QUEBEC CITY, Sept. 11, 2020 (GLOBE NEWSWIRE) — Robex Resources Inc. (“Robex” or “the Company”) (TSXV: RBX/FWB: RB4) is pleased to publish a progress report on its current exploration campaign.

PROGRESS OF THE CURRENT CAMPAIGN

Robex announced the execution in 2020 of an important exploration campaign on the NAMPALA site. This campaign’s operations targeting 8 zones, including 3 for definition, 3 for exploration and 2 for condemnation, have been delayed this year due to the COVID-19 pandemic and the significant rainy season.

For this campaign, 3 drills were planned full time, but 7 drills will now be put into operation on site to make up for the delay. Consequently, our objective of completing the campaign by the end of the year or early in 2021 should be maintained.

A total of 41,280 metres of drilling has already been completed as of September 5, 2020.

RECONCILIATION WORK

Robex started reconciliation work on all pit operations since the start of production in January 2017. The purpose of this work is to refine mineralization knowledge in addition to the information collected from previous drilling campaigns and the 43-101 that followed.

This work, carried out on the 6,000,000 tonnes of processed mineralized material, has allowed us to:

- Refine the density model and validate the pit operating procedures. Indeed, before each excavation, additional channel sampling is conducted to increase the grade measurement accuracy.

- Following the installation of a main crusher on August 1, 2019, we processed 258,443 tonnes of mineralized material located in the Transition zone of the main pit. Initially, this ore was classified as a Resource due to the lack of metallurgical testing in this zone. These encouraging results require further testing before we can determine whether all or part of the transition can be added to our reserves.

- Given low production costs and the geological model, very low-grade mineralized material was processed cost-effectively during the confinement period. Consequently, the operational cut-off grade has been reduced from 0.38 g/t to 0.25 g/t. The excavated low-grades are stored near the ROM pad.

EXPLORATION CAMPAIGN – INTERIM RESULTS

The ZE1 zone located east of the main pit is completed. Here are several intersections from the current campaign:

| Name of hole | From | To | Grade (g/t Au) |

Length (in m) |

True Width (in m) |

Type | Zone | Date | Drilled | Az | Dip | TW% | |

| NAM2020AC-582 | 35 | 55 | 2.73 | 20 | 17.2 | RC | E1 | 20200805 | 101 | 110 | -50 | 86 | % |

| NAM2020RC-317 | 17 | 47 | 1.65 | 30 | 26.0 | RC | E1 | 20200308 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-440 | 16 | 33 | 2.58 | 17 | 14.7 | RC | E1 | 20200603 | 80 | 110 | -50 | 87 | % |

| NAM2020RC-304 | 1 | 24 | 1.69 | 23 | 19.9 | RC | E1 | 20200217 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-583 | 55 | 70 | 2.04 | 15 | 13.0 | RC | E1 | 20200805 | 114 | 110 | -50 | 87 | % |

| NAM2020AC-353 | 15 | 36 | 1.42 | 21 | 17.9 | RC | E1 | 20200326 | 97 | 110 | -50 | 85 | % |

| NAM2020AC-436 | 60 | 84 | 1.22 | 24 | 20.8 | RC | E1 | 20200602 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-372 | 24 | 48 | 1.09 | 24 | 20.7 | RC | E1 | 20200409 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-516 | 63 | 78 | 1.71 | 15 | 13.0 | RC | E1 | 20200702 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-356 | 0 | 23 | 1.04 | 23 | 19.9 | RC | E1 | 20200328 | 85 | 110 | -50 | 87 | % |

| NAM2020AC-434 | 8 | 29 | 1.12 | 21 | 18.2 | RC | E1 | 20200601 | 81 | 110 | -50 | 87 | % |

| NAM2020AC-452 | 47 | 66 | 1.23 | 19 | 16.5 | RC | E1 | 20200609 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-380 | 49 | 62 | 1.75 | 13 | 11.3 | RC | E1 | 20200415 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-577 | 72 | 86 | 1.60 | 14 | 12.1 | RC | E1 | 20200808 | 98 | 110 | -50 | 87 | % |

| NAM2020RC-324 | 74 | 84 | 2.34 | 10 | 8.2 | RC | E1 | 20200316 | 108 | 110 | -50 | 82 | % |

| NAM2020AC-439 | 33 | 54 | 0.99 | 21 | 18.2 | RC | E1 | 20200603 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-458 | 39 | 47 | 2.53 | 8 | 6.9 | RC | E1 | 20200611 | 90 | 110 | -50 | 87 | % |

| NAM2020RC-315 | 47 | 67 | 0.92 | 20 | 17.0 | RC | E1 | 20200305 | 84 | 110 | -50 | 85 | % |

| NAM2020AC-477 | 9 | 30 | 0.85 | 21 | 18.2 | RC | E1 | 20200620 | 80 | 110 | -50 | 87 | % |

| NAM2020AC-411 | 65 | 79 | 1.28 | 14 | 11.8 | RC | E1 | 20200505 | 86 | 110 | -50 | 84 | % |

| NAM2020AC-436 | 28 | 43 | 1.15 | 15 | 13.0 | RC | E1 | 20200602 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-474 | 59 | 80 | 0.81 | 21 | 18.2 | RC | E1 | 20200618 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-422 | 44 | 56 | 1.42 | 12 | 10.2 | RC | E1 | 20200511 | 90 | 110 | -50 | 85 | % |

| NAM2020AC-414 | 20 | 40 | 0.84 | 20 | 17.2 | RC | E1 | 20200506 | 73 | 110 | -50 | 86 | % |

| NAM2020AC-1247 | 3 | 14 | 1.52 | 11 | 9.5 | RC | E1 | 20200324 | 95 | 110 | -50 | 86 | % |

| NAM2020AC-458 | 77 | 86 | 1.84 | 9 | 7.8 | RC | E1 | 20200611 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-473 | 43 | 57 | 1.18 | 14 | 12.1 | RC | E1 | 20200618 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-352 | 26 | 33 | 2.31 | 7 | 6.1 | RC | E1 | 20200326 | 101 | 110 | -50 | 87 | % |

| NAM2020RC-305 | 2 | 9 | 2.25 | 7 | 6.1 | RC | E1 | 20200218 | 108 | 110 | -50 | 87 | % |

| NAM2020AC-503 | 59 | 72 | 1.20 | 13 | 11.3 | RC | E1 | 20200702 | 79 | 110 | -50 | 87 | % |

| NAM2020RC-316 | 54 | 76 | 0.69 | 22 | 19.0 | RC | E1 | 20200308 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-1246 | 6 | 13 | 2.16 | 7 | 6.0 | RC | E1 | 20200324 | 107 | 110 | -50 | 85 | % |

| NAM2020AC-356 | 33 | 40 | 2.10 | 7 | 6.0 | RC | E1 | 20200328 | 85 | 110 | -50 | 86 | % |

| NAM2020AC-432 | 33 | 51 | 0.81 | 18 | 15.6 | RC | E1 | 20200530 | 74 | 110 | -50 | 87 | % |

| NAM2020AC-459 | 32 | 48 | 0.87 | 16 | 13.9 | RC | E1 | 20200612 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-372 | 58 | 72 | 0.99 | 14 | 12.1 | RC | E1 | 20200409 | 90 | 110 | -50 | 86 | % |

| NAM2020RC-341 | 50 | 58 | 1.70 | 8 | 6.8 | RC | E1 | 20200328 | 90 | 110 | -50 | 85 | % |

| NAM2020AC-432 | 52 | 65 | 1.02 | 13 | 11.3 | RC | E1 | 20200530 | 74 | 110 | -50 | 87 | % |

| NAM2020AC-399 | 36 | 50 | 0.91 | 14 | 12.0 | RC | E1 | 20200428 | 77 | 110 | -50 | 86 | % |

| NAM2020RC-322 | 46 | 56 | 1.31 | 10 | 8.4 | RC | E1 | 20200314 | 90 | 110 | -50 | 84 | % |

| NAM2020AC-375 | 40 | 53 | 0.98 | 13 | 11.1 | RC | E1 | 20200413 | 90 | 110 | -50 | 85 | % |

| NAM2020AC-500 | 78 | 90 | 1.04 | 12 | 10.4 | RC | E1 | 20200630 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-441 | 9 | 19 | 1.24 | 10 | 8.7 | RC | E1 | 20200604 | 79 | 110 | -50 | 87 | % |

| NAM2020AC-505 | 12 | 18 | 2.06 | 6 | 5.2 | RC | E1 | 20200630 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-438 | 74 | 84 | 1.19 | 10 | 8.7 | RC | E1 | 20200602 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-436 | 45 | 56 | 1.06 | 11 | 9.5 | RC | E1 | 20200602 | 84 | 110 | -50 | 87 | % |

| NAM2020RC-318 | 28 | 35 | 1.64 | 7 | 6.0 | RC | E1 | 20200309 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-497 | 70 | 74 | 2.70 | 4 | 3.5 | RC | E1 | 20200629 | 85 | 110 | -50 | 87 | % |

| NAM2020AC-497 | 17 | 29 | 0.90 | 12 | 10.4 | RC | E1 | 20200629 | 85 | 110 | -50 | 87 | % |

| NAM2020AC-463 | 25 | 31 | 1.79 | 6 | 5.2 | RC | E1 | 20200613 | 68 | 110 | -50 | 87 | % |

| NAM2020AC-486 | 7 | 22 | 0.71 | 15 | 13.0 | RC | E1 | 20200624 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-414 | 41 | 50 | 1.18 | 9 | 7.7 | RC | E1 | 20200506 | 73 | 110 | -50 | 86 | % |

| NAM2020AC-453 | 43 | 54 | 0.96 | 11 | 9.5 | RC | E1 | 20200610 | 90 | 110 | -50 | 87 | % |

| Name of hole | From | To | Grade (g/t Au) |

Length (in m) |

True Width (in m) |

Type | Zone | Date | Drilled | Az | Dip | TW% | |

| NAM2020AC-533 | 25 | 31 | 1.73 | 6 | 5.2 | RC | E1 | 20200708 | 108 | 110 | -50 | 87 | % |

| NAM2020AC-549 | 71 | 79 | 1.30 | 8 | 6.9 | RC | E1 | 20200715 | 90 | 110 | -50 | 87 | % |

| NAM2020RC-311 | 50 | 62 | 0.87 | 12 | 10.2 | RC | E1 | 20200229 | 69 | 110 | -50 | 85 | % |

| NAM2020AC-497 | 30 | 37 | 1.46 | 7 | 6.1 | RC | E1 | 20200629 | 85 | 110 | -50 | 87 | % |

| NAM2020AC-357 | 62 | 68 | 1.69 | 6 | 5.2 | RC | E1 | 20200328 | 76 | 110 | -50 | 87 | % |

| NAM2020RC-306 | 12 | 23 | 0.92 | 11 | 9.5 | RC | E1 | 20200219 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-472 | 38 | 44 | 1.68 | 6 | 5.2 | RC | E1 | 20200618 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-517 | 15 | 23 | 1.25 | 8 | 6.9 | RC | E1 | 20200703 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-419 | 66 | 72 | 1.71 | 6 | 5.1 | RC | E1 | 20200508 | 78 | 110 | -50 | 84 | % |

| NAM2020AC-382 | 41 | 54 | 0.78 | 13 | 11.0 | RC | E1 | 20200416 | 69 | 110 | -50 | 85 | % |

| NAM2020RC-319 | 44 | 51 | 1.43 | 7 | 6.0 | RC | E1 | 20200311 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-442 | 17 | 23 | 1.65 | 6 | 5.2 | RC | E1 | 20200604 | 70 | 110 | -50 | 87 | % |

| NAM2020AC-394 | 66 | 77 | 0.94 | 11 | 9.1 | RC | E1 | 20200424 | 90 | 110 | -50 | 83 | % |

| NAM2020AC-538 | 79 | 86 | 1.41 | 7 | 6.1 | RC | E1 | 20200713 | 96 | 110 | -50 | 87 | % |

| NAM2020AC-535 | 23 | 31 | 1.22 | 8 | 6.9 | RC | E1 | 20200709 | 96 | 110 | -50 | 87 | % |

| NAM2020AC-508 | 3 | 13 | 0.96 | 10 | 8.7 | RC | E1 | 20200701 | 50 | 110 | -50 | 87 | % |

| NAM2020AC-451 | 37 | 47 | 0.93 | 10 | 8.7 | RC | E1 | 20200608 | 64 | 110 | -50 | 87 | % |

| NAM2020AC-444 | 57 | 64 | 1.32 | 7 | 6.1 | RC | E1 | 20200605 | 64 | 110 | -50 | 87 | % |

| NAM2020RC-340 | 75 | 84 | 1.02 | 9 | 7.7 | RC | E1 | 20200327 | 84 | 110 | -50 | 85 | % |

| NAM2020AC-429 | 19 | 23 | 2.14 | 4 | 3.4 | RC | E1 | 20200514 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-1250 | 1 | 13 | 0.70 | 12 | 10.4 | RC | E1 | 20200325 | 107 | 110 | -50 | 87 | % |

| NAM2020AC-439 | 66 | 77 | 0.75 | 11 | 9.5 | RC | E1 | 20200603 | 84 | 110 | -50 | 87 | % |

| NAM2020AC-388 | 52 | 60 | 1.04 | 8 | 6.8 | RC | E1 | 20200421 | 71 | 110 | -50 | 85 | % |

| NAM2020AC-516 | 13 | 22 | 0.91 | 9 | 7.8 | RC | E1 | 20200702 | 84 | 110 | -50 | 87 | % |

| NAM2020RC-301 | 15 | 24 | 0.92 | 9 | 7.6 | RC | E1 | 20200214 | 80 | 110 | -50 | 85 | % |

| NAM2020RC-312 | 29 | 34 | 1.66 | 5 | 4.2 | RC | E1 | 20200302 | 90 | 110 | -50 | 85 | % |

| NAM2020RC-351 | 25 | 30 | 1.63 | 5 | 4.2 | RC | E1 | 20200323 | 90 | 110 | -50 | 85 | % |

| NAM2020AC-433 | 58 | 67 | 0.88 | 9 | 7.8 | RC | E1 | 20200530 | 80 | 110 | -50 | 87 | % |

| NAM2020AC-392 | 50 | 59 | 0.89 | 9 | 7.6 | RC | E1 | 20200422 | 84 | 110 | -50 | 85 | % |

| NAM2020AC-460 | 84 | 90 | 1.28 | 6 | 5.2 | RC | E1 | 20200612 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-509 | 63 | 75 | 0.64 | 12 | 10.4 | RC | E1 | 20200702 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-372 | 82 | 90 | 0.95 | 8 | 7.0 | RC | E1 | 20200409 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-348 | 24 | 30 | 1.27 | 6 | 5.2 | RC | E1 | 20200401 | 77 | 110 | -50 | 86 | % |

| NAM2020RC-306 | 33 | 41 | 0.95 | 8 | 6.9 | RC | E1 | 20200219 | 90 | 110 | -50 | 86 | % |

| NAM2020AC-360 | 52 | 60 | 0.96 | 8 | 6.8 | RC | E1 | 20200403 | 77 | 110 | -50 | 85 | % |

| NAM2020AC-575 | 45 | 51 | 1.26 | 6 | 5.2 | RC | E1 | 20200807 | 110 | 110 | -50 | 86 | % |

| NAM2020AC-574 | 66 | 70 | 1.89 | 4 | 3.4 | RC | E1 | 20200807 | 101 | 110 | -50 | 85 | % |

| NAM2020AC-391 | 57 | 61 | 1.87 | 4 | 3.4 | RC | E1 | 20200422 | 81 | 110 | -50 | 85 | % |

| NAM2020AC-380 | 25 | 32 | 1.05 | 7 | 6.1 | RC | E1 | 20200415 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-358 | 41 | 48 | 1.06 | 7 | 6.0 | RC | E1 | 20200402 | 90 | 110 | -50 | 85 | % |

| NAM2020RC-303 | 53 | 61 | 0.93 | 8 | 6.8 | RC | E1 | 20200217 | 78 | 110 | -50 | 84 | % |

| NAM2020AC-367 | 29 | 35 | 1.23 | 6 | 5.1 | RC | E1 | 20200407 | 78 | 110 | -50 | 85 | % |

| NAM2020AC-472 | 52 | 59 | 1.04 | 7 | 6.1 | RC | E1 | 20200618 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-411 | 52 | 63 | 0.67 | 11 | 9.3 | RC | E1 | 20200505 | 86 | 110 | -50 | 85 | % |

| NAM2020RC-319 | 72 | 80 | 0.90 | 8 | 6.8 | RC | E1 | 20200311 | 90 | 110 | -50 | 85 | % |

| NAM2020AC-440 | 36 | 41 | 1.39 | 5 | 4.3 | RC | E1 | 20200603 | 80 | 110 | -50 | 87 | % |

| NAM2020AC-452 | 22 | 29 | 0.99 | 7 | 6.1 | RC | E1 | 20200609 | 90 | 110 | -50 | 87 | % |

| NAM2020AC-347 | 51 | 59 | 0.87 | 8 | 6.9 | RC | E1 | 20200401 | 79 | 110 | -50 | 86 | % |

| NAM2020AC-460 | 25 | 32 | 0.98 | 7 | 6.1 | RC | E1 | 20200612 | 90 | 110 | -50 | 87 | % |

| NAM2020RC-308 | 35 | 39 | 1.72 | 4 | 3.4 | RC | E1 | 20200225 | 78 | 110 | -50 | 85 | % |

| NAM2020AC-399 | 24 | 33 | 0.76 | 9 | 7.7 | RC | E1 | 20200428 | 77 | 110 | -50 | 86 | % |

| NAM2020RC-341 | 61 | 68 | 0.99 | 7 | 5.9 | RC | E1 | 20200328 | 90 | 110 | -50 | 84 | % |

| NAM2020AC-556 | 18 | 26 | 0.84 | 8 | 6.9 | RC | E1 | 20200721 | 126 | 110 | -50 | 87 | % |

| NAM2020AC-405 | 72 | 78 | 1.12 | 6 | 5.2 | RC | E1 | 20200501 | 90 | 110 | -50 | 87 | % |

The Resource update is performed taking into account:

- 28,346 samples received from the drilling campaign carried out on the ZE1 zone;

- Reconciliation work that enabled us to refine the density model; and

- A recent increase in the price of gold and the control of production costs at the Nampala mine.

This allows us to establish an increase of +103% in indicated resources for the Nampala property bringing the total to 869,000 oz compared to the last Mineral Resources estimate (MRE2019). The Company will file an independent technical report to support the updated mineral resource within 45 days of this press release.

Nampala Mineral Resources (MRE2020) are reported in thousands of ounces.

| Category | Cut-Off | Weathering type |

Density | Tonnage | Grade | Metal content |

| Au (g/t) | (t/m3) | (000 t) | Au (g/t) | Au (000 oz) | ||

| Indicated | 0.25 | Oxide | 1.80 | 21,422 | 0.63 | 435 |

| 0.33 | Transition | 2.36 | 6,158 | 0.82 | 163 | |

| 0.31 | Fresh Rock | 2.79 | 10,307 | 0.82 | 271 | |

| Subtotal | 37,887 | 0.71 | 869 | |||

| Inferred | 0.25 | Oxide | 1.77 | 542 | 0.55 | 10 |

| 0.33 | Transition | 2.47 | 213 | 0.71 | 5 | |

| 0.31 | Fresh Rock | 2.79 | 2,235 | 0.72 | 52 | |

| Subtotal | 2,989 | 0.69 | 66 | |||

| Total | 2.10 | 40,876 | 0.71 | 936 | ||

Notes regarding the table:

- The independent and qualified person for the Mineral Resource estimate, as defined by NI 43-101, is Mr. Denis Boivin, B.Sc., Geo. (OGQ #816) and Mr. Mario Boissé, Mining Eng. (OIQ # 130715), and the effective date of the estimate is July 31, 2020.

- The mineral resource is not a mineral reserve as it has not demonstrated economic viability. Further metallurgical testing is required to analyze the economic potential of the mineral resource found in the transition and fresh rock zones.

- The mineral resource estimate follows the 2014 CIM definitions and guidelines.

- Results are presented on-site and undiluted for the open-pit scenario and are considered to have reasonable prospects for profitable mining.

- In terms of classification: the distance to the closest (composite) point (DCP) must be less than or equal to 30 metres to be considered an indicated resource. The inferred resource is at a distance greater than 30 metres and less than 100 metres.

- Grade interpolation was performed on the Nampala mining permit from 2-metre drill composites using the grade of the material assayed and clipped at 15 g/t Au. The grade model was interpolated according to the structural patterns of the mineralized zones using the Leapfrog Geo v5.1.0 software Radial Basis Function (RBF) method and assessed in a model pointed at 20 degrees North with blocks of the same size (5 m x 15 m x 5 m). On-site densities were interpolated using the respective oxidation levels.

- The mineral resource is contained within an economic envelope built with the MineSight – Project Evaluator V1.0.4.3902 Lerch-Grossman optimization tool. Only the indicated resource is taken into account to generate the economic envelope. The following economic parameters are used in the optimization:

| Description | UOM | MRE2020 | ||

| Oxide | Transition | Fresh Rock | ||

| Gold price | USD/oz | 1,700 | 1,700 | 1,700 |

| Mining costs | USD/t mined | 2.08 | 2.51 | 2.65 |

| General and administrive costs | USD/t milled | 2.48 | 2.48 | 2.48 |

| CIL (processing, refining and selling) | USD/t milled | 9.31 | 10.24 | |

| Heap leach (processing, refining and selling) | USD/t milled | 9.19 | ||

| Mill recovery | % | 88.9 | 71.9 | |

| Heap leach recovery | % | 70.0 | ||

- The slope of the economic envelope is set to 45 degrees.

- The number of metric tonnes has been rounded to the nearest thousand and the metal grade is presented in troy ounces (tonne x grade / 31.10348). Any discrepancies between totals are due to rounding effects. Rounding practices comply with the recommendations outlined in Form 43-101A1.

- Except for the current political instability in Mali, Denis Boivin P.Geo and Mario Boissé Eng. are not aware of any environmental, permits, legal, title-related, fiscal, sociopolitical or marketing issues, or any other relevant issues that could have a significant impact on the Mineral Resource estimate.

Denis Boivin, P.Geo., on-site consulting geologist, is the qualified and independent person under NI 43-101 who has reviewed and approved the disclosure of the geological information contained in this press release.

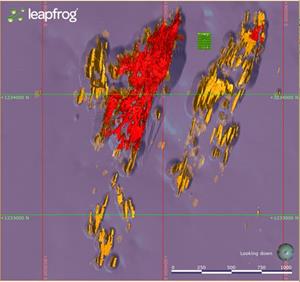

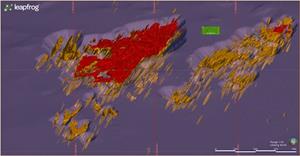

The Indicated Mineral Resources is coloured Gold (On-site) and the excavated Mineral Resources is coloured Red, plan view.

Image of the pit area and the ZE1 zone (on the right side of the image).

https://www.globenewswire.com/NewsRoom/AttachmentNg/a23141e2-51ea-491a-bbdb-e9435533811f

Image of the Indicated Mineral Resources coloured Gold (On-site) and Red (Excavated), oblique view.

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d080cca-6fff-41f8-a822-75aace0424c5

SPECIAL DIVIDEND

Considering the Company’s financial results, the Board of Directors has announced a special dividend of 4 cents to be paid on September 25, 2020, for each issued and outstanding common share listed at market close on September 16, 2020.

A word from the President, Mr. Georges Cohen:

– These initial exploration results are significant, very satisfactory and encouraging for the future of this exploration program.

This allows us to anticipate a considerable extension of the mine’s life, the results of which we will confirm when we publish an estimate of mineral reserves at year-end.

Having a second confirmed pit is the first solid result of this exploration campaign.

– The current cash position and prospects allow us to distribute a second special dividend of 4 cents, bringing the dividend distribution to 6 cents per share as of January 2020.

For information:

Robex Resources Inc.

Benjamin Cohen, CEO

Augustin Rousselet, CFO/COO

Head office: (581) 741-7421

info@robexgold.com

This news release contains statements that may be considered “forecast information” or “forecast statements” in terms of security rights. These forecasts are subject to uncertainties and risks, some of which are beyond the control of Robex. Achievements and final results may differ significantly from forecasts made implicitly or explicitly. These differences can be attributed to many factors, including market volatility, the impact of the exchange rate and interest rate fluctuations, mispricing, the environment (hardening of regulations), unforeseen geological situations, unfavourable operating conditions, political risks inherent in mining in developing countries, changes in government policies or regulations (laws and policies), an inability to obtain necessary permits and approvals from government agencies, or any other risk associated with mining and development. There can be no assurance that the circumstances set out in these forecasts will occur, or even benefit Robex, if any. The forecasts are based on the estimates and opinions of the Robex management team at the time of publication. Robex makes no commitment to make any updates or changes to these publicly available forecasts based on new information or events, or for any other reason, except as required by applicable security laws. The TSX Venture Exchange or the Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) assumes no responsibility for the authenticity or accuracy of this news release.