Sandstorm Gold Ltd.

SAND

sold around 15,500 attributable gold equivalent ounces (GEOs) during third-quarter 2021. This marks a 28.4% increase from the 12,068 ounces GEOs sold in third-quarter 2020. The company generated preliminary revenues of $27.6 million during the quarter, up 18.4% from the year-ago quarter’s $23.3 million.

The preliminary cost of sales, excluding depletion for the September-end quarter, was $3.7 million, leading to cash operating margins of approximately $1,540 per attributable GEO. The company generated cash operating margins of $1,670 per GEO in the prior-year quarter.

In the second-quarter 2021 earnings call, the company projected attributable GEOs for the current year to lie between 62,000 ounces and 69,000 ounces. The company issued its 2025 guidance for attributable gold equivalent production to be more than 125,000 ounces. Given its solid streams and royalties, Sandstorm Gold is on track to achieve the current-year guidance.

The company recently announced that it has increased its revolving credit agreement by 55%, that will enable the company to borrow up to $350 million, including sustainability-related performance targets to start an Environment, Social, and Governance (“ESG”) linked credit facility. This makes Sandstorm Gold the first royalty company with a credit facility associated to its sustainability goals.

Sandstorm Gold is a gold royalty company, which provides upfront financing to gold miners who are looking for capital. In return, the company receives the right to a percentage of the gold produced from a mine, for the life of the mine. It has a portfolio of 229 royalties, of which 28 of the underlying mines are producing now. Sandstorm Gold plans to grow and diversify its low-cost production profile through the acquisition of additional gold royalties.

Last year, miners had to temporarily suspend mine operations as per the government mandates to curb the spread of the coronavirus pandemic. Even though mines have resumed operations now, the resurgence of COVID-19 cases across various parts of the world might lead to further restrictions and suspension of operations, and consequently impact Sandstorm’s results.

During the July-September period, the average gold price was $1,792 per ounce, down 8% year over year, mostly due to the strengthening dollar. This might have negated the impact of higher GEO’s sold during the quarter and weighed on its top-line performance. So far this year, prices of the yellow metal have declined 6.8%.

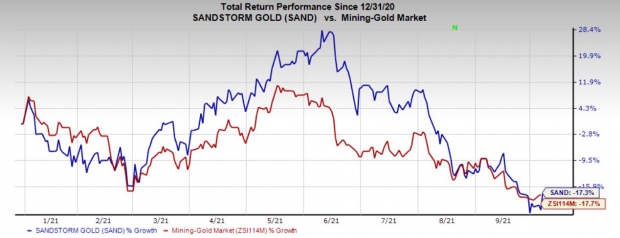

Price Performance

Shares of the company have lost 17.3% so far this year compared with the

industry

’s loss of 17.7%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

Nucor Corporation

NUE

,

Methanex Corporation

MEOH

and

The Chemours Company

CC

. While Nucor and Methanex sport a Zacks Rank #1 (Strong Buy), Chemours carries a Zacks Rank #2 (Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Nucor has an estimated earnings growth rate of 537.4 % for the ongoing year. So far this year, the company’s shares have appreciated 82.9%.

Methanex has a projected earnings growth rate of 409.3 % for 2021. The company’s shares have gained 6% so far this year.

Chemours has an estimated earnings growth rate of 86.4% for the current year. The company’s shares have increased 23.7% year to date.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report