Kinross Gold Corporation

KGC

logged a net loss of $2.7 million per share in fourth-quarter 2021 against a profit of $783.3 million or 62 cents reported in the year-ago quarter.

Barring one-time items, adjusted earnings came in at 8 cents per share that topped the Zacks Consensus Estimate of 6 cents.

Revenues declined 26.4% year over year to $879.5 million. The top line missed the Zacks Consensus Estimate of $917.1 million.

Operational Performance

Attributable gold equivalent ounces produced in the reported quarter totaled 487,621 ounces, down 21.9% year over year. The downside was mainly due to lower production at Tasiast and Round Mountain.

Average realized gold prices were $1,797 per ounce in the quarter, down 4.2% from the year-ago quarter’s figure.

The production cost of sales per gold equivalent ounce was $864 in the quarter, up from $682 in the prior-year quarter. All-in sustaining cost per gold equivalent ounce sold rose 29.5% year over year to $1,312.

Margin per gold equivalent ounce sold was $929 in the quarter, down from the prior-year quarter’s level of $1,190.

FY21 Results

Earnings (as reported) for full-year 2021 were 17 cents per share compared with earnings of $1.06 per share a year ago. Net sales declined 11.5% year over year to around $3,729.4 million.

Financial Review

Adjusted operating cash flow declined 32.5% year over year in the fourth quarter to $356 million. Cash and cash equivalents were $531.5 million as of Dec 31 compared with $1,210.9 million as of Dec 31, 2020.

Long-term debt was $1,589.9 million at the end of the year, up 11.6% from $1424.2 million as of Dec 31, 2020.

Outlook

For 2022, Kinross expects to produce 2.65 million (+/- 5%) gold equivalent ounces. It expects a production cost of sales of $830 per gold equivalent ounce.

All-in sustaining cost per ounce for 2022 is projected at $1,130. Capital expenditures are predicted at around $1,050 million (+/- 5%) for this year.

In 2023 and 2024, the company expects capital expenditures to be $1 billion, in-line with 2022 levels.

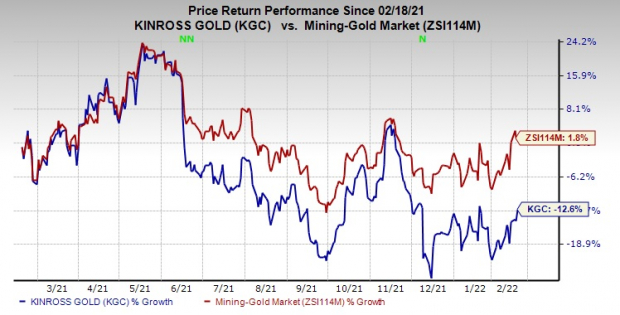

Price Performance

Shares of Kinross have declined 12.6% in the past year compared with a 1.8% rise of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Albemarle Corporation

ALB

,

Nutrien Ltd.

NTR

and

AdvanSix Inc.

ASIX

.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 56.2% for the current year. The Zacks Consensus Estimate for ALB’s earnings for the current year has been revised 8.9% upward in the past 60 days. You can see

the complete list of today’s Zacks #1 Rankstocks here.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 22.1%. ALB has rallied around 73.9% over a year.

Nutrien, sporting a Zacks Rank #1, has a projected earnings growth rate of 55.8% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 13.2% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missing once. It has a trailing four-quarter earnings surprise of roughly 73.5%, on average. NTR has rallied around 35.2% in a year.

AdvanSix has a projected earnings growth rate of 7.4% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 5.3% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has surged 55.6% over a year. The company carries a Zacks Rank #2 (Buy).

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report