GrowGeneration Corp.

GRWG

reported a loss per share of 7 cents in the fourth quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 8 cents per share. The company had reported earnings per share of 3 cents in the fourth quarter of 2020. The quarterly results reflect the ongoing weakness in the cannabis industry. The supply/demand imbalance in California and other Western states caused by the tremendous oversupply of outdoor cannabis has put pressure on cannabis pricing. Also, slower-than-expected federal legalization has been weighing on the industry.

GrowGeneration generated revenues of $91 million in fourth-quarter 2021, which improved 46% year over year. The top line surpassed the Zacks Consensus Estimate of $89.2 million. Comparable store sales in the quarter declined 12.3% from the prior year.

E-commerce revenues, including Agron revenues, in the quarter under review were $7.7 million, up from $3.2 million in the last-year quarter. Private label and proprietary products contributed around 7.5% to overall sales in the fourth quarter compared with 0.5% in the prior-year quarter.

Cost of sales surged 47% year on year to $67.5 million in the quarter. Gross profit gained 45% year over year to $23 million, driven by higher revenues. Gross margin was 25.5% in the fourth quarter, a 30 basis point contraction year over year.

Store operating costs were $14 million compared with $6 million witnessed in the prior-year quarter. Selling, general, and administrative expenses soared 101% to around 12 million in the quarter under review. Adjusted EBITDA was a loss of $1.9 million in the reported quarter against the prior-year quarter’s positive $5.5 million.

Financial Position

At the end of 2021, GrowGeneration had cash and cash equivalents of $41.4 million compared to $178 million at the end of 2020. GRWG had $39.8 million of marketable securities. Long-term debt was $66 million as of Dec 31, 2021, down from $158 million as of Dec 31, 2020.

Acquisition Activity

GrowGeneration purchased the assets of Indoor Store, LLC (All Seasons Gardening), an indoor-outdoor garden supply center specializing in hydroponics systems, lighting, and nutrients, in October 2021. All Seasons Gardening is the largest hydroponics retailer in New Mexico.

On Dec 31, 2021, GRWG purchased the assets of Mobile Media, Inc and MMI Agriculture, a mobile shelving facility. On Jan 31, 2022, the company completed the acquisition of Horticultural Rep Group, a specialty marketing and sales organization of horticultural products based in Ogden, UT.

2021 Results

GrowGeneration’s earnings per share in 2021 was 21 cents, beating the Zacks Consensus Estimate of 20 cents. Sales soared 119% year over year to $422.5 billion, which surpassed the Zacks Consensus Estimate of $421 billion.

2022 Guidance

GrowGeneration provided revenue guidance for 2022 between $415 million and $445 million. Full-year adjusted EBITDA guidance is expected in the range of $30 million to $35 million. GRWG expects to open 15 to 20 locations this year. The company currently has 63 locations across 13 states.

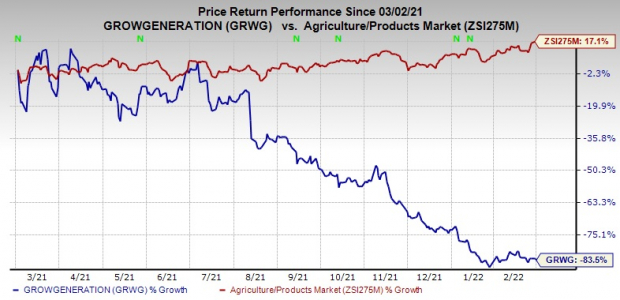

Price Performance

Image Source: Zacks Investment Research

In the past year, GrowGeneration’s shares have fallen 83.5% against the

industry

’s rally of 17.1%.

Zacks Rank & Stocks to Consider

GrowGeneration currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space include

Teck Resources

TECK

,

Cabot Corporation

CBT

and

Allegheny Technologies Incorporated

ATI

. All of these stocks carry a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Teck Resources has a projected earnings growth rate of 21.5% for the current fiscal year. The Zacks Consensus Estimate for TECK’s current fiscal year earnings has been revised upward by 28% in the past 60 days.

Teck Resources beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 13%. TECK’s shares have surged around 74% in a year.

Cabot has a projected earnings growth rate of 7.6% for the current year. The Zacks Consensus Estimate for CBT’s current-year earnings has been revised upward by 8% in the past 60 days.

Cabot beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 21.6%. CBT has rallied around 43% in a year.

Allegheny has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised upward by 46% in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 127.2%. ATI has appreciated around 26% over a year.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report