Click here

to read the previous molybdenum outlook.

Like other markets, the molybdenum space felt the impact of the coronavirus in 2020.

The

oil

price crash hit demand for the metal, although it saw some recovery in China in Q2.

With 2021 now in swing, investors interested in the

industrial metal

are now wondering about the molybdenum outlook for next year. Here the Investing News Network (INN) looks back at the main trends in the sector and what’s ahead for molybdenum.

Download today!

Molybdenum trends 2020: The year in review

The coronavirus pandemic hit markets globally at the end of March, when governments started to take steps to slow the spread of the virus.

Lockdowns and containment measures impacted demand for metals across the board, and as mentioned, molybdenum was no exception.

“The molybdenum market was hit hard by the pandemic,” James Jeary of CRU Group explained to INN. “The biggest impact on demand was caused by the oil price crash, as the oil and

gas

sector is one of the largest end uses for moly.”

The wider slowdown in industrial production also impacted demand for molybdenum, which is mostly used to make stainless steel, cast

iron

and superalloys.

“The strength of moly consumption in the Chinese stainless steel sector has also been stronger than previously expected,” Jeary said. “This has been reflected in the strength of Chinese moly imports, which have been at historically high levels.”

Although there was a strong recovery in China in the second half of 2020, global demand is still expected to have dropped on a year-on-year basis, Olivier Mason of Roskill told INN.

“Mine supply did not follow suit, however,” he said.

Roskill expects global mine production to be little changed overall in 2020, despite Freeport-McMoRan’s (NYSE:

FCX

) production cut at its Climax mine in the US in response to the deteriorating market conditions, and the Yichun Lumin mine in China being idle for half the year following a tailings spill.

“Some mines had to comply with local measures aimed at slowing the spread of COVID-19, resulting in some temporary falls in supply, but once these measures were eased, output recovered,” Mason said.

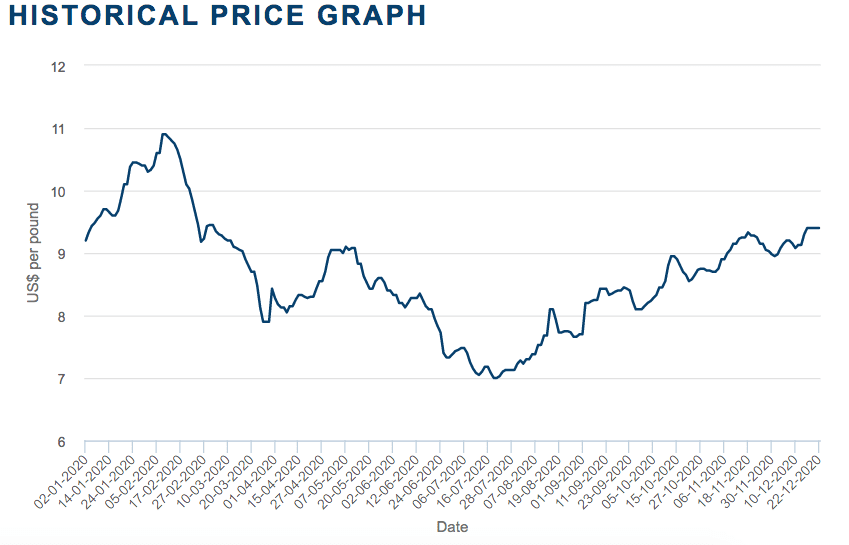

2020 molybdenum price performance. Chart via the

London Metal Exchange

.

Looking over at prices, molybdenum oxide prices fell gradually from their peak in February to their low point in July, according to Roskill data.

“Although such a decline was to be expected given the drop in demand, the recovery in prices since July has been something of a surprise, but it serves to underline the strength in the recovery in Chinese demand,” Mason said.

Jeary agreed, saying the drop in prices was expected given the macro environment and the crash in oil prices, as oil and moly prices have a broad-scale relationship.

“The recovery in the second half of the year has been stronger than anticipated, primarily due to moly consumption in Chinese stainless underpinning domestic prices and western prices following suit.”

Molybdenum outlook 2021: What’s ahead

As the new year kicks off, CRU is forecasting that demand for molybdenum will recover, with better oil prices underpinning demand strength.

“However, we do not expect to return to 2019 demand levels until 2022,” Jeary said.

For his part, Mason said the global economy is expected to recover strongly from the COVID-19 pandemic, which is likely to translate into improved molybdenum demand in 2021.

“In China, stimulus measures have already given demand a boost,” he added.

On the supply side, mine output is expected to have changed little in 2020. For Jeary, there should be fewer large-scale disruptions to mine supply than occurred in 2020.

“However, reduced production guidance at some key operations ― primarily due to lower moly grades year-on-year ― means that mine supply growth will be limited,” he said.

Molybdenum is mined as a by-product of

copper

, and copper miners have prioritized operational activities in 2020. As a result, they have deferred maintenance, sustaining CAPEX and stripping.

“This represents a key disruption risk to potential moly by-product output next year,” Jeary explained.

Download today!

Meanwhile, Roskill is forecasting that mine supply will rise in 2021. “Albeit modestly, thanks to the commissioning of new capacity and better full-year operating rates at some mines,” Mason said.

Overall, Roskill expects the molybdenum market to have been oversupplied in 2020. Demand is expected to recover strongly in 2021, but current expectations are that the market will still be oversupplied, although to a far lesser extent than in 2020.

“Risks to this view include a far stronger recovery in demand than is currently forecast … another risk is on the supply side; currently, Roskill’s base case is that the rise in mine supply in 2021 will be relatively modest,” Mason commented to INN. “Any deviation from the base-case supply forecast will have implications on the market balance.”

According to CRU, recovering demand and limited mine supply growth means that the market will return to deficit next year. “Risks to the forecast include further COVID-19 lockdowns hampering demand recovery,” Jeary said. “The deficit could widen if increased mine disruption occurs or molybdenum grades are lower than currently anticipated.”

When looking at where prices are headed in 2021, Mason said the key factor is whether the level of Chinese imports of roasted and unroasted ores and concentrates is sustained.

“The jump in Chinese ore imports in 2020 was partly to compensate for the decline in domestic mine production; now that the idle Yichun Luming mine has restarted, domestic mine supply will rise,” he said. “If this results in a lower requirement for imported ores, this could put pressure on molybdenum prices, especially if demand outside of China cannot absorb this material.”

For his part, Jeary said CRU is expecting prices to rise in 2021.

“The recovery in demand should support price gains. We may see some sluggishness in Q1 before the Lunar New Year in China, but after that prices should begin to move higher,” he added.

Commenting on what factors investors should keep an eye out for in 2021, Jeary said the oil price is always a good indicator of the longer-term price trend for molybdenum.

“The progress of big copper projects in South America could also be important sources of by-product molybdenum over time,” he added.

Roskill’s Mason also suggested watching oil prices, as any recovery in prices could spur renewed drilling and refining activity, which should translate into increased molybdenum requirements.

Don’t forget to follow us

@INN_Resource

for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Download today!