Teck Resources Ltd

TECK

is poised to gain from its cost-reduction initiatives, solid project pipelines and an innovation-driven efficiency program. Improvement in metals and crude prices will also drive growth. However, uncertainties related to the extent and impact of the coronavirus pandemic on demand as well as on commodity prices, suppliers and global financial markets are concerns.

Teck currently carries a Zacks Rank #3 (Hold). It has a

VGM Score

of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3, offer the best investment opportunities for investors. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Q1 Earnings Top Estimates:

Teck reported adjusted earnings of 48 cents per share in the March-end quarter, beating the Zacks Consensus Estimate of 43 cents. The bottom line also improved from the prior-year quarter’s earnings of 13 cents per share, driven by higher prices of its principal products, most significantly copper, zinc and blended bitumen.

The company has a trailing four-quarter average earnings surprise of 133.6%.

Underpriced:

Looking at Teck’s price-to-earnings ratio, its shares are underpriced at the current level, which seems attractive for investors. The company has a trailing P/E ratio of 21.9, which is lower than the industry average of 45.9.

Positive Earnings Estimates:

Teck’s earnings estimate for the current year is currently pegged at $2.08 per share, suggesting a year-over-year surge of 166.7%.

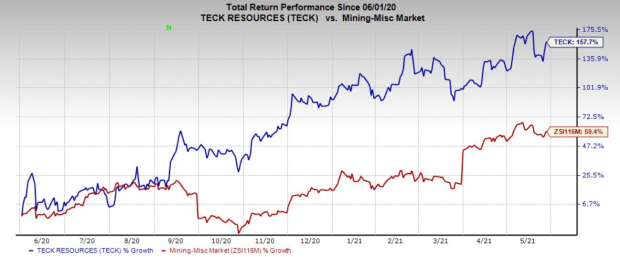

Price Performance

Teck’s shares have appreciated 157.7% over the past year, outperforming the

industry

’s growth of 59.4%.

Image Source: Zacks Investment Research

Growth Drivers in Place

Teck is poised to gain from the Neptune Bulk Terminals facility upgrade project, which is now in the commissioning phase and ramp-up will continue as planned. The project will strengthen the steelmaking coal-supply chain, and meet the long-term requirements of customers for consistent, high-quality products. The first steelmaking coal production through this upgraded facility is anticipated in the current quarter. The company projects steelmaking coal production between 25.5 million tons and 26.5 million tons in 2021.

Demand for steelmaking coal continues to recover from the impact of the pandemic. The company targets 7.5 million tons steelmaking coal sales to China in 2021, in a bid to capitalize on the increase in demand due to restrictions on Australian coal imports.

Construction activities at the QB2 copper project surpassed the half-way point in April. The first production from this project is targeted for second-quarter 2022. Once completed, QB2 will transform the company’s copper business, making it a major global copper producer. Copper production from Highland Valley Copper and Antamina mine continues to be higher in the ongoing quarter as a result of higher copper grades. Copper production for 2021 is expected in the range of 275,000 to 290,000 tons. The company produced 275.7 tons of copper in 2020.

The refined copper market improved during the first quarter, with higher copper prices through the quarter. The recovery in copper price is the result of Chinese government stimulus measures, increased infrastructure spending and improved manufacturing activities in China. Apart from this, zinc and crude oil prices continue to strengthen, supported by improved global demand.

Teck has implemented a cost-reduction program to lower its operating costs, and deferred some of the planned capital projects in a bid to counter the uncertain economic conditions. Moreover, Teck continues to implement its innovation-driven efficiency program — RACE21 — that is expected to boost productivity across the business.

Few Headwinds to Counter

Teck’s current-year guidance reflects uncertainties related to the extent and impact of the pandemic on demand as well as on commodity prices, suppliers and global financial markets. The company’s QB2 project will be likely be unfavorably impacted due to worsening of the COVID-19 situation in Chile.

Moreover, copper production from Andacollo mine and Quebrada Blanca might be lower this year due to lower copper grades. Zinc production is also projected to be bleak due to maintenance and water-related challenges in 2020.

Bottom Line

Investors might want to hold on to the stock, at present, as it has ample prospects for outperforming peers in the near future.

Stocks to Consider

Better-ranked stocks in the basic materials space include

ArcelorMittal

MT

,

Cabot Corporation

CBT

and

Dow Inc.

DOW

. All of these stocks flaunt a Zacks Rank #1, currently.

ArcelorMittal has a projected earnings growth rate of 984.7% for the current fiscal year. The company’s shares have soared nearly 179% in the past year.

Cabot has an expected earnings growth rate of 125.9% for the current fiscal year. The company’s shares have rallied around 79.4% over the past year.

Dow has an estimated earnings growth rate of 261.6% for the current fiscal year. The company’s shares have gained roughly 75% in a year’s time.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report