Silver futures for July 2021 delivery closed at $28.04 an ounce on Jun 14, gaining 5% so far this year. Annual inflation rate in the United States advanced to 5% in May 2021 from 4.2% in April — above market expectation of 4.7%. Notably, this marked the highest level since August 2008, reflecting the ongoing economic recovery and low base effects due to the pandemic last year.

So far this year, silver prices have averaged around $26.60 per ounce. According to the Silver Institute, silver prices will average around $27.30 this year, registering an impressive 33% year-over-year increase. It anticipates silver prices to reach $32 later in the year. Notably, earlier in February, the white metal had peaked to $31 an ounce — crossing the $30 threshold for the first time since 2013.

Factors Likely to Drive the Silver Rally

Silver’s performance will primarily be driven by demand and supply imbalance. The white metal is benefiting from its safe haven demand, varied industrial use and growing focus on silver-consuming green energy applications. The Silver Institute projects silver demand to grow 15% this year. Major part of the increase will be driven by investment demand, which is expected to go up 26% to 252.8 million ounces (Moz) — the highest level since 2015.

Industrial demand is expected to log year-over-year growth of 8% and hit a record high of 524 Moz, courtesy of reopening of economies and investment in green energy solutions. Surging sales of electric vehicles will also support silver demand. Jewelry fabrication is forecast to increase 24% in 2021 to 184.4 Moz driven by an economic recovery.

Meanwhile, total silver supply is expected to be up 8% this year to 1,056.3 Moz. After being severely impacted by coronavirus-related mine closures last year, mine production is expected to bounce back in 2021 with a projected year-over-year growth of 8.2% to 848.5 Moz with the biggest comebacks from Mexico, Peru and Bolivia. Mexico, particularly is expected to log strong numbers as new projects, such as Cerro Los Gatos, Juanicipio and Capela, ramp-up production rates. Recycling activity is anticipated to higher owing to higher silver prices. Thus, it is apparent that silver is headed for a deficit this year, which will prop up prices.

The long-term outlook for silver remains solid. Given numerous industrial applications for silver, particularly those pertaining to “green” technologies and 5G will continue to support demand for silver in years to come. Demand for silver in solar photovoltaic (PV) cells is surging as countries move toward adopting renewable energy sources. The Silver Institute estimates silver demanded from 5G to more than double to around 16Moz by 2025. By 2030, it will require around 23Moz — a 206% increase from current levels.

In the automobile industry, demand for silver will rise to 88 Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Charging points and charging stations will also call for a massive amount of silver. Silver demand for “printed and flexible electronics” will grow 54% over the next nine years. Overall, with more countries now focusing on lowering carbon emissions, they will need more silver for electric vehicles, charging stations and 5G, and cables connecting new wind turbines and solar farms to the grid.

Image Source: Zacks Investment Research

In a year’s time, the

Mining – Silver

industry has rallied 59.4%, outperforming the S&P 500’s rally of 40.6%. The industry falls under the broader

Basic Materials

sector, which gained 54.8% in the same time frame.

4 Silver Stocks to Watch

Fresnillo plc

FNLPF

: The Mexico-based company primarily explores for silver, gold, lead, and zinc concentrates. Its flagship project is Fresnillo silver mine located in the state of Zacatecas.

The company is investing in a number of projects to increase production and ensure steady growth in future years. Focus on improving operational performance and enhancing efficiency is expected to result in lower costs. Its high quality assets, ample mineral resources, competitive margins and disciplined approach to development will continue to drive growth.

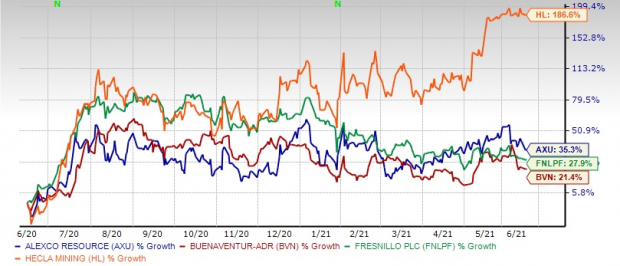

The Zacks Consensus Estimate for the company’s current-year earnings indicates year-over-year growth of 87.5%. The estimates have also moved up 3.7% in 90 days’ time. The company’s shares have gained 27.9% in the past year. It currently carries a Zacks Rank #3 (Hold).

Hecla Mining Company

HL

: This Coeur d’Alene, ID-based company, together with its subsidiaries discovers, acquires, develops, and produces precious and base metal properties in the United States and internationally.

The company has a diverse asset portfolio in mining friendly jurisdictions. It boasts two of the largest silver mines in the world and two highest-grade large silver mines. It is pursuing acquisition opportunities to complement existing portfolio. The company currently produces about one-third of the silver mined in the United States. This is expected to grow as Lucky Friday Mine in Idaho ramps up. The mine’s production is expected to double again in 2021 and 60% more within four years. The company is also one of the lowest-cost U.S. silver producers.

The Zacks Consensus Estimate for earnings for fiscal 2021 indicates year-over-year improvement of 375%. The estimate has been revised upward by 1.4% over the past 90 days. Shares of the company have soared 186.6% over the past year. The company currently carries a Zacks Rank #3. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Buenaventura Mining Company Inc.

BVN

: Based in Lima, Peru, the company engages in exploration, mining, and processing of gold, silver, lead, zinc, and copper metals in Peru, the United States, Europe, and Asia. It currently operates several mines in Peru — Orcopampa, Uchucchacua, Julcani, El Brocal, La Zanja and Coimolache, and is developing the Tambomayo project.

The company is well-poised for growth, backed by its solid capital structure with ample liquidity and a portfolio of base and precious metals. The company has embarked on a debottlenecking program to reduce costs at its direct operation mines. The program has driven impressive results in Tambomayo, where the company simplified the metallurgical process and optimized mine preparation. In Uchucchacua, it has improved efficiency in the underground mine. At El Brocal, it has increased production driven by operational improvements. Overall, the program has resulted in significant cost savings in each of its mines.

The Zacks Consensus Estimate for the company’s current-year earnings indicates year-over-year growth of 244%. The estimates have gone up 1.4% over the past 90 days. The company’s shares have appreciated 21.4% in the past year. It currently carries a Zacks Rank #3.

Alexco Resource Corp.

AXU

: Headquartered in Vancouver, Canada, Alexco Resource operates the majority of the historic Keno Hill Silver District, in Canada’s Yukon Territory — one of the highest-grade silver deposits in the world. The company is currently advancing Keno Hill to production and started concentrate production and shipments in the first quarter of 2021. Keno Hill is expected to produce an average of approximately 4.4 million ounces of silver per year contained in high quality lead/silver and zinc concentrates at an average all-in sustaining cost of $11.59 per ounce. Keno Hill has significant potential to grow and Alexco Resource has a long history of expanding the operation’s mineral resources through successful exploration.

The Zacks Consensus Estimate for the company’s fiscal 2021 earnings suggests year-over-year improvement of 220%. The estimate has been revised upward by 33% over the past 90 days. Its shares have appreciated 35.3% in a year’s time. The stock has a Zacks Rank #3.

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report