Results include 1.47 g/t Au over 111m, 14.39 g/t Au over 9m, 4.25 g/t Au over 15m

TORONTO, Sept. 08, 2020 (GLOBE NEWSWIRE) — Marathon Gold Corporation (“Marathon” or the “Company”; TSX: MOZ) is pleased to report drill results from recent exploration drilling at the Valentine Gold Project, central Newfoundland (the “Project”). These latest results represent fire assay data from thirteen drill holes completed within the six-kilometre long Sprite Corridor, including the new Berry Zone. Highlights include:

- VL-20-838 intersected 1.47 g/t Au over 111 metres, including 35.02 g/t Au over 1 metre and including 14.92 g/t Au over 2 metres;

- VL-20-839 intersected 14.39 g/t Au over 9 metres, including 60.13 g/t Au over 2 metres, and 4.25 g/t Au over 15 metres, including 13.34 g/t Au over 4 metres;

- VL-20-837 intersected 8.24 g/t Au over 5 metres, including 36.21 g/t Au over 1 metre; and

- VL-20-844 intersected 4.38 g/t Au over 8 metres;

All quoted intersections comprise uncut gold assays in core lengths. All significant assay intervals are reported in Table 1.

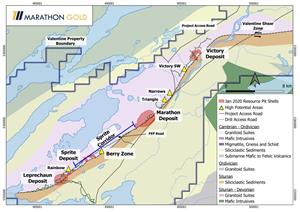

Matt Manson, President & CEO commented: “These most recent assay results from the Valentine Gold Project represent exploration drill holes located both within the new Berry Zone, and step-out holes extending northeastwards towards the Frozen Ear Pond (“FEP”) Road area (Figure 1). Well developed Quartz-Tourmaline-Pyrite-Gold vein mineralization is now being consistently intersected over the 650-metre strike extent of the Berry Zone between sections 13350E and 14000E. We currently have four exploration rigs active at Valentine: the first is conducting exploration step outs toward the FEP Road, moving north-eastwards from Berry; the second is moving south-westwards toward the FEP Road from the margin of the Marathon Deposit; the third is conducting the recently announced 8,000 metre in-fill program at Berry; and a fourth rig has been mobilized to the Narrows prospect, located northeast of the Marathon Deposit, to conduct scout drilling in an area of recent promising trenching results. The 2020 Exploration program at Valentine is discovery-oriented and focused on areas with little previous drilling. The success achieved to date at Berry has allowed us to add an in-fill program aimed at delineating potential mineral resources. We expect to be releasing the results of both the in-fill and greenfield drilling steadily through the fall as it comes available.”

Gold mineralization at the Valentine Gold Project is contained predominantly within shallowly southwest dipping, en-echelon stacked Quartz-Tourmaline-Pyrite-Gold (“QTP-Au”) veins. At the Leprechaun and Marathon Deposits, and at the new Berry Zone, these QTP-Au veins form steeply northwest plunging “Main Zone” envelopes within intrusive host rocks on the hanging-wall (NW) side of the Valentine Lake Shear Zone. The extent of mineralization appears related to the size and frequency of sheared mafic dykes which extend NE-SW within the hanging-wall, parallel to the shear zone.

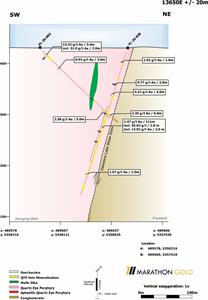

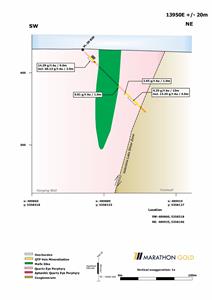

The results released today are derived from drill-holes oriented steeply down through Main Zone QTP-Au stacking towards the northwest (VL-20-837, 838, 841 & 842) and oblique drill-holes oriented across the strike of Main Zone mineralization towards the southeast (VL-20-839, 840, 843, 844, 845, 846, 847, 848 & 849; Figure 2). Four of the thirteen drill holes (VL-20-837, 838, 839 & 842; Figures 3 and 4) are located within the 650-metre long interval between sections 13350E and 14000E where QTP-Au mineralization appears best developed. Overall, eleven of the thirteen drill holes returned “significant” drill intersections of greater than 0.7 g/t Au (Table 1), and twelve of the thirteen drill holes returned drill intersections with gold grades above the 0.3 g/t Au cut-off used in the January 2020 Mineral Resource Estimate for the Project. No “significant” mineralization was encountered in drill holes VL-20-846 and 847.

Table 1: Significant assay intervals, Sprite Corridor, Valentine Gold Project

| DDH | Section | Az | Dip | From | To | Core Length (m) | True Thickness (m) | Gold g/t | Gold g/t (cut) |

| VL-20-837 | 13600E | 343 | -73 | 21 | 22 | 1 | 0.85 | 4.15 | |

| 25 | 26 | 1 | 0.85 | 4.01 | |||||

| 34 | 35 | 1 | 0.85 | 0.71 | |||||

| 40 | 46 | 6 | 5.1 | 1.63 | |||||

| 60 | 65 | 5 | 4.25 | 8.24 | 7.00 | ||||

| Including | 64 | 65 | 1 | 0.85 | 36.21 | 30.00 | |||

| 80 | 81 | 1 | 0.85 | 0.79 | |||||

| 123 | 124 | 1 | 0.85 | 1.11 | |||||

| 132 | 134 | 2 | 1.7 | 2.76 | |||||

| 149 | 152 | 3 | 2.55 | 4.71 | |||||

| 182 | 186 | 4 | 3.4 | 1.11 | |||||

| 241 | 244 | 3 | 2.55 | 2.84 | |||||

| 253 | 254 | 1 | 0.85 | 13.61 | |||||

| 256 | 260 | 4 | 3.4 | 5.67 | |||||

| VL-20-838 | 13650E | 345 | -73 | 30 | 31 | 1 | 0.85 | 1.02 | |

| 75 | 77 | 2 | 1.7 | 0.77 | |||||

| 95 | 99 | 4 | 3.4 | 4.42 | |||||

| 121 | 232 | 111 | 94.35 | 1.47 | 1.43 | ||||

| including | 156 | 157 | 1 | 0.85 | 35.02 | 30.00 | |||

| including | 192 | 194 | 2 | 1.7 | 14.92 | ||||

| 260 | 261 | 1 | 0.85 | 1.7 | |||||

| VL-20-839 | 13950E | 163 | -45 | 12 | 21 | 9 | 6.3 | 14.39 | 7.69 |

| including | 18 | 20 | 2 | 1.4 | 60.13 | 30.00 | |||

| 71 | 72 | 1 | 0.7 | 0.81 | |||||

| 83 | 84 | 1 | 0.7 | 2.65 | |||||

| 90 | 105 | 15 | 10.5 | 4.25 | 3.06 | ||||

| including | 90 | 94 | 4 | 2.8 | 13.35 | 8.89 | |||

| VL-20-840 | 14030E | 163 | -50 | 75 | 76 | 1 | 0.7 | 0.74 | |

| VL-20-841 | 14050E | 345 | -76 | 10 | 11 | 1 | 0.95 | 1.01 | |

| 16 | 17 | 1 | 0.95 | 0.77 | |||||

| 40 | 45 | 5 | 4.75 | 2.57 | |||||

| 83 | 84 | 1 | 0.95 | 3.79 | |||||

| 118 | 120 | 2 | 1.9 | 1.45 | |||||

| 126 | 127 | 1 | 0.95 | 4.08 | |||||

| 132 | 133 | 1 | 0.95 | 0.9 | |||||

| VL-20-842 | 13850E | 342 | -76 | 51 | 52 | 1 | 0.95 | 0.83 | |

| 73 | 75 | 2 | 1.9 | 2.25 | |||||

| 89 | 90 | 1 | 0.95 | 1.43 | |||||

| 98 | 102 | 4 | 3.8 | 1.63 | |||||

| 108 | 109 | 1 | 0.95 | 1.51 | |||||

| 111 | 112 | 1 | 0.95 | 0.84 | |||||

| 113 | 114 | 1 | 0.95 | 1.17 | |||||

| 117 | 121 | 4 | 3.8 | 3.17 | |||||

| 130 | 132 | 2 | 1.9 | 2.03 | |||||

| 138 | 139 | 1 | 0.95 | 0.96 | |||||

| 232 | 233 | 1 | 0.95 | 2.77 | |||||

| 245 | 246 | 1 | 0.95 | 6.37 | |||||

| VL-20-843 | 14100E | 165 | -45 | 67 | 68 | 1 | 0.7 | 0.76 | |

| 69 | 70 | 1 | 0.7 | 1.2 | |||||

| VL-20-844 | 14100E | 164 | -60 | 24 | 25 | 1 | 0.85 | 2.9 | |

| 45 | 53 | 8 | 6.8 | 0.72 | |||||

| 141 | 149 | 8 | 6.8 | 4.38 | |||||

| VL-20-845 | 14150E | 164 | -45 | 51 | 53 | 2 | 1.4 | 2.32 | |

| 63 | 65 | 2 | 1.4 | 1.59 | |||||

| 103 | 105 | 2 | 1.4 | 1.91 | |||||

| VL-20-848 | 14270E | 163 | -45 | 105 | 106 | 1 | 0.7 | 0.79 | |

| VL-20-849 | 14350E | 164 | -69 | 10 | 11 | 1 | 0.85 | 0.96 | |

| 23 | 24 | 1 | 0.85 | 1.66 | |||||

| 94 | 95 | 1 | 0.85 | 13.79 | |||||

| 101 | 102 | 1 | 0.85 | 1.87 | |||||

| 113 | 114 | 1 | 0.85 | 0.85 |

Notes on the Calculation of Assay Intervals

- “Significant” assay intervals are defined as 1m core length or more of mineralization with an average fire assay result of greater than 0.7 g/t Au, representing the bottom cut-off for high-grade mill feed in the Marathon April 2020 Pre-Feasibility Study mine plan (see technical report dated April 21, 2020). Assay intervals with an average fire assay result of between 0.3 g/t Au and 0.7 g/t Au are above the cut-off used in the January 2020 Mineral Resource Estimate for the Project but are not considered “significant” for the purposes of this news release.

- Cut gold grades are calculated at 30 g/t Au.

- No significant assays were returned in drill holes VL-20-846 and 847.

Figure 1: Location Map, Valentine Gold Project is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2e57c3b9-d7ac-4d8d-ae00-035fe75def06

Figure 2: Location of Berry Zone exploration drill hole collars VL-20-837 to VL-20-849 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2c835d12-b1f7-45c2-913b-0d35847f48cd

Figure 3: Cross section 13650E (View NE) Sprite Corridor, Valentine Gold Project is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/26285c28-a855-4ed7-9b55-c9f56d3d438d

Figure 4: Cross section 13950E (View NE) Sprite Corridor, Valentine Gold Project is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7a60b6bc-ab70-4a20-8c84-c54e040c6d18

Qualified Person

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Nicholas Capps, P.Geo. (NL), Project Manager for exploration at the Valentine Gold Project. Exploration data quality assurance and control for Marathon is under the supervision of Jessica Borysenko, P.Geo (NL), GIS Manager for Marathon Gold Corporation. Both Mr. Capps and Ms. Borysenko are qualified persons under National Instrument (“NI”) 43-101.

Quality Assurance-Quality Control (“QA/QC”)

QA/QC protocols followed at the Valentine Gold Project include the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, NL. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.30 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (70 – 95% of core length), and reported with and without a top-cut of 30 g/t Au applied.

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold company advancing its 100%-owned Valentine Gold Project located in the central region of Newfoundland and Labrador, one of the top mining jurisdictions in the world. The Project comprises a series of four mineralized deposits along a 20-kilometre system. An April 2020 Pre-Feasibility Study outlined an open pit mining and conventional milling operation over a twelve-year mine life with a 36% after-tax rate of return. The Project has estimated Proven Mineral Reserves of 1.3 Moz (26.3 Mt at 1.52 g/t) and Probable Mineral Reserves of 0.6 Moz (14.8 Mt at 1.23 g/t). Total Measured Mineral Resources (inclusive of the Mineral Reserves) comprise 1.9 Moz (31.7 Mt at 1.86 g/t) with Indicated Mineral Resources (inclusive of the Mineral Reserves) of 1.19 Moz (23.2 Mt at 1.60 g/t). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Please see the Technical Report dated April 21, 2020 for further details and assumptions relating to the Valentine Gold Project.

For more information, please contact:

| Matt Manson President & CEO Tel: 416 987-0711 mmanson@marathon-gold.com |

Hannes Portmann CFO & Business Development Tel: 416 855-8200 hportmann@marathon-gold.com |

Amanda Mallough Senior Associate, Investor Relations Tel: 416 855-8202 amallough@marathon-gold.com |

To find out more information on Marathon Gold Corporation and the Valentine Gold Project, please visit www.marathon-gold.com.

Cautionary Statement Regarding Forward-Looking Information

Certain information contained in this news release, constitutes forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Marathon expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. More particularly and without restriction, this news release contains forward-looking statements and information about Marathon’s intention to complete the Offering and the timing thereof, economic analyses for the Valentine Gold Project, capital and operating costs, processing and recovery estimates and strategies, future exploration and mine plans, objectives and expectations and corporate planning of Marathon, future feasibility studies and environmental impact statements and the timetable for completion and content thereof and statements as to management’s expectations with respect to, among other things, the matters and activities contemplated in this news release.

Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of mineral resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable mineral reserves.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include receipt of all necessary regulatory approvals, completion of all conditions to closing of the Offering, availability of financing to fund Marathon’s exploration and development activities, the ability of the current exploration program to identify and expand mineral resources, operational risks in exploration and development for gold, Marathon’s ability to realize the pre-feasibility study, delays or changes in plans with respect to exploration or development projects or capital expenditures, uncertainty as to calculation of mineral resources, changes in commodity and power prices, changes in interest and currency exchange rates, the ability to attract and retain qualified personnel, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources), changes in development or mining plans due to changes in logistical, technical or other factors, title defects, government approvals and permits, cost escalation, changes in general economic conditions or conditions in the financial markets, environmental regulation, operating hazards and risks, delays, taxation rules, competition, public health crises such as the COVID-19 pandemic and other uninsurable risks, liquidity risk, share price volatility, dilution and future sales of common shares, aboriginal claims and consultation, cybersecurity threats, climate change, delays and other risks described in Marathon’s documents filed with Canadian securities regulatory authorities.

You can find further information with respect to these and other risks in Marathon’s Amended and Restated Annual Information Form for the year ended December 31, 2019 and other filings made with Canadian securities regulatory authorities available at www.sedar.com. Other than as specifically required by law, Marathon undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise.