- Study evaluates the Proposed Project and three Expansion Scenarios for the Pebble copper-gold-molybdenum-silver-rhenium project [1]

- All alternatives are extensions of the Proposed Project reviewed by U.S. Army Corps of Engineers

- Innovative engineering design and environmental safeguards set new standard for American mining

VANCOUVER, BC / ACCESSWIRE / September 9, 2021 / Northern Dynasty Minerals Ltd. (TSX:NDM)(NYSE American:NAK) (“Northern Dynasty” or the “Company”) is pleased to announce the results of a 2021 Preliminary Economic Assessment (“2021 PEA”) providing updated production, financial and cost estimates for its proposed Pebble Project (the “Proposed Project”) in Southwest Alaska as described in the Pebble Project permit application and its amendments, which recently underwent a comprehensive review by the U.S. Army Corps of Engineers (“USACE”) culminating in their publishing of a Final Environmental Impact Statement (“EIS”). In addition to the Proposed Project, the 2021 PEA examines three potential mine expansion scenarios, and potential alternative strategies for gold recovery that could form the basis for future permit applications and review. U.S. dollars and U.S. standard units are used unless otherwise indicated. All results are post-tax.

The currently proposed project detailed in the 2021 PEA is the Proposed Project, and is consistent with the Project Description in the Pebble EIS, published by the USACE in July 2020. It does not include an onsite gold plant. With the exception of the Proposed Project, all development alternatives evaluated in the 2021 PEA are presented to demonstrate the optionality inherent in the polymetallic Pebble deposit by presenting a broad range of potential pathways for future mine development. The 2021 PEA also models other options for potential development in the future, to show how the project life could be extended and metal production enhanced through an expansion at different points in time or via alternative treatment scenarios. Neither Northern Dynasty nor the Pebble Partnership has proposed or intends to propose any of these development alternatives in the near-term for regulatory approval. Any future development options beyond the Proposed Project would require extensive federal, state and local permitting processes and approvals before proceeding, which would be in addition to the initial permits and approvals required for the Proposed Project.

Summary of Key Projected Results 1

Proposed Project :

- 20 years of open pit mining with a processing rate of 180,000 tons per day (“Tpd”)

- At forecast long-term [2] metal prices, Internal Rate of Return (“IRR”) of 15.8% and Net Present Value at 7% discount rate (“NPV 7 “) of $2.3 billion

- At prevailing [3] metal prices, IRR of 23.8% and NPV 7 of $4.8 billion

- Life-of-mine (“LOM”) metal production for this scenario: 6.4 billion lb copper; 7.3 million oz gold; 300 million lb molybdenum; 37 million oz silver; and 230,000 kg rhenium

- Average annual metal production: 320 million lb copper; 363,000 oz gold; 15 million lb molybdenum; 1.8 million oz silver and 12,000 kg rhenium

Expansion Scenarios :

- 90 to 101 year mine life with a peak processing rate of up to 270,000 Tpd

- At forecast long-term metal prices, IRR of 18.2% to 21.5% and NPV 7 of $5.8 to $8.5 billion

- At prevailing metal prices, IRR of 25.8% to 29.8% and NPV 7 of $9.9 to $14.0 billion

- LOM metal production for these scenarios: 60 billion lb copper; 50 million oz gold; 2.9 billion lb molybdenum; 267 million oz silver; and 2 million kg rhenium

- Average annual metal production: 600 million lb copper; 500,000 oz gold; 29 million lb molybdenum; 2.6 million oz silver and 20,000 kg rhenium

Onsite Gold Plant :

- Addition of an onsite gold plant at Production Year 5

- Proposed Project

- At forecast long-term metal prices, IRR of 16.5% and NPV 7 of $2.7 billion

- At prevailing metal prices, IRR of 25.9% and NPV 7 of $5.4 billion

- LOM gold and silver production for this scenario: 9.0 million oz and 39 million oz, respectively

- Average annual metal production: 453,000 oz gold and 2 million oz silver

- Expansion Scenarios

- At forecast long-term metal prices, IRR of 18.9% to 22.7% and NPV 7 of $6.7 to $9.8 billion

- At prevailing metal prices, IRR of 26.3% to 30.8% and NPV 7 of $10.9 to $15.4 billion

- LOM gold and silver production for these scenarios: 65 million oz and 289 million oz, respectively

- Average annual metal production: 644,000 to 721,000 oz gold and 3.2 to 2.9 million oz silver

Low-Cost/High-Margin Production:

- Proposed Project: average co-product C1 Copper Cost of $1.65/lb CuEq and Gold Cash Cost of $753/oz; average by-product C1 Copper Cost of $0.69/lb and Gold Cash Cost of ($1,147)/oz

- Expansion Scenarios: average co-product C1 Copper Cost of $1.53/lb CuEq to $1.56/lb CuEq and Gold Cash Cost of $699/oz to $712/oz; average by-product C1 Copper Cost of $0.53/lb to $0.88/lb and Gold Cash Cost of ($2,013)/oz to ($1,979)/oz

- Proposed Project: average annual Net Smelter Return (“NSR”) of $1.6 billion and LOM NSR of $32 billion

- Expansion Scenarios: average annual NSR of $2.8 to $3.2 billion and LOM NSR of $285 billion

Scheduled for release in October 2021, the 2021 Pebble Project Preliminary Economic Assessment is an update to a Technical Report completed in 2011, which included an economic analysis that was considered out of date mainly due to the revisions to the Pebble Project as submitted in its permit application and amendments. The Proposed Project is similar to the 25-year Investment Decision Case in the 2011 Technical Report, but the current open pit produces less waste rock and therefore occupies a smaller footprint. The Proposed Project does not include the secondary gold plant, which was a component of the 2011 Technical Report, although the 2021 PEA does evaluate a scenario with a gold plant for the Proposed Project. The 2021 PEA advances the waste, tailings, and water management plans, but these are rooted in similar data and concerns as were addressed in the 2011 Technical Report. Both the 2021 PEA and the 2011 Technical Report evaluate similar scale open pit expansions. Furthermore, the transportation and power infrastructure for the two reports are similar in concept.

“The 2021 PEA forecasts robust economics for the Proposed Project and also future potential developments,” said Northern Dynasty President and CEO Ron Thiessen. “It is a project that can be designed, built and operated with industry-leading environmental safeguards while generating significant financial returns over multiple decades.”

The 2021 PEA has been prepared within the guidelines established by National Instrument 43-101 (“NI 43-101”) to disclose the current costs estimates and potential financial results for the Pebble Project. The Company is a “foreign issuer” under the U.S. Exchange Act and entitled to file continuous disclosure reports with the U.S. Securities and Exchange Commission under the MJDS between Canada and the United States, and to provide disclosure on our mineral properties, including the Pebble Project, in accordance with NI 43‐101 disclosure standards and CIM Definition Standards.

The 2021 PEA is based on an August 2020 mineral resource estimate (see Northern Dynasty news release dated August 20, 2020). The 2021 PEA is preliminary in nature, and includes Inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no assurance that the 2021 PEA will be realized. Mineral Resources that are not mineral reserves do not have demonstrated economic viability, and there is no assurance that the Pebble Project mineral resources will ever be upgraded to reserves. The 2021 PEA assumes that the Proposed Project will ultimately be able to obtain the required permits from the USACE and state of Alaska authorities to enable development of the Proposed Project. Neither the 2021 PEA, nor the mineral resource estimates on which the 2021 PEA is based, have been adjusted for any risk that the Pebble Partnership may not be able to successfully appeal the record of decision issued by the USACE on November 25, 2020 denying the granting of the required permit under the Clean Water Act. In addition, the 2021 PEA does not account for any additional capital or operating costs that may be necessary to obtain the required federal or state permits, should adjustments to the operating or environmental mitigation plans be required to be made in order to secure the required permits.

The financial potential of the 20-year operation described in the 2021 PEA’s Proposed Project analysis is further evaluated through modeling the possible addition of a secondary gold recovery plant in Production Year 5 that uses the most efficient and permittable lixiviants available at the time any related permitting applications are made.

In addition, it evaluates three potential Expansion Scenarios, which could see increased mining and processing rates at the Pebble Project, at three different points in time (increased production starting in years 21, 10 and 5 of the mine life) and at various throughput rates. Expansion Scenarios are modelled on a mine development concept submitted by Northern Dynasty’s 100%-owned U.S.-based subsidiary Pebble Limited Partnership (“Pebble Partnership”) to the USACE during federal permitting in response to the federal agency’s Request for Information (“RFI”) about future potential mine development scenarios.

The analysis of specific expansion alternatives included in the 2021 PEA does not reflect a decision by Northern Dynasty or the Pebble Partnership to implement any of these alternatives. Rather, it is an analysis of examples of reasonable alternatives that may be initiated by Pebble Project proponents in the future. The same is true of the identified possible timing of the implementation of each alternative. As noted elsewhere, the implementation of each identified alternative would require extensive permit modifications or the application for and approval of new federal, state and local permits.

“The significant metal production forecasts and robust financial estimates we’re releasing today clearly suggest that Pebble is potentially more than just one of the greatest accumulations of copper and other strategic metals ever discovered on American soil,” said Mr. Thiessen. “It’s also a mineral resource that has the potential to sustain an environmentally sound and financially rewarding mining operation in the near-term, and become one of America’s most important metals producers for decades to come.”

Thiessen said the Proposed Project evaluated in the 2021 PEA – a project the USACE determined in its Final EIS would “not have measureable effects” on fisheries in Southwest Alaska – incorporates industry-leading engineering and environmental safeguards, and substantial closure funding (>$1.4 billion after 20 years of mining). The USACE issued a negative Record of Decision for the Pebble Project based, in part, on perceived impacts to the fishery that the Company believes were not adequately substantiated.

“We believe the proactive, environmentally-driven risk reduction concepts we’ve incorporated are setting a new standard for the global mining sector,” Thiessen said. “They are costs that must be incurred to develop safely and responsibly in America, and they are fully reflected in the positive economics from the development scenarios we’re announcing today.”

In addition to raising performance standards for modern mining, the proposed Pebble Project has the potential to make a significant positive contribution towards achieving the United States’ economic, manufacturing, military and climate change policy goals.

As the largest undeveloped copper, gold and rhenium resource in the world, Pebble has the potential to produce considerable quantities of critical minerals and metals – including those for which the U.S. currently relies on foreign producers for a significant proportion of its needs. Copper, in particular, is considered to be critical for renewable energy and electrification technologies, including EVs.

“In order to achieve its vision for global leadership in transitioning to a low-carbon future, the U.S. simply must develop its own domestic sources of copper and other critical metals,” Thiessen said. “In doing so, it should also demonstrate to the rest of the world what environmentally sound and socially responsible mining looks like. That’s precisely what we’ve undertaken to do at Pebble, and through the project designs evaluated in this PEA.”

Project Overview & Forecast Mine Production

The Proposed Project evaluated in the 2021 PEA is a compact, open pit mine feeding a conventional 180,000 Tpd copper flotation concentrator. It would be capable of processing 1.3 billion tons of mineralized material over 20 years of mining at the extremely low strip ratio of 0.12:1, compared to typical porphyry copper projects which range as high as 2:1 to 3:1.

The Proposed Project reflects industry-leading tailings, waste and water management strategies proposed by the Pebble Partnership, as evaluated by the USACE in the Final EIS, as well as power and transportation infrastructure necessary for developing, operating and closing the proposed mine.

The three Expansion Scenarios evaluated in the 2021 PEA are modelled on a concept identified by the Pebble Partnership in an RFI submission to the USACE during the federal permitting process. The Pebble Partnership’s response to the USACE RFI is included in the USACE’s administrative record for the Pebble EIS.

The first Expansion Scenario evaluated would expand the Pebble process plant from 180,000 to 250,000 Tpd following the 20-year project life envisioned in the Proposed Project, with subsequent mining and processing of an additional 6.3 billion tons of mineralized material. The second and third evaluated Expansion Scenarios would expand the Pebble process plant to 270,000 Tpd in Production Year 10 and Production Year 5 of open pit production under the Proposed Project, respectively.

All three Expansion Scenarios process the same volume of mineralized material over the life of mine – 8.6 billion tons.

Production Summary [4]

|

Proposed |

Expansion Scenarios |

|||||

|---|---|---|---|---|---|---|

|

Project |

Year 21 |

Year 10 |

Year 5 |

|||

| Mineralized Material |

B tons |

1.3 |

8.6 |

8.6 |

8.6 |

|

|

Copper Equivalent [5] |

% |

0.58 |

0.72 |

0.72 |

0.72 |

|

|

Copper |

% |

0.29 |

0.39 |

0.39 |

0.39 |

|

|

Gold |

oz/ton |

0.009 |

0.01 |

0.01 |

0.01 |

|

|

Molybdenum |

ppm |

154 |

208 |

208 |

208 |

|

|

Silver |

oz/ton |

0.042 |

0.047 |

0.046 |

0.046 |

|

|

Rhenium |

ppm |

0.28 |

0.36 |

0.36 |

0.36 |

|

|

Waste |

B tons |

0.2 |

14.4 |

14.4 |

14.4 |

|

|

Open Pit Strip Ratio |

0.12 |

1.67 |

1.67 |

1.67 |

||

|

Open Pit Life |

Years |

20 |

78 |

73 |

68 |

|

|

Life of Mine |

Years |

20 |

101 |

91 |

90 |

|

| Metal Production (LOM) | ||||||

|

Copper |

M lb |

6,400 |

60,400 |

60,400 |

60,400 |

|

|

Gold (in Cu Concentrate) |

k oz |

7,300 |

50,400 |

50,500 |

50,500 |

|

|

Silver (in Cu Concentrate) |

k oz |

37,000 |

267,000 |

267,000 |

267,000 |

|

|

Gold (in Gravity Concentrate) |

k oz |

110 |

782 |

783 |

782 |

|

|

Molybdenum |

M lb |

300 |

2,900 |

2,900 |

2,900 |

|

|

Rhenium |

k kg |

230 |

2,000 |

2,000 |

2,000 |

|

| Metal Production (Annual [6] ) | ||||||

|

Copper |

M lb |

320 |

600 |

660 |

670 |

|

|

Copper Concentrate |

k tons |

559 |

1,000 |

1,200 |

1,200 |

|

|

Gold (in Cu Concentrate) |

k oz |

363 |

500 |

560 |

560 |

|

|

Silver (in Cu Concentrate) |

k oz |

1,800 |

2,600 |

2,900 |

3,000 |

|

|

Molybdenum |

M lb |

15 |

29 |

32 |

32 |

|

|

Molybdenum Concentrate |

k tons |

14 |

26 |

29 |

29 |

|

|

Rhenium |

k kg |

12 |

20 |

22 |

22 |

|

The 2021 PEA also evaluates the impact of incorporating potential financing strategies – including outsourcing of infrastructure, gold streaming, and an onsite gold production plant – on forecast metal production and financial results for the Proposed Project and the three Expansion Scenarios.

In all examined development alternatives, an onsite gold plant, as modeled, could commence operation in Production Year 5 after acquiring the required permits, and could be expanded with the process plant expansions undertaken at Production Years 10 and 21 for the corresponding Expansion Scenarios. In the case of the Production Year 5 Expansion Scenario, a permitted gold plant could be constructed to match the process plant expansion.

Potential gold plant production is shown below, along with total gold and silver production in concentrates and gold plant doré.

Development Cases with Onsite Gold Production [7]

|

Proposed |

Expansion Scenarios |

||||

|

Project |

Year 21 |

Year 10 |

Year 5 |

||

| Gold Plant (LOM) | |||||

|

Gold (as Doré) |

k oz |

1,800 |

14,500 |

14,500 |

14,400 |

|

Silver (as Doré) |

k oz |

2,600 |

22,500 |

22,600 |

22,500 |

| Total Production (LOM) | |||||

|

Gold |

k oz |

9,000 |

65,000 |

65,100 |

64,900 |

|

Silver |

k oz |

39,000 |

289,000 |

289,000 |

289,000 |

“Copper production at Pebble could represent approximately 13-23% of domestic U.S. copper production [8] under the various scenarios,” said Ron Thiessen. “In a global context, it could further strengthen the U.S. position as one of the most important copper producers in the world at a time when the U.S. and the world need more copper to meet low carbon energy goals.”

Financial Results

The 2021 PEA financial model and results table below use long-term metal prices to forecast key financial performance metrics for the Pebble Project. Forecast financial results utilizing prevailing metal prices are also provided in the section of this release entitled “Summary of Key Projected Results.”

Long-term metal prices used are:

- Copper: $ 3.50 / lb

- Gold: $ 1,600 / oz

- Molybdenum: $ 10 / lb

- Silver: $ 22 / oz

- Rhenium: $ 1,500 / kg

Net Present Value is calculated using a 7% discount rate. By convention, a discount rate of 8% is typically applied to copper and other base metal projects, while 5% is applied to gold and other precious metal projects. Given the polymetallic nature of the Pebble deposit and the large contributions of gold to total project revenues, a 7% blended discount rate has been selected.

For the Proposed Project and the Expansion Scenarios, the 2021 PEA considers the impact of each on financial results of third parties owning and financing the construction of key transportation and power infrastructure, as is commonly the case in Alaska. It is assumed these third parties would either construct the facilities through their own resources or they would be included in overall project construction management. The Pebble Partnership would lease, operate and maintain the facilities as part of overall mine operations, with lease payments set to provide a market rate of return to lessors.

Estimated initial capital cost for these components, including indirect costs, owners’ costs and contingency are:

- transportation infrastructure (marine terminal/related facilities and access road): $784 million

- power supply (mine site power plant and natural gas pipeline): $896 million

Financial results presented in the 2021 PEA and in the results table below also incorporate the impact of gold streaming. The calculation assumes that 30% of gold production at Pebble would be streamed at a delivery price of $500/oz in consideration for an estimated upfront payment of $1.3 billion.

Infrastructure outsourcing, gold streaming and the addition of an onsite gold plant have been examined in the 2021 PEA because Northern Dynasty believes this to be the most likely development outcome for the Pebble Project over time. Northern Dynasty does not have any arrangements or commitments for infrastructure or gold streaming in place, and any arrangements or commitments secured may ultimately be on different terms than those assumed in the 2021 PEA. While transportation and power infrastructure outsourcing agreements have not yet been negotiated for the Pebble Project, it is considered to be a realistic potential outcome.

Gold recovery plants are employed safely at hardrock mines in Alaska today, and have recently been approved for large-scale new mine developments in the State. Northern Dynasty and the Pebble Partnership continue to evaluate multiple technologies to safely employ secondary gold recovery as doré at the Pebble Project. Any future plan to incorporate secondary gold recovery would require extensive federal, state and local permitting processes and approvals before proceeding.

Financial Results Summary

|

Proposed |

Expansion Scenarios |

||||

|---|---|---|---|---|---|

|

Project |

Year 21 |

Year 10 |

Year 5 |

||

| Revenue [9] | |||||

|

Annual Gross Revenue |

$M |

1,700 |

3,100 |

3,400 |

3,500 |

|

Life of Mine Gross Revenue |

$M |

35,000 |

312,000 |

312,000 |

312,000 |

| Realization Charges | |||||

|

Annual Charges |

$M |

150 |

270 |

300 |

310 |

|

Life of Mine Charges |

$M |

2,900 |

28,000 |

28,000 |

28,000 |

| Net Smelter Return | |||||

|

Annual NSR |

$M |

1,600 |

2,800 |

3,100 |

3,200 |

|

Life of Mine NSR |

$M |

32,000 |

285,000 |

285,000 |

285,000 |

| Financial Model Results | |||||

| Infrastructure & Streaming | |||||

|

Post Tax IRR |

% |

15.8 |

18.2 |

19.5 |

21.5 |

|

Post Tax NPV 7 |

$M |

2,300 |

5,800 |

7,400 |

8,500 |

|

Payback |

Years |

4.7 |

4.4 |

4.3 |

5.0 |

| With Gold Plant | |||||

|

IRR |

% |

16.5 |

18.9 |

20.4 |

22.7 |

|

NPV 7 |

$M |

2,700 |

6,700 |

8,400 |

9,800 |

|

Payback |

Years |

4.8 |

4.5 |

4.5 |

5.0 |

The tables below provide NPV and IRR sensitivity analyses for the Proposed Project to changes in copper and gold prices.

Proposed Project – NPV 7 Sensitivity to metal price changes ($B)

|

Copper Price ($/lb) |

||||||

|

3.00 |

3.25 |

3.50 |

3.75 |

4.00 |

||

|

Gold Price ($/oz) |

1,200 |

0.5 | 1.0 | 1.4 | 1.9 | 2.4 |

|

1,400 |

0.9 | 1.4 | 1.9 | 2.3 | 2.8 | |

|

1,600 |

1.4 | 1.8 | 2.3 | 2.7 | 3.2 | |

|

1,800 |

1.8 | 2.3 | 2.7 | 3.2 | 3.6 | |

|

2,000 |

2.2 | 2.7 | 3.1 | 3.6 | 4.0 | |

Proposed Project – IRR Sensitivity to metal price changes (%)

|

Copper Price ($/lb) |

||||||

|

3.00 |

3.25 |

3.50 |

3.75 |

4.00 |

||

|

Gold Price ($/oz) |

1,200 |

8.9% | 10.6% | 12.2% | 13.7% | 15.1% |

|

1,400 |

10.7% | 12.4% | 13.9% | 15.4% | 16.8% | |

|

1,600 |

12.6% | 14.2% | 15.8% | 17.2% | 18.6% | |

|

1,800 |

14.5% | 16.2% | 17.7% | 19.2% | 20.5% | |

|

2,000 |

16.6% | 18.3% | 19.8% | 21.2% | 22.7% | |

Cost Estimate

Forecast initial capital costs for the Proposed Project are $6.0 billion, and do not include the projected costs of any of the Expansion Scenarios as these options are evaluated in the 2021 PEA as extensions of the Proposed Project. Additional capital expenditures would be required to facilitate the addition of an onsite gold plant and development of the various Expansion Scenarios.

The $6.0 billion capex estimate below includes $1.7 billion in estimated costs for transportation infrastructure and power supply, which, as described above, are expected to be outsourced.

The 2021 PEA also incorporates annual costs for the closure plan described in the Pebble Project Final EIS. Estimated value of the Pebble closure fund will be $1.4 billion for the Proposed Project and between $3.1 and $3.3 billion for the Expansion Scenarios.

Cost Estimate Summary

|

Proposed |

Expansion Scenarios |

||||

|---|---|---|---|---|---|

|

Project |

Year 21 |

Year 10 |

Year 5 |

||

| Costs | |||||

|

Total Initial Capital Cost |

$M |

6,049 |

6,049 |

6,049 |

6,049 |

|

Infrastructure Lease |

$M |

1,680 |

1,680 |

1,680 |

1,680 |

|

Net Initial Capital Cost |

$M |

4,369 |

4,369 |

4,369 |

4,369 |

|

LOM Sustaining Capital Cost |

$M |

1,500 |

16,400 |

16,500 |

16,600 |

|

Life of Mine Operating Cost [10] |

$/ton |

10.98 |

12.46 |

12.14 |

12.21 |

|

Copper C1 Cost [11] |

$/lb CuEq |

1.65 |

1.56 |

1.53 |

1.54 |

|

AISC (Co-Product Basis) |

$/lb CuEq |

1.88 |

1.76 |

1.73 |

1.74 |

|

Gold C1 Cost |

$/oz Au |

753 |

712 |

699 |

702 |

| Closure Funding | |||||

|

Annual Contribution |

$M/yr |

34 |

9 |

10 |

11 |

|

Life of Mine Contribution |

$M |

814 |

991 |

969 |

1,005 |

|

Life of Mine Bond Premium |

$M |

159 |

1,144 |

783 |

848 |

|

Closure Fund [12] |

$M |

1,412 |

3,170 |

3,292 |

3,124 |

| Life of Mine Taxes [13] | |||||

|

Alaska Mining License |

$M |

687 |

8,203 |

8,140 |

8,215 |

|

Alaska Royalty |

$M |

304 |

3,624 |

3,597 |

3,630 |

|

Alaska Income Tax |

$M |

752 |

9,122 |

10,219 |

10,318 |

|

Borough Severance & Tax |

$M |

490 |

4,343 |

4,121 |

4,172 |

|

Federal Income Tax |

$M |

1,378 |

16,932 |

18,973 |

19,158 |

| Annual Taxes [14] | |||||

|

Alaska Mining License |

$M |

34 |

72 |

89 |

91 |

|

Alaska Royalty |

$M |

15 |

32 |

40 |

40 |

|

Alaska Income Tax |

$M |

38 |

90 |

112 |

115 |

|

Borough Severance & Tax |

$M |

25 |

38 |

45 |

46 |

|

Federal Income Tax |

$M |

69 |

168 |

208 |

212 |

“Pebble has the potential to become an economic engine for Southwest Alaska, a region that is currently one of the most economically challenged in all of the U.S.,” said Ron Thiessen. “The ability of Pebble to produce copper at a low cash cost, and generate many millions in annual taxes and other government revenues in Alaska, while setting aside appropriate closure funding, could propel this region of Alaska into prosperity and opportunity. Incorporating the Pebble Performance Fund [15] into the development options will ensure that residents of the region participate directly in the economic outcomes of Pebble development and operations.”

Proposed Project Description

The open pit mine defined in the Proposed Project would be capable of extracting 1.3 billion tons of mineralized material grading 0.29% copper, 0.009 oz/ton gold, 154 ppm molybdenum, 0.042 oz/ton silver and 0.28 ppm rhenium, with a notably low strip ratio of 0.12:1. The open pit would employ conventional mining equipment.

The proposed process plant design incorporates a conventional copper flotation circuit. Crushed rock would be conveyed from a location near the pit rim to a crushed material stockpile, which would feed twin grinding circuits – each using a semi-autogenous grinding mill in series with two ball mills. Three stages of flotation would produce two concentrates: copper, with gold and silver credits; and molybdenum, with rhenium credits. Gravity concentrators would produce a gold concentrate. Two tailings streams (bulk and pyritic) would be generated by the plant and pumped to separate tailings storage facilities (“TSF”).

Should a secondary gold recovery plant be added in Production Year 5, pyritic tails from the copper-molybdenum cleaner circuit would be re-floated to remove additional gangue and upgrade gold content. The gold-bearing pyrite concentrate from this step would then be re-ground and fed to a closed circuit recovery plant. Gold and silver would be recovered, via processing, to produce doré. Alternate technologies may be employed, pending the results of future testing, permitting, etc.

Tailings embankments would be constructed with non-acid generating and non-metal leaching waste rock from the open pit or a local quarry, with potentially acid generating and metal leaching waste rock co-disposed with pyritic tailings, and ultimately transferred to the open pit at closure.

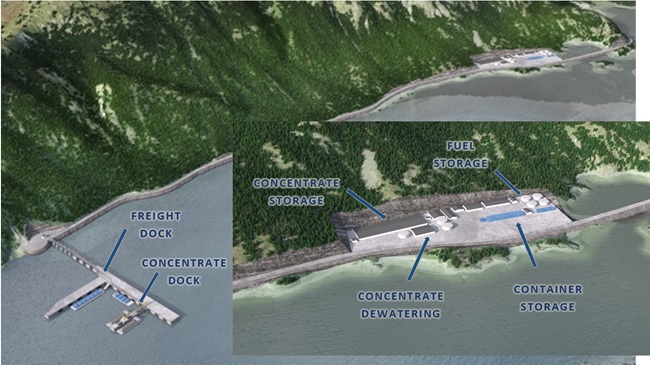

Copper concentrate would be thickened and pumped to a dewatering facility at the marine terminal. Molybdenum concentrate would be dried and put into bulk sacks, which would be placed into shipping containers for transport to refineries. Gravity gold concentrate would also be placed in sacks and shipped via shipping containers to treatment facilities.

Projected metallurgical results are based on work conducted between 2004 and 2013, including 103 locked cycle tests that define the response for eight geometallurgical domains.

The Pebble Partnership developed the Proposed Project tailings, waste and water management systems in response to environmental and safety concerns raised by project stakeholders. The water balance utilizes a 76-year synthetic record created by matching data at the Pebble Project site to data collected at the nearby Iliamna and Port Alsworth airports. This extensive environmental dataset provides a level of certainty to the water management plan that exceeds that available to most modern mines in the U.S.

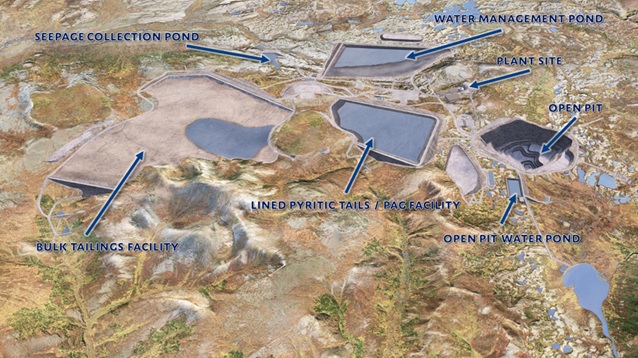

Key elements of the proposed Pebble Project’s approach to tailings, waste and water management include:

- separation of bulk and pyritic tailings, and storage of each in separate TSFs to achieve water management, water quality, stability and closure goals;

- the bulk TSF would employ a flow-through design with downstream water collection and treatment. Combined with storage of thickened, benign tailings (~85% of the total), the flow-through design and water management plan would allow the bulk TSF to operate with a minimal water cover pond and very large tailings beaches, which would reduce both the likelihood and consequence of failure and facilitates reclamation and secure closure of the facility;

- the pyritic TSF would provide sub-aqueous storage for potentially reactive tailings (~15% of the total) and waste rock within a fully-lined facility during mine operations, with these materials to be transferred to the former open pit for safe, permanent underwater storage at closure. This approach would reduce water quality risks, and eliminate any risk associated with embankment failure post-closure;

- conservative design criteria have been applied to all of the Pebble Project’s tailings embankments, including buttresses and reduced slope angles, and an overall ‘factor of safety’ beyond industry norms;

- utilizing the 76-year weather record to design a water management system to manage the wettest 20 years in that record on top of very stringent storm event criteria; and

- development of a comprehensive approach to water treatment to ensure discharge water would consistently meet stringent state and federal water quality criteria.

Figure 1: Site Layout [16]

The Proposed Project would incorporate significant power and transportation infrastructure. An 82-mile gravel access road would connect mine-site facilities with a marine terminal on Cook Inlet. The marine terminal would include a barge dock for receipt of incoming supplies and fuel, concentrate dewatering, storage and trans-shipment to nearby moored ocean-going freighters, fuel-receiving facilities, and fuel storage.

Concentrate and water return pipelines would be buried in or adjacent to the access road. The terminus of the concentrate pipeline at the marine terminal would receive the pumped slurry, dewater the copper concentrate, and transfer it to a storage building. Copper concentrate would then be transported via conveyor to barges, which in turn would transfer the copper concentrate to ocean-going freighters. The filtrate water would be pumped back to the mine site for re-use.

Figure 2: Marine Terminal Layout

Mine site power demand would be 270 MW. The natural gas-fueled combined cycle power plant to be constructed to provide this power would have a total capacity of 318 MW (to provide N+1 redundancy). A 6 MW natural gas-fired plant would supply power to the marine terminal.

Natural gas would be transferred to the marine terminal and mine site via a pipeline that interconnects with a compression station on an existing pipeline on the Kenai Peninsula. The pipeline would cross Cook Inlet, coming ashore near the marine terminal and from there it would parallel the access road to the mine site. The Cook Inlet crossing to the marine terminal is 78 miles and from the marine terminal to the mine site is 74 miles, for a total combined pipeline length of 152 miles.

Mine Closure

The 2021 PEA includes the closure concepts defined in the Pebble Project EIS. Once mining of the 1.3 billion ton open pit is complete, the first closure phase would commence with removal of the process plant and other redundant facilities. The bulk tailings facility would be drained and materials permitted to consolidate, while pyritic tailings and co-disposed waste rock would be relocated to the open pit. During phase 2, pit dewatering would cease and the water level in the former open pit would be permitted to rise to a pre-determined level to ensure inward flow. During phase 3, the final stages of bulk tailings facility closure, capping and runoff control would be completed. Phase 4 would consist of long-term water management, treatment and monitoring.

Expansion Scenarios

The 2021 PEA evaluates three Expansion Scenarios modelled on a future mine development concept identified by the Pebble Partnership and submitted to the USACE during the EIS process. The concept submitted to the USACE in response to its RFI envisions an expansion of the proposed Pebble mine’s process plant to 250,000 Tpd after the Proposed Project was complete, and the processing of an additional 6.3 billion tons of mineralized material. All Expansion Scenarios would need to be based on models that would have to be developed into a plan or project that could be submitted for additional federal, state and local permitting.

The Expansion Scenarios utilize an elevated cutoff grade while the open pit is mined, with lower grade material to be stockpiled and fed to the plant after the open pit has been exhausted. Lower grade stockpiles and waste rock dumps could be located northeast and south of the open pit, along with additional water management and treatment facilities. The power plant would also be expanded to meet an expected 404 MW demand, as would tailings facilities, with additional locations selected to manage additional volumes.

Minor changes would be required to the Proposed Project infrastructure to accommodate the Expansion Scenarios. For instance, expansion would require a compressor station at the marine terminal to increase the capacity of the natural gas pipeline. Additional concentrate production would also require expansion of the concentrate pipeline system.

“Pebble is a unique asset, potentially offering generations of low cost copper produced using industry-leading mining technologies, the result of which would elevate southwestern Alaska economically while helping the U.S. meet its renewable energy and carbon reduction goals,” said Ron Thiessen. “There is substantial, untapped potential here.”

Qualified Persons

A NI 43-101 Technical Report prepared by the Qualified Persons listed below will be posted on the Company’s website (www.northerndynastyminerals.com), as well as on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov) within 45 days. The Qualified Persons have reviewed and approved the scientific, technical, and economic information contained in this news release.

- Hassan Ghaffari, P.Eng. of Tetra Tech – Metallurgy

- Robin Kalanchey, P.Eng. of Ausenco – Process

- Sabry Abdel Hafez, P.Eng. of Tetra Tech – Open Pit Mining

- Les Galbraith, P.Eng., P.E. of Knight Piésold – Tailings and water management

- James Lang, P.Geo. of J M Lang Professional Consulting Inc. – Geology and exploration*

- Eric Titley, P.Geo. of Hunter Dickinson – Resource data base and sampling*

- David Gaunt, P.Geo. of Hunter Dickinson – Resource estimation*

- Stephen Hodgson, P.Eng. of Hunter Dickinson – Overall project information*

* Non-independent Qualified Person

About Northern Dynasty Minerals Ltd.

Northern Dynasty is a mineral exploration and development company based in Vancouver, Canada. Northern Dynasty’s principal asset, owned through its wholly owned Alaska-based U.S. subsidiary, Pebble Limited Partnership, is a 100% interest in a contiguous block of 2,402 mineral claims in Southwest Alaska, including the Pebble deposit, located 200 miles from Anchorage and 125 miles from Bristol Bay. The Pebble Partnership is the proponent of the Pebble Project, an initiative to develop one of the world’s most important mineral resources.

For further details on Northern Dynasty and the Pebble Project, please visit the Company’s website at www.northerndynastyminerals.com or contact Investor services at (604) 684-6365 or within North America at 1-800-667-2114. Review Canadian public filings at www.sedar.com and U.S. public filings at www.sec.gov.

Ronald W. Thiessen

President & CEO

U.S. Media Contact:

Dan Gagnier, Gagnier Communications (646) 569-5897

Forward-Looking Information and other Cautionary Factors

This release includes certain statements that may be deemed “forward-looking statements” under the United States Private Securities Litigation Reform Act of 1995 and under applicable provisions of Canadian provincial securities laws. All statements in this release, other than statements of historical facts, which address permitting, development and production for the Pebble Project are forward-looking statements. These include statements regarding (i) the mine plan for the Pebble Project, the financial results of the 2021 PEA, including net present value and internal rates of return, and the ability of the Pebble Partnership to secure the financing to proceed with the development of the Pebble Project, including any stream financing and infrastructure outsourcing, (ii) the social integration of the Pebble Project into the Bristol Bay region and benefits for Alaska, (iii) the political and public support for the permitting process, (iv) the ability to successfully appeal the negative Record of Decision and secure the issuance of a positive Record of Decision by the U.S. Army Corps of Engineers and the ability of the Pebble Project to secure all required federal and state permits, (v) the right-sizing and de-risking of the Pebble Project, including any determination to pursue any of the expansion scenarios for the Pebble Project or to incorporate a gold plant, (vi) the design and operating parameters for the Pebble Project mine plan, including projected capital and operating costs, (vii) exploration potential of the Pebble Project, (viii) future demand for copper and gold and the metals prices assumed for the financial projections including the 2021 PEA, (ix) the potential addition of partners in the Pebble Project, and (x) the ability and timetable of NDM to develop the Pebble Project and become a leading copper, gold and molybdenum producer. Although NDM believes the expectations expressed in these forward-looking statements are based on reasonable assumptions, such statements should not be in any way be construed as guarantees that the Pebble Project will secure all required government permits, establish the commercial feasibility of the Pebble Project, achieve the required financing or develop the Pebble Project. Such forward-looking statements or information related to this Preliminary Economic Assessment include but are not limited to statements or information with respect to the mined and processed material estimates; the internal rate of return; the annual production; the net present value; the life of mine; the capital costs, operating costs estimated for each of the Proposed Project and three Expansion Scenarios for the Pebble Project; and other costs and payments for the proposed infrastructure for the Pebble Project (including how, when, where and by whom such infrastructure will be constructed or developed); projected metallurgical recoveries; plans for further development, and securing the required permits and licenses for further studies to consider expansion of the operation; and market price of precious and base metals; or other statements that are not statement of fact.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by NDM as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Assumptions used by NDM to develop forward-looking statements include the assumptions that (i) the Pebble Project will obtain all required environmental and other permits and all land use and other licenses without undue delay, (ii) any feasibility studies prepared for the development of the Pebble Project will be positive, (iii) NDM’s estimates of mineral resources will not change, and NDM will be successful in converting mineral resources to mineral reserves, (iv) NDM will be able to establish the commercial feasibility of the Pebble Project, and (v) NDM will be able to secure the financing required to develop the Pebble Project. The likelihood of future mining at the Pebble Project is subject to a large number of risks and will require achievement of a number of technical, economic and legal objectives, including (i) obtaining necessary mining and construction permits, licenses and approvals without undue delay, including without delay due to third party opposition or changes in government policies, (ii) finalization of the mine plan for the Pebble Project, (iii) the completion of feasibility studies demonstrating that any Pebble Project mineral resources that can be economically mined, (iv) completion of all necessary engineering for mining and processing facilities, (v) the inability of NDM to secure a partner for the development of the Pebble Project, and (vi) receipt by NDM of significant additional financing to fund these objectives as well as funding mine construction, which financing may not be available to NDM on acceptable terms or on any terms at all. NDM is also subject to the specific risks inherent in the mining business as well as general economic and business conditions, such as the current uncertainties with regard to COVID-19. Investors should also consider the risk factors identified in its Annual Information Form for the year ended December 31, 2020, as filed on SEDAR and included in the Company’s annual report on Form 40-F filed by the Company with the SEC on EDGAR.

The National Environment Policy Act Environmental Impact Statement process requires a comprehensive “alternatives assessment” be undertaken to consider a broad range of development alternatives, the final project design and operating parameters for the Pebble Project and associated infrastructure may vary significantly from that currently contemplated. As a result, the Company will continue to consider various development options and no final project design has been selected at this time, and no determination has been made to pursue any of the expansion options identified in the PEA.

For more information on the Company, Investors should review the Company’s filings with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedar.com.

[1] All cases include infrastructure outsourcing and gold streaming (see p. 6 ‘Financial Results’ for more information) and may require additional permitting

[2] Long-term metal prices: copper $3.50/lb; gold $1,600/oz; molybdenum $10/lb; silver $22/oz; rhenium $1,500/kg

[3] Prevailing metal prices: copper $4.25/lb; gold $1,800/oz; molybdenum $18/lb; silver $24/oz; rhenium $1,600/kg

[4] Unless otherwise noted, units cited are U.S. standard units

[5] Copper equivalent (CuEQ) calculations use metal prices: US$1.85/lb for Cu, US$902/oz for Au and US$12.50/lb for Mo, and recoveries: 88% Cu, 75% Au, and 82% Mo

[6] Life of mine volumes ÷ life of mine years

[7] The gravity gold concentrate is fed to the gold plant when it is operating

[8] U.S. Geological Survey, 2021, Mineral commodity summaries 2021: U.S. Geological Survey, 200 p., https://doi.org/10.3133/mcs2021

[9] Revenue values do not include a gold plant contribution

[10] Includes cost of infrastructure lease:

- Proposed Project – $2.80/ton milled

- Year 21 Expansion – $0.54/ton milled

- Year 10 Expansion – $0.53/ton milled

- Year 5 Expansion – $0.53/ton milled

[11] C1 costs calculated on co-product basis

[12] Maximum value of closure fund during life of mine based on 4% compounding interest

[13] Estimated based on current Alaskan statutes

[14] Life of mine taxes ÷ life of mine years

[15] See Northern Dynasty news release data June 16, 2020

[16] PAG – potentially acid generating

SOURCE: Northern Dynasty Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/663286/Northern-Dynasty-Preliminary-Economic-Assessment-for-Alaskas-Pebble-Project-Presents-Robust-Projected-Financial-Results-and-Globally-Significant-Potential-Metal-Production-With-Excellent-Optionality