Newmont Corporation

’s

NEM

board recently approved the advancement of the Ahafo North Project to the execution stage. The project, exceeding the required internal rate of return (“IRR”), will be bringing profitable production from the best un-mined gold deposit in West Africa.

The Ahafo North Project includes four open-pit mines and the setting up of a stand-alone mill. The construction is expected to complete in the second half of 2023. At the current gold prices, production from the mine is expected to deliver more than 30% IRR.

It will also lead to the creation of approximately 1,800 jobs, with more than 550 permanent roles. The company aims to focus on the key aspect of achieving gender parity in the workforce after the commencement of operations.

There have been considerable engagements with traditional leaders, local and regional government agencies and also public stakeholder engagement meetings by the company. Stakeholders have backed the project’s infrastructure plans and permits necessary to begin construction.

The company remains dedicated to maintaining its stakeholder interaction by providing regular updates as the project proceeds. This will strengthen its social acceptance.

The full scope of funding will be deployed to high-impact activities, including but not limited to tasks like finalizing engineering and EPCM services, relocating of the national highway and support of additional resettlement activities, constructing and commissioning a 3.7-million-ton per annum plant, constructing a Tailings and Wastewater Management Storage Facility, and long-lead sourcing including the acquisition of 14 CAT 770 haul trucks.

Newmont noted that the project will expand its existing footprint in Ghana and add more than three million ounces of gold production over the initial 13-year mine life. It is committed to sustainably develop and operate the project to add value to its stakeholders.

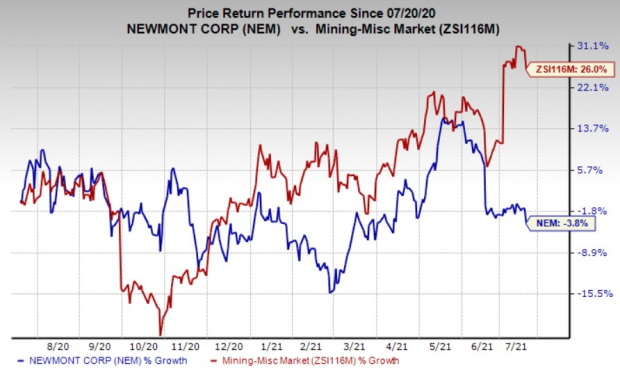

Shares of Newmont have declined 3.8% over a year against the

industry

’s rise of 26%. Its earnings growth rate for the current year is pegged at 25.6%.

Image Source: Zacks Investment Research

In its first-quarter earnings call, the company said that it expects attributable gold production of 6.5 million ounces, gold cost applicable to sales (CAS) to be $750 per ounce and all-in sustaining costs (AISC) to be $970 per ounce. It also foresees an increase in gold production and is undertaking investments in its operating assets and other growth prospects.

Zacks Rank & Stocks to Consider

Currently, Newmont carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

Glencore PLC

GLNCY

and

Rio Tinto Group

RIO

, both sporting a Zacks Rank #1 (Strong Buy), and

BHP Group

BHP

, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Glencore has a projected earnings growth rate of 296.7% for the current year. The company’s shares have appreciated 82.9% over a year.

Rio Tinto has a projected earnings growth rate of 124.3% for the current year. The company’s shares have grown 32.6% over a year.

BHP has a projected earnings growth rate of 192.5% for the current year. The company’s shares have gained 38.8% over a year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report