Iron ore prices have plunged below $100 a ton for the first time since July 2020, as China — the world’s biggest steelmaker — intensified curbs on steel production to lower carbon emissions. Signs of a slowdown across China’s property sector have also acted as a drag on the main steel-making ingredient. Iron ore prices have more than halved from the record $230 per ton attained in May this year. It has lost 34% so far in 2021.

China’s Curb on Steel Output Weighs on Iron

The slump in iron ore makes it one of the worst-performing major commodities this year. This is in sharp contrast to the solid run it had last year, logging a solid gain of 80%. A combination of China’s massive infrastructure stimulus to recover from the pandemic-induced slump, which fueled demand for iron ore, and supply concerns in Brazil due to the coronavirus pandemic drove the prices up. After hitting the record high of $230 earlier this year, iron ore prices started losing steam as China clamped down on the steel industry, which given its high energy consumption and outdated technology and equipment, is one of the biggest contributors to pollution in the country. China has thus repeatedly urged steel mills to reduce output this year to curb carbon emissions.

China remains committed to its pledge reach carbon neutrality by 2060. The country intends to step up its production curbs in a bid to reduce pollution and ensure clearer air for the Winter Olympics coming up in February 2022. This is going to weigh on iron ore demand for the balance of the year.

Per the National Bureau of Statistics of China, the monthly crude steel production in the country was down 13.2% year over year, slipping for the third straight month to 83.24 million tons in August. Average daily output is at the lowest since March 2020. This reflects the impact of the implementation of production restrictions at steel mills.

China’s Property Sector Slowdown Hurts Further

Signs of a slowdown across China’s property sector have hit iron ore prices. The country’s property investment in August rose a meager 0.3% from a year ago — the slowest pace in 18 months. It is lower than the rise of 1.4% in July, reflecting the tighter financing conditions. China’s new home prices rose at their slowest pace in months, as authorities tried to rein in a red-hot property market, and cooling measures were expected to limit home price growth going forward. China’s property market is also grappling with problems at its second-largest property developer, Evergrande Group. It is currently the world’s most indebted property developer, owing more than $300 billion in liabilities and nearing a possible default for an interest payment this week.

China Evergrande’s Hong Kong-listed shares fell 10.24% on Sep 17, which underscored concerns about the broader health of China’s real estate sector and triggered a wider sell-off.

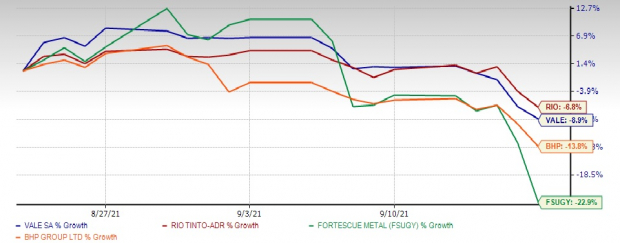

Image Source: Zacks Investment Research

Owing to the plunge in iron ore prices, iron ore producers including

Rio Tinto plc

RIO

,

BHP Group

BHP

,

Vale S.A.

VALE

and

Fortescue Metals Group Ltd.

FSUGY

have seen their shares tumble 6.8% 13.8%, 8.9% and 22.9%, respectively, over the past month. All of these stocks carry a Zacks Rank #5 (Strong Sell) currently. Lower iron ore prices are expected to impact their results in the ongoing quarter.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Neverthless, these miners will benefit from demand in rest of the world. The steel industry is showing promise as demand remains robust across construction and manufacturing sectors across rest of the world. Steel prices continue to race ahead, buoyed by an upturn in demand across key markets, tight supply conditions and low steel inventory throughout the supply chain.

The World Steel Association projects steel demand to grow 5.8% in 2021 and reach 1,874 million. In 2022, steel demand is expected to go up 2.7% to reach 1,924.6 Mt. In China, steel demand is expected to grow 3.0% in 2021 but will decline 1% in 2022 due to the intensified environmental push. Meanwhile, steel demand will go up 8.2% and 4.2% in 2021 and 2022, respectively, in advanced economies. The ongoing recovery in automotive and construction sectors worldwide will drive demand for steel. In the United States, massive government spending to rebuild infrastructure including railroads, highways and bridges will significantly boost steel demand, thus fueling the need for iron ore.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report