Newmont Corporation

NEM

reported a net loss from continuing operations of $8 million or a penny per share in third-quarter 2021 against a profit of $611 million or 76 cents per share in the year-ago quarter.

Barring one-time items, adjusted earnings were 60 cents per share that missed the Zacks Consensus Estimate of 71 cents.

Newmont reported revenues of $2,895 million, down around 9% year over year. The figure missed the Zacks Consensus Estimate of $3,126.5 million. The downside was due to lower average realized gold prices and lower gold sales volumes.

Operational Highlights

Newmont’s attributable gold production in the third quarter declined 6% year over year to 1.45 million ounces in the quarter, due to lower throughput at Nevada Gold Mines and Tanami. Reduced throughput, grade milled and recovery at Boddington also led to the downside.

Average realized prices of gold fell 7.1% year over year to $1,778 per ounce.

The company’s costs applicable to sales (CAS) for gold was $1,175 per ounce, up 4% year over year.

All-in sustaining costs (AISC) for gold increased 10% year over year at $1,120 per ounce, mainly due to higher CAS per ounce and elevated sustaining capital spend. This was partly offset by lower treatment and refining costs.

Regional Performance

North America:

Third-quarter attributable gold production in North America was 384,000 ounces, down 7% year over year. Gold CAS in the region was $800 per ounce, up 5% year over year.

South America:

Attributable gold production in South America was 188,000 ounces, up 14% year over year. Gold CAS in the region rose 8% on a year-over-year basis to $958 per ounce.

Australia:

Attributable gold in the region was 274,000 ounces, down 11% year over year. Gold CAS in the region rose 14% year over year to $788 per ounce.

Africa:

Production in the region totaled 210,000 ounces of gold in the quarter, down 8% year over year. Gold CAS was $886 per ounce, up 28% year over year.

Nevada:

Production totaled 308,000 ounces of gold in the quarter, down 9% year over year. Gold CAS was $768 per ounce, up 1% year over year.

Financial Position

The company ended the quarter with cash and cash equivalents of $4,636 million, down 3.9% year over year. At the end of the quarter, the company had long-term debt of $4,990 million, down 17.2% year over year.

Net cash from continuing operations amounted to $1.1 billion and free cash flow was $735 million in the quarter.

Outlook

For 2021, Newmont now expects attributable gold production of 6 million ounces, down from 6.5 million ounces expected earlier. The company also expects gold CAS to be $790 per ounce and AISC to be $1,050 per ounce, up from the earlier view of $750 per ounce and $970 per ounce, respectively.

Newmont stated that Boddington faced issues from severe weather and Nevada Gold Mines is also witnessing headwinds. The revised upside in cost outlook includes the impact from lower production volumes as well as elevated royalties and production taxes at higher gold prices.

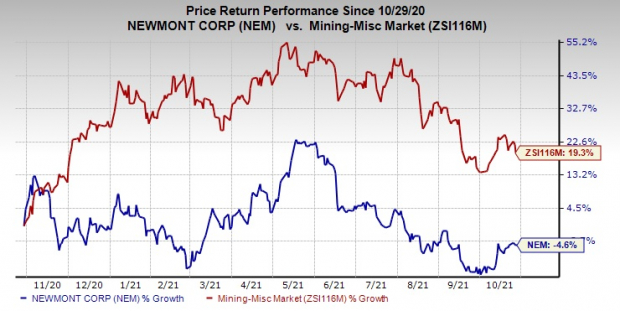

Price Performance

Newmont’s shares have declined 4.6% in the past year against the 19.3% rally of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

The Chemours Company

CC

and

Olin Corporation

OLN

.

Nucor has a projected earnings growth rate of around 580.2% for the current year. The company’s shares have soared 132.3% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.9% for the current year. The company’s shares have gained 41.1% in the past year. It currently carries a Zacks Rank #2 (Buy).

Olin has an expected earnings growth rate of around 700% for the current year. The company’s shares have surged 238.3% in the past year. It currently flaunts a Zacks Rank #1.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report