ALLETE Inc

.’s

ALE

strategic capital investment plans, improving earnings estimates and steady dividend payments make a strong case for investment in this utility stock. ALLETE is engaged in providing clean energy to its customers.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Growth Projection

The Zacks Consensus Estimate for 2022 and 2023 earnings has moved up by 16.1% and 7.5%, year over year, respectively. The revenue estimate of $1.57 billion for 2022 implies year-over-year growth of 10.8%. For 2023, revenues are expected to be $1.58 billion, suggesting year-over-year growth of 0.7%.

Dividend & Long-term EPS Growth

ALLETE has a long history of

dividend payments

and has paid dividends to its shareholders every year since 1950. ALLETE aims to increase its dividend rate annually in the range of 5-7%, subject to the approval of its board of directors. ALLETE has raised its dividend annually for the last 10 years. ALLETE’s current annual dividend of $2.60 per share reflects an increase of 46.1% from $1.78 per share paid in 2011.

ALLETE’s long-term dividend payout ratio target is 60-70%. Currently, ALLETE has a dividend yield of 3.92% compared with the industry’s 3.12%.

ALLETE’s long-term (three- to five-year) earnings growth rate is currently pegged at 9.3%.

Investments

ALLETE plans to make investments of $2.7 billion during 2023-2027 time period. The strategic investments are directed to strengthen its existing infrastructure and boost its clean energy production plans.

Debt Position

The debt-to-capital ratio of ALLETE at the end of the third quarter was 36.9% compared with the industry average of 54.3%. It indicates that the company is using comparatively lower debt to manage its business compared with its peers.

The times interest earned (“TIE”) ratio of ALE at third-quarter 2022 end was 2.6. The strong TIE ratio reflects the companies’ financial strength and their ability to meet their debt obligations.

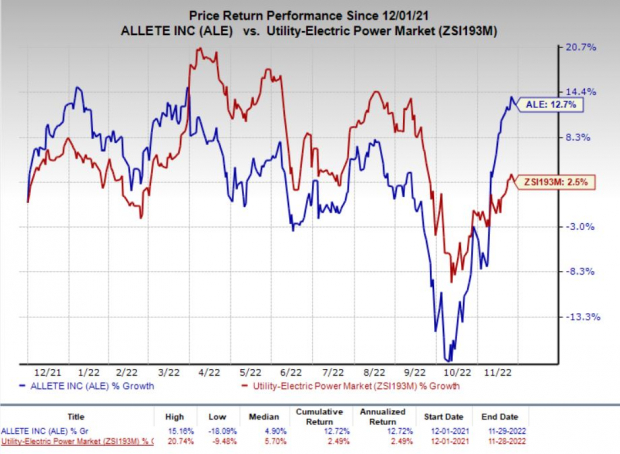

Price Performance

In the past year, the stock has risen 12.7% compared with the

industry

’s 2.5% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the Utilities sector include

Pinnacle West Capital

PNW

,

NiSource

NI

and

Global Water Resources

GWRS

. All companies currently carry a Zacks Rank #2.

Pinnacle West, NiSource and Global Water Resources delivered an average positive earnings surprise of 116.1%, 0.3% and 180%, respectively, in the last four quarters.

The Zacks Consensus Estimate for 2022 earnings for Pinnacle West, NiSource and Global Water Resources has moved 2.8%, 0.7% and 5% upward, respectively, in the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report