Kinross Gold Corporation

KGC

recently completed the sale of 100% of its Russian assets to the Highland Gold Mining group of companies for total cash consideration of $340 million. The company received $300 million in U.S. denominated cash in its corporate account and will receive a deferred payment of $40 million after a year of closing.

The earlier-agreed total consideration for the transaction was $680 million, which included a payment of $100 million upon closing, with the balance of $580 million scheduled to be received in annual payments from 2023 through to 2027. The transaction amount was adjusted by the parties following a review by the recently-formed Russian Sub-commission on the Control of Foreign Investments. The commission approved this deal for a purchase price of less than $340 million. With the approval and completion of the sale, Kinross sold all of its interests in Russia and has no further obligations or liabilities in the country.

Kinross stated that after the divestment of its Russian business, the rebalanced portfolio retains a substantial production outlook led by its two tier-one assets (Tasiast and Paracatu), a strong portfolio of mines in the Americas, a growing business in Chile, and the large, world-class Great Bear project in Canada.

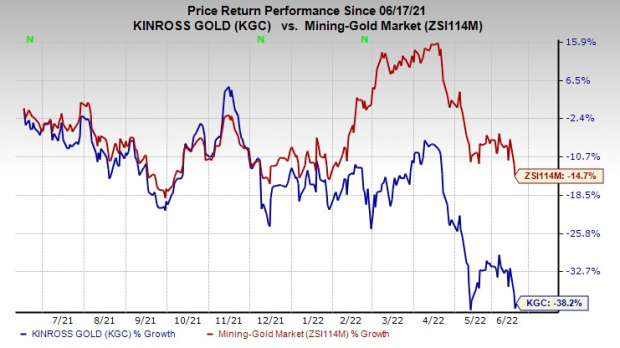

Shares of KGC have declined 38.2% in the past year compared with 14.7% decline of the

industry

.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it expects to produce 2.15 million (+/- 5%) gold equivalent ounces in 2022. It expects a production cost of sales of $830 per gold equivalent ounce.

All-in sustaining cost per ounce for 2022 is projected at $1,150. Capital expenditures are predicted at around $850 million (+/- 5%) for this year, down from $1,050 million as expected earlier.

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Inc.

ATI

,

Cabot Corporation

CBT

and

Nutrien Ltd.

NTR

.

Allegheny has a projected earnings growth rate of 1,030.8% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 40% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI has gained around 7.6% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Cabot, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 29.5% for the current year. The Zacks Consensus Estimate for CBT’s earnings for the current year has been revised 12.1% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 17.2% over a year.

Nutrien has a projected earnings growth rate of 174.6% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 30.7% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 5.8%. NTR has gained 48.5% in a year. The company flaunts a Zacks Rank #1.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report