The Mosaic Company

MOS

is set to release

fourth-quarter 2021

results on Feb 22, after the closing bell. Mosaic’s fourth-quarter performance is likely to reflect the benefits of higher prices and demand for phosphate and potash.

Mosaic delivered an earnings surprise of 38.1%, on average, over the trailing four quarters. It posted a negative earnings surprise of 15.1% in the last reported quarter.

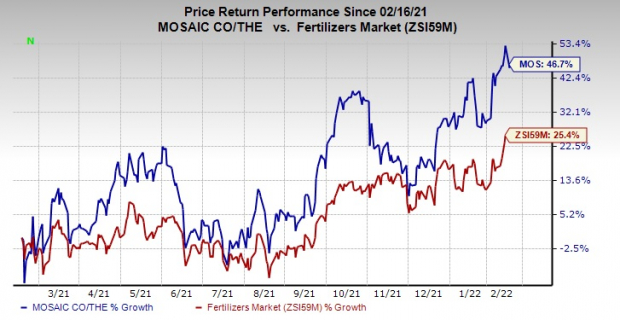

Shares of Mosaic have gained 46.7% in the past year compared with a 25.4% rise of the

industry

.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Mosaic this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP:

Earnings ESP for Mosaic is +1.80%. The Zacks Consensus Estimate for the fourth-quarter earnings is currently pegged at $1.95. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Mosaic currently carries a Zacks Rank #2.

What do the Estimates Indicate?

The Zacks Consensus Estimate for Mosaic’s fourth-quarter consolidated sales is currently pegged at $3,811 million, calling for an increase of 55.1% from the year-ago quarter’s tally.

The Zacks Consensus Estimate for net sales in the Phosphates segment is currently pegged at $1,435 million, which calls for an increase of 45% year over year.

The consensus mark for net sales in the Potash segment is currently pegged at $915 million, which suggests an increase of 63.7% year over year.

The Zacks Consensus Estimate for net sales in the Mosaic Fertilizantes segment is currently pegged at $1,552 million, which calls for an increase of 88.6% year over year.

Factors at Play

Mosaic is likely to have benefited from higher prices and demand for phosphate and potash. Higher agricultural commodity prices and attractive farm economics are driving demand for fertilizers globally. Global phosphate markets remain robust on solid demand and pricing dynamics.

Tight availability along with firm demand is expected to drive phosphate prices globally. Potash prices are also likely to strengthen on the back of robust global demand, aided by strong grower economics and higher crop prices.

The company, in its third-quarter call, noted that it expects strong agricultural commodity pricing trends to continue through the fourth quarter of 2021, driving demand for fertilizers. It also sees average realized prices for phosphate in the fourth quarter to be $55-$65 per ton higher than the prior quarter’s levels. Potash’s average realized prices are forecast to be $110-$130 per ton higher than the third quarter’s figures.

Mosaic is also likely to have benefited from actions to reduce costs amid a still-challenging operating environment. Its actions to improve operating cost structure through transformation plans are expected to have boosted its profitability. Transformational savings are also likely to have supported margins in the Mosaic Fertilizantes segment.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Nutrien Ltd.

NTR

, scheduled to release earnings on Feb 16, has an Earnings ESP of +2.61% and sports a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nutrien’s fourth-quarter earnings has been revised 0.9% upward in the past 30 days. The consensus estimate for NTR’s earnings for the quarter is currently pegged at $2.30.

Element Solutions Inc.

ESI

, slated to release earnings on Feb 22, has an Earnings ESP of +3.45% and carries a Zacks Rank #3.

The consensus estimate for Element Solutions’ fourth-quarter earnings has been stable in the past 30 days. The Zacks Consensus Estimate for ESI’s earnings is pegged at 29 cents.

Newmont Corporation

NEM

, scheduled to release earnings on Feb 24, has an Earnings ESP of +3.37% and carries a Zacks Rank #3.

The consensus estimate for Newmont’s fourth-quarter earnings has been revised 2.7% upward over the past 30 days. The Zacks Consensus Estimate for NEM’s earnings for the quarter stands at 76 cents.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report