Newmont Corporation

NEM

reported a net loss from continuing operations of $61 million or 8 cents per share in fourth-quarter 2021 against a profit of $806 million or $1.00 per share in the year-ago quarter.

Barring one-time items, adjusted earnings were 78 cents per share, topping the Zacks Consensus Estimate of 76 cents.

Newmont reported revenues of $3,390 million, up around 0.3% year over year. The figure beat the Zacks Consensus Estimate of $3,333.9 million.

Operational Highlights

Newmont’s attributable gold production in the fourth quarter declined roughly 1% year over year to 1.62 million ounces in the quarter.

Average realized prices of gold fell 3% year over year to $1,798 per ounce.

The company’s costs applicable to sales (CAS) for gold was $802 per ounce, up 9% year over year.

All-in sustaining costs (AISC) for gold inched up 1% year over year to $1,056 per ounce, mainly due to higher CAS per ounce.

Regional Performance

North America:

Fourth-quarter attributable gold production in North America was 404,000 ounces, down 7% year over year. Gold CAS in the region was $883 per ounce, up 21% year over year.

South America:

Attributable gold production in South America was 182,000 ounces, down 9% year over year. Gold CAS in the region rose 11% on a year-over-year basis to $860 per ounce.

Australia:

Attributable gold in the region was 339,000 ounces, up 12% year over year. Gold CAS in the region was flat year over year at $724 per ounce.

Africa:

Production in the region totaled 245,000 ounces of gold in the quarter, up 1% year over year. Gold CAS was $786 per ounce, up 8% year over year.

Nevada:

Production totaled 377,000 ounces of gold in the quarter, up 10% year over year. Gold CAS was $753 per ounce, up 2% year over year.

FY21 Results

Earnings (as reported) for full-year 2021 were $1.39 per share compared with $3.31 per share a year ago. Net sales rose 6.3% year over year to $12,222 million.

Financial Position

The company ended the year with cash and cash equivalents of $4,992 million, down 9.9% year over year. At the end of the year, the company had long-term debt of $5,565 million, up 1.6% year over year.

Net cash from continuing operations amounted to $1,299 million and free cash flow was $858 million in the fourth quarter.

Outlook

For 2022, Newmont expects attributable gold production of 6.2 million ounces. The company also expects gold CAS to be $820 per ounce and AISC to be $1,050 per ounce.

Newmont’s guidance reflects increasing gold production and ongoing investment in its operating assets and most promising growth prospects. It includes current development capital costs and production related to Tanami Expansion 2, Ahafo North, Yanacocha Suldes, Pamour at Porcupine and Cerro Negro District Expansion 1.

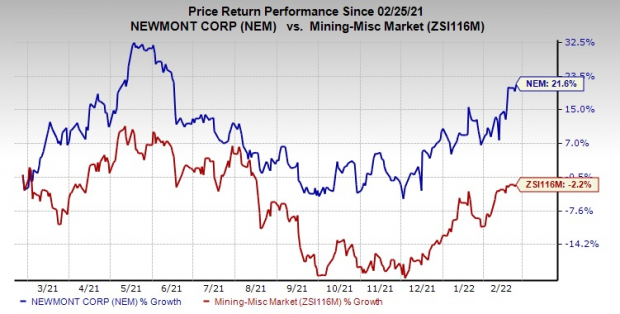

Price Performance

Newmont’s shares have increased 21.6% in the past year against a 2.2% decline of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Incorporated

ATI

,

Nutrien Ltd.

NTR

and

AdvanSix Inc.

ASIX

.

Allegheny, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s earnings for the current year has been revised 45.6% upward in the past 60 days. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 15.2% over a year.

Nutrien, sporting a Zacks Rank #1, has a projected earnings growth rate of 62.3% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 11.5% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missing once. It has a trailing four-quarter earnings surprise of roughly 60.3%, on average. NTR has rallied around 34.9% in a year.

AdvanSix has a projected earnings growth rate of 7.7% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 3.2% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 23.6%. ASIX has surged 26.6% over a year. The company carries a Zacks Rank #2.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report