Sandstorm Gold Ltd.

SAND

sold record 18,000 attributable gold equivalent ounces (GEOs) during second-quarter 2021. This marks a 65% increase from the 10,920 ounces GEOs sold in second-quarter 2020. The company generated record preliminary revenues of $32.4 million during the quarter, up 73.2% from the year-ago quarter’s $18.7 million.

Preliminary cost of sales, excluding depletion for the second quarter, was $4.1 million leading to cash operating margins of approximately $1,570 per attributable GEO. The company generated cash operating margins of $1,458 per GEO in the prior-year quarter.

The company projects attributable GEOs sold for the current year to lie between 55,000 ounces and 62,000 ounces. It anticipates attributable gold equivalent production of 125,000 ounces in 2024.

Sandstorm Gold is a gold royalty company, which provides upfront financing to gold miners that are looking for capital. In return, the company receives the right to a percentage of the gold produced from a mine, for the life of the mine. It has a portfolio of 229 royalties, of which 29 of the underlying mines are producing. Sandstorm Gold plans to grow and diversify its low-cost production profile through the acquisition of additional gold royalties.

Last year, miners had to temporarily suspend mine operations as per government mandates to curb the spread of the coronavirus pandemic. Even though mines have resumed operations, resurgence of COVID-19 cases across various parts of the world might lead to the further restrictions and suspension of operations again. These are likely to impact Sandstorm’s operations.

The pandemic-induced apprehensions regarding global economic growth fueled safe-haven demand in the last year. Therefore, gold prices gained 25% in 2020. However, earlier this year gold prices had dropped below $1,700 an ounce on successful vaccine roll-outs and massive stimulus packages. During May and June, the yellow metal crossed the $1,800 mark, which might have contributed to the company’s record sales and revenue performance in the second quarter.

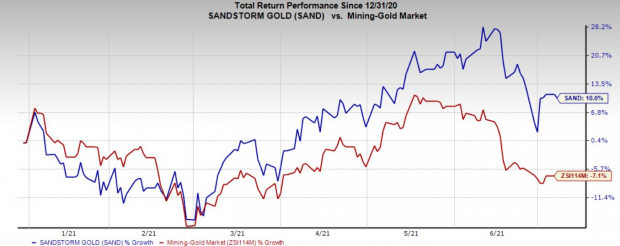

Price Performance

Shares of the company have gained 10% so far this year as against the

industry

’s loss of 7.1%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

Univar Solutions Inc.

UNVR

,

Nucor Corporation

NUE

and

Cabot Corporation

CBT

. While Univar and Nucor sporting a Zacks Rank #1 (Strong Buy), Cabot carries a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Univar has a projected earnings growth rate of 35.2% for 2021. The company’s shares have rallied around 53% in a year’s time.

Nucor has a projected earnings growth rate of 259.9% for the current year. The company’s shares have soared around 130% over the past year.

Cabot has an expected earnings growth rate of around 126% for the current fiscal year. The company’s shares have surged 60% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report