B2Gold Corp.

BTG

is gaining from solid performance across its operating mines as well as its focus on mine expansions and exploration activities. The company’s strong financial position, stellar operational performance and current higher gold prices are likely to drive growth.

The company currently carries a Zacks Rank #3 (Hold) and has a

VGM Score

of A. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) 2 (Buy) or 3, offer the best investment opportunities. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Valuation is Inexpensive

The trailing 12-month EV/EBITDA ratio is 4.2 for the company, while the industry’s average trailing 12-month EV/EBITDA ratio is 6.1.

Superior Return on Assets

B2Gold currently has a Return on Assets (ROA) of 12.4%, higher than the industry’s 5.3%. An above-average ROA denotes that the company is generating earnings by effectively managing its assets.

Growth Drivers in Place

B2Gold is focused on achieving impressive operational and financial performance from existing mines and expanding the Fekola Mine throughput and annual gold production. The mine continued its solid operating performance in third-quarter 2021. During the reported quarter, the company increased throughput at the Fekola mill and completed the significant waste-stripping campaigns related to the development of Phases 5 and 6 of the Fekola Pit. Mining reached the higher-grade zones in Phase 5 of the Fekola Pit in the quarter. The mill now has the potential to run at an annualized throughput rate of 8.3 Mtpa (Million Tons Per Annum). B2Gold expects production between 560,000 ounces and 570,000 ounces of gold in 2021.

At Otjikoto mine, B2Gold completed the waste-stripping campaigns at the Wolfshag and Otjikoto pits. Gold production increased as mining reached the higher-grade zone at the base of the Wolfshag Pit during the third quarter. Development of the Wolfs hag underground mine continues to progress well, with stope ore production expected to commence in early 2022. The mine is on track to produce between 190,000 and 200,000 ounces of gold in the current year.

Also, B2Gold’s Colombia-based Gramalote joint-venture (JV) project will be a growth driver as it has the potential to become a large, low-cost open-pit gold mine. The partners are evaluating different project-optimization opportunities to reduce capital and operating costs as well as improve the operability and sustainability of the project. The company is committed toward advancing the scope of planned feasibility study work, which will enable the final feasibility study to be completed by the end of second-quarter 2022.

In 2021, B2Gold expects to generate operating cash flows of around $630 million, assuming gold price of $1,800 per ounce. The company aims to reduce debt levels, backed by its strong cash position. Management is planning heavy exploration this year with an approximately $66-million budget, including a record $25 million allocated to high-quality targets for the company’s ongoing grassroot exploration programs.

B2Gold achieved solid performances across its Fekola, Masbate and Otjikoto mine operations during the third quarter. Fekola and Otjikoto attained record quarterly gold production during the quarter. Given the strong production so far this year, B2Gold increased the current-year total gold production guidance to 1,015,000-1,055,000 ounces from the prior range of 970,000-1,030,000 ounces. It produced 1,040,737 ounces of gold in 2020.

The company is bearing the brunt of inflationary cost pressure across all sites, which is impacting the input prices of reagents, fuel and consumables. Volatility in gold prices is a concern.

Bottom Line

Investors might want to hold on to the stock, at present, owing to the prospect of outperforming peers in the near future.

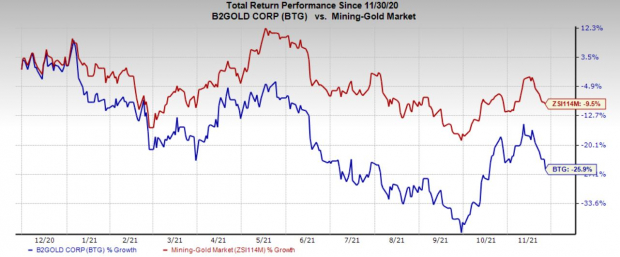

Price Performance

The stock has depreciated 25.9% in the past year compared with the

industry

’s decline of 9.5%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the basic materials space are

Olin Corporation

OLN

,

Bunge Limited

BG

and

Nucor Corporation

NUE

. While Olin and Bunge flaunt a Zacks Rank #1, Nucor carries a Zacks Rank #2.

Olin’s third-quarter 2021 adjusted earnings beat the Zacks Consensus Estimate, while revenues missed the same. It has an expected earnings growth rate of around 740% for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has been revised 20.5% upward in the past 60 days.

Olin’s shares have surged 229% in the past year. The company has a long-term earnings growth of 56%.

Bunge’s third-quarter 2021 earnings and sales beat the respective Zacks Consensus Estimate. It has a trailing four-quarter earnings surprise of 105.7%, on average. The company has an estimated earnings growth rate of around 45% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 36%.

Bunge’s shares have appreciated 60% in the past year. It has a long-term earnings growth of 12.6%.

Nucor’s third-quarter adjusted earnings missed the Zacks Consensus Estimate, while sales beat the same. It has a trailing four-quarter earnings surprise of 2.74%, on average.

Nucor has a projected earnings growth rate of around 583% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 18.1% in the past 60 days. The company’s shares have soared 128% in a year.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report