Sandstorm Gold Ltd.

SAND

announced preliminary record gold equivalent ounces (GEOs) sold and revenues in the first quarter of 2022.

The company sold nearly 18,700 attributable GEOs during the quarter. This marks a 7% increase from 17,444 ounces GEOs sold in first-quarter 2021. The company generated preliminary revenues of $35.3 million in the quarter under discussion compared with the year-ago quarter’s $31 million.

The preliminary cost of sales, excluding the depletion for the March-end quarter, was $5.3 million lower than the $5.4 million reported in the first quarter of 2021. This led to cash operating margins of approximately $1,600 per attributable GEO in the quarter under review, higher than the prior-year quarter’s $1,470 per GEO.

The first quarter 2022 results built on the momentum of the strong performance last year. In 2021, Sandstorm Gold had sold approximately a record 67,548 attributable GEOs, up 29% from the prior year’s levels. The figure came within the company’s guidance of 64,000-69,000 ounces. The company delivered record revenues of $114.9 million for the year.

Per the company’s guidance provided on Feb 16, attributable gold equivalent ounces are expected to be between 65,000 and 70,000 for 2022. The company had mentioned that it is expecting attributable gold equivalent production to be more than 100,000 ounces in 2025, subject to the conversion of the Hod Maden interest into a gold stream.

Sandstorm Gold is a gold royalty company that provides upfront financing to gold miners who are looking for capital. In return, the company receives the right to a percentage of the gold produced from a mine for the life of the mine. It currently boasts a portfolio of 230 royalties, of which 29 of the underlying mines are producing now. SAND plans to grow and diversify its low-cost production profile through the acquisition of additional gold royalties

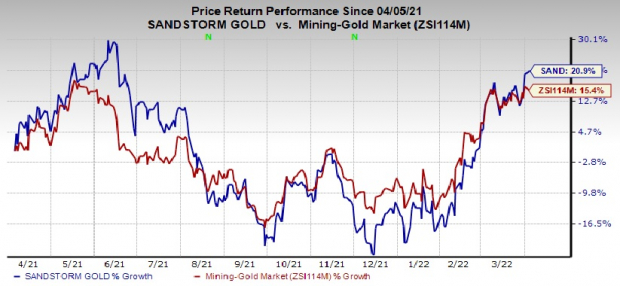

Price Performance

Image Source: Zacks Investment Research

Sandstorm Gold’s shares have gained 20.9% in the past year compared with the

industry

‘s growth of 15.4%.

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include

The Mosaic Company

MOS

,

AdvanSix Inc.

ASIX

and

Allegheny Technologies Incorporated

ATI

.

Mosaic has a projected earnings growth rate of 125% for the current year. The Zacks Consensus Estimate for MOS’ current-year earnings has been revised upward by 33.3% in the past 60 days.

Mosaic’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 3.7%. MOS has rallied around 116% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 64.8% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised upward by 58% in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 23.6%. ASIX has soared 89% in a year. The company flaunts a Zacks Rank #1.

Allegheny, currently carrying a Zacks Rank #2 (Buy), has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 127.2%. ATI has rallied around 24% over a year.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report