Dominion Energy

’s

D

systematic capital expenditure to expand its existing electric and natural gas infrastructure, contributions from organic and inorganic assets as well as expanding renewable generation make it a solid investment option in the utility space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Growth Projections

The Zacks Consensus Estimate for 2021 and 2022 earnings per share has moved up 0.3% and 0.2%, respectively, in the past 60 days.

The Zacks Consensus Estimate for revenues for 2021 indicates a year-over-year decline of 3.3%, but the same for 2022 suggests growth of 7.4%.

Surprise History and Earnings Growth

Dominion delivered an average earnings surprise of 2.4% in the last four quarters.

Dominion’s long-term (three to five years) earnings growth is projected at 6.8%.

Regular Investments & Emission Reduction

Dominion Energy plans to invest $32 billion in the 2021-2025 time period to strengthen its existing infrastructure, out of which a major portion will be invested in zero-carbon generation and energy storage. Over the next 15 years, Dominion Energy aims to invest $72 billion to strengthen its infrastructure and add more clean power generation assets to its portfolio. Currently, up to 88% of operating earnings are generated from the portfolio of regulated electric and natural gas utility companies.

As of December 2019, Dominion Energy cut carbon emissions from electric generating units by more than 55% since 2005 and reduced methane emissions from natural gas infrastructure operations by 25% since 2010. Dominion aims to attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050 from 2005 levels.

Return on Equity & Dividend Yield

Return on Equity (ROE) indicates how efficiently Dominion Energy is utilizing shareholders’ funds to generate returns. At present, Dominion’s ROE is 12.56%, higher than the industry average of 9.26%.

Currently, Dominion has a

dividend yield

of 3.4% compared with the Zacks S&P 500 composite’s 1.34%.

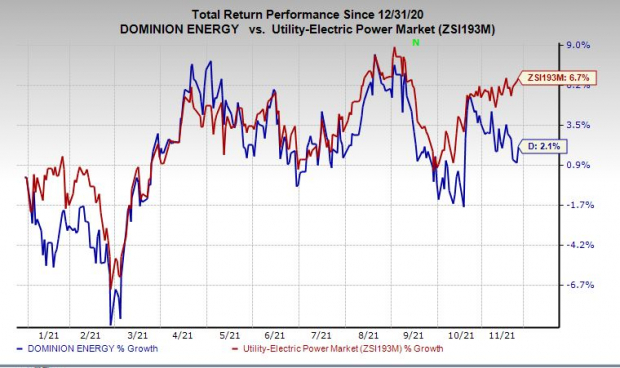

Price Performance

Year to date, Dominion’s shares have returned 2.1% compared with the

industry

’s 6.7% rally.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include

IDACORP Inc.

IDA

,

Chesapeake Utilities

CPK

and

Alliant Energy Corporation

LNT

, each holding a Zacks Rank #2.

IDACORP, Chesapeake Utilities, and Alliant Energy delivered an average earnings surprise of 5.2%, 12.6%, and 4.4%, respectively, in the last four quarters.

The Zacks Consensus Estimate for 2021 earnings per share of IDACORP, Chesapeake Utilities, and Alliant Energy has moved up 0.4%, 3.5%, and 1.9%, respectively, in the past 60 days.

Year to date, shares of IDACORP, Chesapeake Utilities, and Alliant Energy have returned 16.7%, 25.9%, and 15.6%, respectively, compared with the Zacks Utility Sector’s 6.4% growth.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report