Apogee Enterprises

APOG

delivered sequential improvements in adjusted earnings per share in the last six quarters, which is impressive, considering the ongoing supply-chain disruptions and inflationary pressures. This has been aided by continued strong performances in Architectural Framing Systems and Architectural Services segments, which are expected to continue. Pricing actions, benefits from completed restructuring actions, cost-saving actions, and efforts to improve productivity and efficiency will also drive APOG’s results.

Apogee currently has a Zacks Rank #2 (Buy) and a

VGM Score

of A. Our research shows that stocks with a VGM Score of A or B, in combination with a Zacks Rank #1 (Strong Buy) or Rank of 2, offer the best investment opportunities. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Let’s delve deeper and look at the factors that make the stock an attractive investment option.

Solid Q3 Results

: APOG reported adjusted earnings per share of $1.07 for third-quarter fiscal 2023, which marked a 70% surge from the prior-year quarter. Revenues were $368 million in the quarter, up 10% year over year.

Upbeat FY23 Guidance

: The company anticipates revenue growth of 10% for fiscal 2023, primarily driven by Architectural Framing Systems. APOG expects adjusted earnings per share between $3.90 and $4.05 for fiscal 2023. The mid-point of the guidance indicates 60% growth from adjusted earnings per share of $2.48 reported in fiscal 2022. The year-over-year margin expansion, primarily driven by the improved performances in Framing Systems and Glass, will aid earnings in 2023.

Positive Earnings Surprise History

: APOG’s earnings surpassed the Zacks Consensus Estimate in all the four quarters, delivering an average trailing four-quarter earnings surprise of 46%.

Northbound

Estimates

: The Zacks Consensus Estimate for Apogee’s fiscal 2023 earnings has moved up 1% to $3.96 over the past 30 days.

Healthy Growth Projections

: The Zacks Consensus Estimate for Apogee’s fiscal 2023 earnings is pegged at $3.96, suggesting year-over-year growth of 60%.

Growth Drivers in Place

The Architectural Framing Systems segment delivered an operating income of more than $20 million in the three consecutive quarters. The operating margin was 13.4% in the last reported quarter compared with 8.5% in the prior-year quarter. The segment continued to witness solid year-over-year growth and margin expansion despite significant supply-chain and inflation headwinds due to pricing actions and the benefits of completed restructuring and cost-saving actions. The company has been making investments to enable growth in the Architectural Services segments, which is expected to boost margins. The segment has been awarded several projects and is building a project pipeline for the coming years.

Strong project pipeline and improving order trends will support top-line growth for APOG. The company’s segments have the potential to increase market share, expand into new geographies and markets, and introduce products. Apogee has broader exposure in various projects across different sectors, including healthcare, education, government and multifamily housing, and a growing renovation business. The company is witnessing strong demand for new construction activities. Apart from this, various government stimulus measures support the company’s construction end markets.

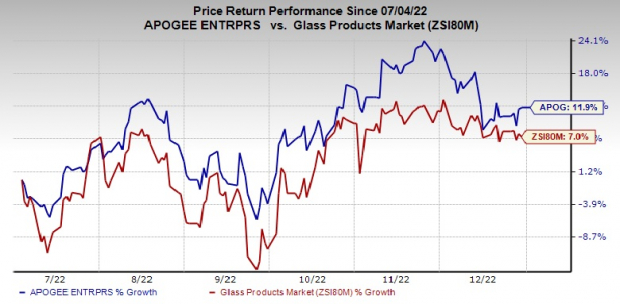

Price Performance

Image Source: Zacks Investment Research

Shares of Apogee have gained 11.9% in the past six months compared with the

industry

’s 7% growth.

Other Stocks to Consider

Some other top-ranked stocks from the Industrial Products sector are

KnowBe4

KNBE

,

Deere & Company

DE

and

Caterpillar Inc.

CAT

. While KNBE sports a Zacks Rank of 1, DE and CAT carry a Zacks Rank of 2.

KnowBe4’s earnings surprise in the last four quarters was 216.7%, on average. The Zacks Consensus Estimate for the company’s 2022 earnings is pegged at 24 cents per share, indicating a 118% year-over-year rise. Earnings estimates have moved up 4% in the past 30 days. KNBE’s shares have appreciated 52% in the past six months.

The Zacks Consensus Estimate for fiscal 2023 earnings per share for Deere is pegged at $27.83, suggesting a 19.5% increase from that reported in the last year. The consensus estimate moved 2% upward in the last 30 days. DE has a trailing four-quarter average earnings surprise of 7%. DE’s shares have gained 42% in the past six months.

Caterpillar has an estimated year-over-year earnings growth rate of 28% for fiscal 2022. Earnings estimates are pegged at $13.85. The consensus estimate has been revised by 1% north in the past 30 days. CAT has an average trailing four-quarter earnings surprise of 14.7%. Its shares have gained 34% over the past six months.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report