earlier. The revised guidance indicates a drop of 6.5% year on year. Production will bear the impact of the stoppage of operations at Cuajone, temporary reduction in ore grades, and recoveries at the Peruvian operations.

Copper prices have recently lost steam, weighed down by mounting fears of a global economic slowdown and resurgent Covid-19 outbreaks in top consumer China. Silver has lost value as bets of aggressive tightening by major central banks diverted investors from the non-yield metal.

On top of this, Southern Copper is facing higher costs for diesel and fuel, operating and repair materials, supplies, energy, as well as higher labor costs. This will hurt its margins. For 2021, the company’s per pound cash cost before by-product revenues was 67 cents. For 2022, the company is projecting cash costs in the range of 80 cents to 85 cents per pound. Operating cash costs are likely to be higher due to lower grades.

Overall, lower production levels, the recent drop in copper and silver prices as well as elevated costs are expected to impact the company’s earnings this year.

The Zacks Consensus Estimate for SCCOs earnings per share is pegged at $3.82 for 2022 and $3.64 for 2023, indicating year-on-year decline of 13% and 4.6%, respectively. Both the estimates have been revised downward over the past 30 days.

Stocks to Consider

Some better-ranked stocks in the basic materials space are

Kronos Worldwide

KRO

,

DAQO New Energy

DQ

and

Cabot Corporation

CBT

, each sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Kronos has a projected earnings growth rate of 110% for the current year. The Zacks Consensus Estimate for KRO’s current-year earnings has been revised 61% upward in the past 60 days.

Kronos has a trailing four-quarter earnings surprise of roughly 24%, on average. KRO has gained around 13% year-to-date.

Daqo New Energy has a projected earnings growth rate of 130% for the current year. The Zacks Consensus Estimate for DQ’s current-year earnings has moved up 21% in the past 60 days.

Daqo New Energy has a trailing four-quarter earnings surprise of 2.16%, on average. DQ has appreciated 13% so far this year.

Cabot has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT’s earnings for the current fiscal has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 16.2%. CBT has risen around 16% so far this year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report