Kinross Gold Corporation

KGC

recently inked a definitive agreement with the government of Mauritania to provide enhanced certainty on Tasiast economics.

The agreement includes key terms such as continuation of tax exemptions on fuel duties, repayment of roughly $40 million to Kinross by the government in outstanding VAT refunds and payment of $10 million to the government by the company to resolve disputed matters.

It also introduces an updated escalating royalty structure linked to the gold price that aligns with current Mauritanian mining legislation and is comparable to other royalties in the region. The agreement also states the nomination of two observers by the government to the board of the Kinross subsidiary operating the Tasiast mine.

Kinross and the government are focused on resuming milling operations at Tasiast as well as prioritizing efforts and processes to achieve this shared objective.

The government noted that the completion of this deal is a testament to the quality of the strategic alliance between the Mauritania government and Kinross. The deal also reflects on the government’s commitment and focus on attracting responsible, experienced and long-term private sector partners in Mauritania to execute projects that advance the country’s development and provide benefits to its people.

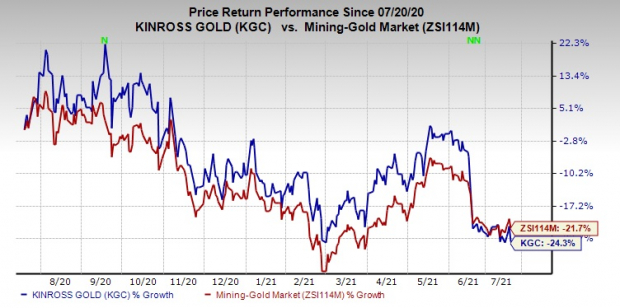

Shares of Kinross have declined 24.3% in the past year compared with 21.7% fall of the

industry

.

Image Source: Zacks Investment Research

Kinross, last month, lowered its 2021 production guidance to 2.1 million gold equivalent ounces, compared with 2.4 million gold equivalent ounces it projected earlier on Feb 10, 2021. Kinross’ annual production outlook for 2022 and 2023 is pegged at 2.7 million and 2.9 million gold equivalent ounces, respectively.

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

Olin Corporation

OLN

and

Cabot Corporation

CBT

.

Nucor has a projected earnings growth rate of around 403% for the current year. The company’s shares have surged 126.1% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 523.7% for the current year. The company’s shares have skyrocketed 264.1% in the past year. It currently sports a Zacks Rank #2 (Buy).

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 43.6% in the past year. It currently flaunts a Zacks Rank #1.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report