Kirkland Lake Gold Ltd.

KL

reported net earnings of $224.2 million or 91 cents per share in second-quarter 2021 compared with $150.2 million or 54 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 92 cents that topped the Zacks Consensus Estimate of 85 cents.

The company recorded revenues of $662.7 million, up 14% year over year. The figure was in-line with the Zacks Consensus Estimate.

Operational Highlights

Total gold production was 379,195 ounces in the quarter, up 15% year over year. Average realized price of gold was $1,814 per ounce, up 5.7% year over year.

Operating cash costs per ounce for gold rose 15.2% year over year to $431. All-in sustaining costs (AISC) for gold increased 3.9% year over year to $780 per ounce in the quarter.

Financial Position

At the end of the second quarter 2021, Kirkland Lake Gold had cash and cash equivalents of $858.4 million compared with $792.2 million as of Mar 31, 2021.

Net cash provided by operating activities increased 49% year over year to $330.6 million in the quarter.

Guidance

For 2021, the company expects total gold production between 1,300,000 ounces and 1,400,000 ounces. AISC for gold is expected between $790 and $810 per ounce for 2021. Operating cash costs per ounce sold is projected in the range of $450-$475.

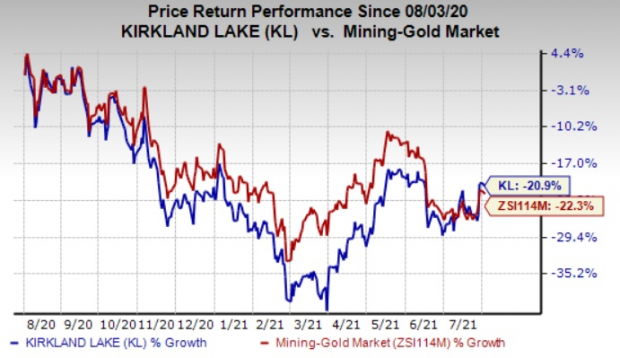

Price Performance

Shares of Kirkland Lake Gold have declined 20.9% in the past year against 22.3% fall of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Kirkland Lake Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

Dow Inc.

DOW

and

Cabot Corporation

CBT

.

Nucor has a projected earnings growth rate of around 444.9% for the current year. The company’s shares have surged 137.3% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Dow has an expected earnings growth rate of around 403.01% for the current year. The company’s shares have gained 48.2% in the past year. It currently carries a Zacks Rank #2.

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 44.9% in the past year. It currently holds a Zacks Rank #2.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report