Newmont Corporation

NEM

reported net income from continuing operations of $379 million or 48 cents per share in second-quarter 2022, down from $640 million or 80 cents per share in the year-ago quarter.

Barring one-time items, adjusted earnings were 46 cents per share that missed the Zacks Consensus Estimate of 60 cents.

Newmont reported revenues of $3,058 million, almost flat year over year. The figure missed the Zacks Consensus Estimate by 0.5%. Higher average realized gold prices and copper sales volume were partly offset by reduced average realized co-product metal prices.

Operational Highlights

Newmont’s attributable gold production in the second quarter increased roughly 3.4% year over year to around1.5 million ounces in the quarter.

Average realized prices of gold rose 0.7% year over year to $1,836 per ounce.

The company’s costs applicable to sales (CAS) for gold were $932 per ounce, up 23.4% year over year. The increase was mainly driven by higher direct operating costs resulting from higher labor costs and increased commodity inputs, including higher fuel and energy costs.

All-in sustaining costs (AISC) for gold were up 15.8% year over year to $1,199 per ounce, mainly due to higher CAS per gold equivalent ounce.

Regional Performance

North America:

Second-quarter attributable gold production in North America was 316,000 ounces, down 20% year over year. Gold CAS in the region was $1,124 per ounce, up 46% year over year.

South America:

Attributable gold production in South America was 210,000 ounces, up 11% year over year. Gold CAS in the region rose 36% on a year-over-year basis to $982 per ounce.

Australia:

Attributable gold in the region was 366,000 ounces, up 22% year over year. Gold CAS in the region was down 7% year over year to $710 per ounce.

Africa:

Production in the region totaled 243,000 ounces of gold in the quarter, up 20% year over year. Gold CAS was $838 per ounce, up 10% year over year.

Nevada:

Production totaled 290,000 ounces of gold in the quarter, up 2% year over year. Gold CAS was $1,035 per ounce, up 37% year over year.

Financial Position

The company ended the quarter with cash and cash equivalents of $4,307 million, down 6% year over year. At the end of the quarter, the company had long-term debt of $5,568 million, up 11.6% year over year.

Net cash from continuing operations amounted to $1,033 million. Free cash flow totaled $514 million in the second quarter.

Outlook

For 2022, Newmont expects attributable gold production of 6 million ounces. The company also expects gold CAS to be $900 per ounce and AISC to be $1,150 per ounce.

Newmont’s cost guidance reflects the impact of lower production volumes and higher direct operating costs related to labor, energy, consumables and supplies due to sustained inflationary pressures.

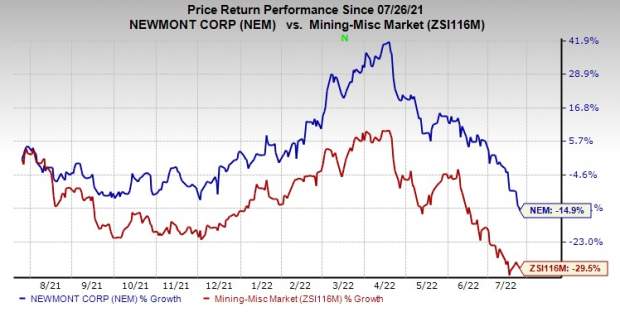

Price Performance

Newmont’s shares have declined 14.9% in the past year compared with a 29.5% fall of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Albemarle Corporation

ALB

,

Cabot Corporation

CBT

and

Sociedad Quimica y Minera de Chile S.A.

SQM

.

Albemarle has a projected earnings growth rate of 241.8% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 21.5% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 22.5%, on average. ALB has gained around 13.7% in a year and currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Cabot, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 22.5% for the current year. The Zacks Consensus Estimate for CBT’s earnings for the current year has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 28.6% over a year.

Sociedad has a projected earnings growth rate of 422.4% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 75.3% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average being 28.2%. SQM has gained 89.6% in a year. The company sports a Zacks Rank #1.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report