Navient Corporation

NAVI

and

Maximus

MMS

have entered into an agreement, per which the latter will take over the loan servicing for the U.S. Department of Education-owned student loan accounts of the former, through a contract novation. The deal is likely to be finalized in the beginning of fourth-quarter 2021.

The novation is subject to the U.S. Department of Education’s approval. The companies have submitted a preliminary request for review, which will be subject to the Federal Student Aid’s (FSA) consent. The financial terms of the deal have not been disclosed.

The six million borrowers, who currently pay their federal student loans to Navient, the largest student-loan company in the United States, will now be offloaded to Maximus, a government loan servicing company.

The deal, if green lighted by the FSA and other customary closing conditions, would lead to Navient calling it quits on its student loan servicing program as planned. The program would then join the FSA portfolio at Maximus, which includes the Debt Management and Collections System contract and Next Generation Business Process Operations contract vehicle.

Per the contract novation, several Navient employees on the Department of Education loan servicing team will be transferred to Maximus. This will ensure the operative continuum of the quality service imparted to the FSA customers, along with the competencies of the same avant-garde technology employed today.

Jack Remondi, Navient’s president and CEO, said, “Navient is pleased to work with the Department of Education and Maximus to provide a smooth transition to borrowers and Navient employees as we continue our focus on areas outside of government student loan servicing.”

“We look forward to the successful completion of this contract novation and working in partnership with Navient and FSA in the successful migration of operations for this critical function. We are pleased to further our strong track record of supporting FSA as we expand into federally originated student loan servicing,” said Teresa Weipert, general manager for the Maximus U.S. Federal Services Segment.

Nearly majority of federal student loan borrowers have been escaping their payments, thanks to the moratorium on collections that the government had imposed in the wake of the pandemic. However, these payments will start getting collected since the Biden administration has conveyed its intentions to restart collections on Jan 31, 2022.

Navient’s focus on tapping growth opportunities is anticipated to boost its overall business performance. Further, a gradually improving economy and a declining unemployment rate are expected to support the company. However, it continues to battle with the strict regulations in the student lending market.

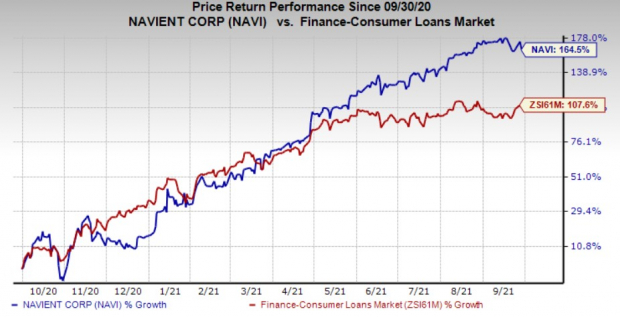

Shares of Navient have gained 164.5% over the past year, outperforming 107.6% growth of the

industry

it belongs to.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

The Zacks Consensus Estimate for

Credit Acceptance Corporation

’s

CACC

ongoing-year earnings has moved 24.4% north in the last 60 days. Also, its share price has appreciated 74.2% in a year’s time. It sports a Zacks Rank #1 (Strong Buy) presently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for

SLM Corporation

’s

SLM

current-year earnings has been revised 2.5% upward in the last 60 days. Also, its share price has risen 120.4% over the past year. It currently carries a Zacks Rank #2 (Buy).

First Cash

FCFS

carries a Zacks Rank of 2, at present. The Zacks Consensus Estimate for 2021 earnings has been revised 2.2% upward over the last 60 days. Further, in the past year, the company’s shares have gained 53.4%.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report