Kinross Gold Corporation

KGC

recently announced a new $1 billion term loan. The three-year term loan will mature on Mar 7, 2025. It has a flexible repayment schedule and no mandatory amortization repayments.

The funds from this loan were utilized by the company to repay amounts drawn under its $1.5 billion revolving credit facility in relation to the completion of its acquisition of Great Bear Resources Ltd. The joint lead arrangers were The Bank of Nova Scotia, HSBC Bank Canada and RBC Capital Markets.

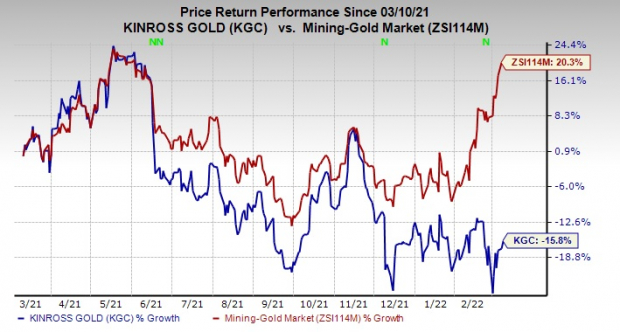

Shares of KGC have declined 15.8% in the past year against a 20.3% increase of the

industry

.

Image Source: Zacks Investment Research

Kinross ended 2021 with cash and cash equivalents of $531.5 million, down around 56% year over year. Long-term debt was $1,589.9 million at the end of the year, up 11.6% year over year.

The company’s attributable gold equivalent ounces produced in the fourth quarter totaled 487,621 ounces, down 21.9% year over year. The downside was primarily due to lower production at Tasiast and Round Mountain.

The company, in its fourth-quarter call, stated that it expects to produce 2.65 million (+/- 5%) gold equivalent ounces for 2022. KGC anticipates production cost of sales of $830 per gold equivalent ounce.

All-in sustaining cost per ounce for 2022 is projected at $1,130. Capital expenditures are predicted at around $1,050 million (+/- 5%) for this year.

In 2023 and 2024, the company expects capital expenditures to be $1 billion, in line with 2022 levels.

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Incorporated

ATI

,

The Mosaic Company

MOS

and

AdvanSix Inc.

ASIX

.

Allegheny, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s earnings for the current year has been revised 45.6% upward in the past 60 days. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 19.5% over a year.

Mosaic, sporting a Zacks Rank #1, has a projected earnings growth rate of 106.4% for the current year. The Zacks Consensus Estimate for MOS’s current-year earnings has been revised 22.2% upward in the past 60 days.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters, while missing once. It has a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 76% in a year.

AdvanSix has a projected earnings growth rate of 17.3% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 12.4% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 12.4%. ASIX has surged 40.8% in a year. The company carries a Zacks Rank #2.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report