Nokia Corporation

NOK

has announced that it will provide high-capacity optical network solutions to Uninett, Norway’s national research and education network. This will help Uninett expand the fiber infrastructure in the northern part of the country.

The expansion is primarily driven by EISCAT Scientific Association’s extreme capacity needs for ionosphere and upper atmosphere 3D research in the Northern region.

Uninett provides modern connectivity infrastructure that includes nationwide fiber network access. The organization is part of GÉANT, the pan-European data network for the research and education community. It caters to the needs of the community by providing bandwidth capacity, scalability and data security.

Nokia’s optical transport solutions will enable multi-disciplined research, including geophysical sensing and sustainable resource exploration. It also has a multi-year framework agreement to supply solutions to GÉANT’s member networks.

Nokia’s solution is based on its 1830 Photonic Service Interconnect platform that enables Data Center Interconnect applications. Leveraging Nokia’s Photonic Service Engine processors, the solution can be scaled from 100 Gbps to 600 Gbps per channel.

Nokia’s photonic transport and switching solution will help boost scientific and industrial research among organizations. The Finland-based company is likely to benefit from the increasing demand for next-generation connectivity.

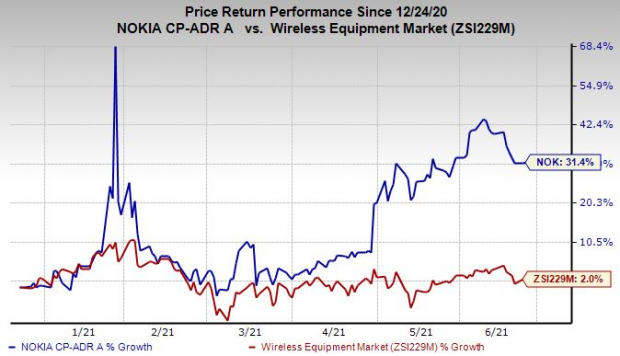

Nokia’s shares have gained 31.4% in the past six months compared with 2% growth of the

industry

.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader industry are

Ooma, Inc.

OOMA

,

ADTRAN, Inc.

ADTN

and

ATN International, Inc.

ATNI

, each carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Ooma delivered a trailing four-quarter earnings surprise of 65.5%, on average.

ADTRAN delivered a trailing four-quarter earnings surprise of 184.2%, on average.

ATN International delivered a trailing four-quarter earnings surprise of 424.2%, on average.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report