Southern Copper Corporation

‘s

SCCO

solid copper reserves, high-quality, world-class assets in investment-grade countries, such as Mexico and Peru, its commitment to increase low-cost production, growth investments, and estimate revision activity make it a good investment choice.

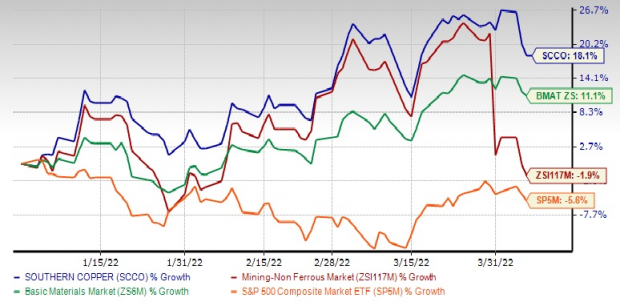

Zacks Rank & Price Performance

Southern Copper currently has a Zacks Rank #2 (Buy) and a

VGM Score

of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Year to date, the stock has gained 18.1%, against the

industry

‘s decline of 1.9%. It has outperformed the

Basic Materials

sector’s growth of 11.1% in the same time frame. Meanwhile, the S&P 500 composite index has lost 5.6%.

Image Source: Zacks Investment Research

The company has delivered earnings growth of 31.3% in the past five years, ahead of the industry’s 13.5%. The long-term earnings growth rate is currently pegged at 7.7%.

Northbound Estimate Revision

: The Zacks Consensus Estimate for 2022 and 2023 earnings has moved north by 4% and 14%, respectively, in the past 30 days, reflecting analyst optimism.

Earnings Surprise History

: The company has a trailing four-quarter earnings surprise of 3.2%, on average.

Return on Equity (ROE)

: Southern Copper’s trailing 12-month ROE of 42.6% reinforces its growth potential. The company’s ROE is higher than the industry’s ROE of 23.3%, highlighting its efficiency in utilizing shareholders’ funds.

Growth Drivers

Southern Copper boasts the largest copper reserves in the industry and operates high-quality, world-class assets in investment-grade countries, such as Mexico and Peru. Backed by its constant commitment to increasing low-cost production and growth investments, the company is well-poised to continue delivering enhanced performance. Including the Michiquillay ($2.5 billion) and Los Chancas ($2.6 billion) projects, its total investment program in Peru runs to $7.9 billion. Peru is currently the second-largest producer of copper globally and holds 13% of the world’s copper reserves. Michiquillay is expected to become one of Peru’s largest copper mines and will produce 225,000 tons of copper per year (along with by-products of molybdenum, gold and silver) for an initial mine life of more than 25 years and at a competitive cash cost.

In Mexico, the company has a total planned investment of $413 million (so far, invested $217 million in this project) in the Buenavista Zinc – Sonora project. It is expected to be completed in 2023 and will double the company’s zinc production capacity.

In 2021, Southern Copper delivered record highs for sales, net income and adjusted EBITDA. Net sales increased on the back of higher prices for all its main products — copper, molybdenum, zinc and silver. Higher sales and gains from its strict cost control measures helped offset increases in costs, which led to an improved net income. Copper prices have been gaining this year on supply concerns from top producer Chile, disruptions caused by the war in Ukraine, and the impact of the latest Covid outbreak in China. Supply disruptions due to prolonged high energy prices have led to a surge in zinc prices. Higher metal prices are likely to support results this year as well.

The company had a cash balance of around $3 billion as of Dec 31, 2021. Its cash balance has witnessed a CAGR of 30% over the past five years. Southern Copper’s total debt-to-total capital ratio was at 0.44 as of Dec 31, 2021, down from 0.47 as of Dec 31, 2020. Last year, its board of directors hiked its quarterly dividend by 29% to 90 cents per share. The company’s dividend yield is at 5.49%, higher than the industry’s 2.54% and the S&P 500’s 1.33%. Backed by its significant cash generation capability, Southern Copper continues to focus on developing projects that will maintain the company’s characteristics of being a low-cost copper producer. It has a strong pipeline of world-class copper greenfield projects and several other opportunities.

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space include

The Mosaic Company

MOS

,

AdvanSix Inc.

ASIX

and

Allegheny Technologies Incorporated

ATI

.

Mosaic has a projected earnings growth rate of 125% for the current year. The Zacks Consensus Estimate for MOS’ current-year earnings has been revised upward by 33.3% in the past 60 days.

Mosaic’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 3.7%. MOS has rallied around 116% so far this year. It currently sports a Zacks Rank #1.

AdvanSix has a projected earnings growth rate of 64.8% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised upward by 58% in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 23.6%. ASIX has gained 3% year to date. The company flaunts a Zacks Rank #1.

Allegheny, currently carrying a Zacks Rank #2, has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 127.2%. Year to date, ATI has rallied around 74%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report