Taking the next significant step toward mining automation,

Rio Tinto plc Plc

RIO

in partnership with

Caterpillar Inc.

CAT

will deploy the world’s first fully autonomous water truck at its $2.6 billion Gudai-Darri iron ore mine in Western Australia’s Pilbara region. Water spraying is a vital part of mining operations and this new technology will enhance productivity by enabling digital tracking of water consumption, while cutting down water wastage. This marks a significant step in Rio Tinto’s mine automation and digitalization program, and Caterpillar’s efforts in developing autonomous solutions for customers.

The water trucks with 160,000-litre tank capacity have intelligent on-board system, which on detecting dry and dusty conditions on site will trigger the application of water. When a refill is required, the trucks are programed to self-drive to the water stand, park and top-up, and return to the field. Caterpillar’s three water trucks will join Gudai-Darri’s fleet of Caterpillar heavy mobile equipment including autonomous haul trucks and production drills. Rio Tinto intends to make Gudai-Darri one of the world’s most technologically advanced mines. Construction at Gudai-Darri continues to progress with production ramp-up on track for early 2022. Once completed, the mine will have an annual capacity of 43 million tons.

Notably, Rio Tinto’s existing Autonomous Haulage System has improved safety by reducing the risks associated with operators working around heavy machinery. Rio Tinto and other miners are increasingly relying on autonomous systems for haulage and drilling. With the help of technology and automation, miners are bringing radical changes to mining operations to increase productivity, reduce cost and improve frontline safety. The companies are investing in digital initiatives like AI, cloud computing and advanced analytics.

Brazilian miner,

Vale S.A

VALE

has been increasingly embracing the use of robotics and automation. For instance, at its Brucutu Mine, the entire fleet is autonomous, and recently it reached a record of physical use of that fleet. The autonomous operation test for trucks at the Carajás mine in Pará has already begun and implementation is planned for the second quarter of 2021. The company has expanded the use of 25 to 40 autonomous trucks at major underground mines in Sudbury. It is also preparing the infrastructure to enable autonomous underground operation in the Voisey’s Bay and Thompson expansion. Vale recently announced that it will be able to resume operations at its Timbopeba iron ore dry processing plant in the coming months thanks to the use of an unmanned train.

BHP Group

BHP

has been operating a fully-autonomous truck fleet at its Western Australian Jimblebar mine since 2017. The site is now one of the safest operations in its portfolio, with significant events involving trucks at Jimblebar having dropped by more than 90% since the introduction of autonomous haulage. Following its success, BHP announced it would implement an autonomous fleet at its Goonyella Riverside coal mine in Queensland in late 2019. The transition to an autonomous fleet of up to 86 trucks over the next two years is underway and will involve more than 40,000 hours of training delivered to the Goonyella team to develop the competencies required for autonomous operations. Separately, BHP has announced that it will introduce 20 autonomous trucks at its Newman East (Eastern Ridge) mine in Western Australia by the end of this year.

Capitalizing on this increasing demand, the largest global manufacturer of construction and mining equipment, Caterpillar is enhancing its autonomous capabilities and bringing innovative products into markets that provide it with a competitive edge in mining. Recently speaking at Bernstein 37th Annual Strategic Decisions Conference, Caterpillar’s CEO Jim Umpleby pointed toward a “long healthy cycle” in mining and strong commodity prices. Umpleby also highlighted that the energy transition has immense potential for Caterpillar in the long haul. The intensifying global focus on shifting from fossil fuels to zero emissions will require huge amount of commodities. This is a win-win situation for both miners and mining equipment makers.

BHP currently sports a Zacks Rank #1 (Strong Buy), while VALE, Rio Tinto and Caterpillar carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

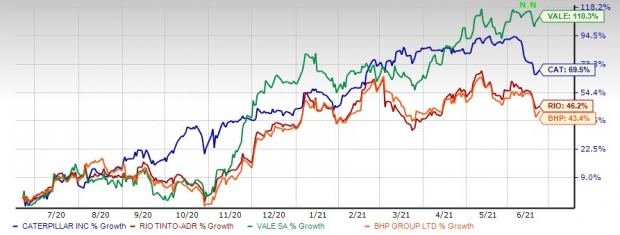

The Zacks Consensus Estimate for BHP’s fiscal 2021 earnings suggests year-over-year growth of 84%. The stock has gained 43% in the past year.

The Zacks Consensus Estimate for Rio Tinto’s fiscal 2021 earnings indicates year-over-year improvement of 41%. The stock has surged 46% in the past year.

The Zacks Consensus Estimate for Vale’s fiscal 2021 earnings suggests year-over-year growth of 138%. The stock has soared 110% in the past year.

The Zacks Consensus Estimate for Caterpillar’s fiscal 2021 earnings indicates year-over-year growth of 46%. The stock has appreciated 69.5% in the past year.

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report