Great Panther Mining Limited

GPL

recently announced that it has entered into an agreement with Guanajuato Silver Company Ltd. to sell 100% of its subsidiary Minera Mexicana El Rosario S.A. de C.V. (“MMR”), which comprises the Guanajuato Mine Complex, the Topia mine, and the El Horcón and Santa Rosa projects in Mexico. This is a strategic transaction for GPL as it marks an important step toward becoming a gold company focused on maximizing the potential of the Tucano Gold Mine. By divesting its assets in Mexico, the company intends to pursue growth opportunities in Brazil.

The sale of the silver mines in Mexico will enable Great Panther to focus on maximizing the full potential of the Tucano Gold Mine in Brazil. According to the company, the mine has the greatest value creation potential for its stakeholders. GPL intends to continue investing in unlocking value from both the underground as well as the regional potential of the district. The company’s long-term objective is to expand further in Brazil, and divesting the Mexican silver assets will help it achieve these goals.

Per the agreement, Guanajuato Silver will purchase MMR for a total upfront consideration of $14.7 million and up to $2 million in additional payments.

Last month, Great Panther reported an adjusted loss per share of 2 cents in first-quarter 2022 against earnings of 1 cent per share in the year-ago quarter. Lower metal sales volumes due to decreased production, offset partially by higher realized prices for gold, lead and zinc, led to the loss.

Great Panther produced 17,913 gold-equivalent ounces in the first quarter of 2022, 41% lower than the year-ago quarter due to lesser output at the Tucano mine in Brazil and the Topia mine in Mexico. The figure included 14,319 ounces of gold and 173,698 silver ounces.

The company stated that it remains on track to return to a normalized production rate in the second half of the year and affirmed its consolidated production guidance at 100,000-119,000 gold-equivalent ounces for 2022. In the second half of 2022, Tucano is expected to contribute at least 65% to the guidance. Significant stripping activity and low production of gold ounces in the quarter resulted in higher unit costs compared with the prior-year quarter. However, these costs are anticipated to normalize in the second half of 2022.

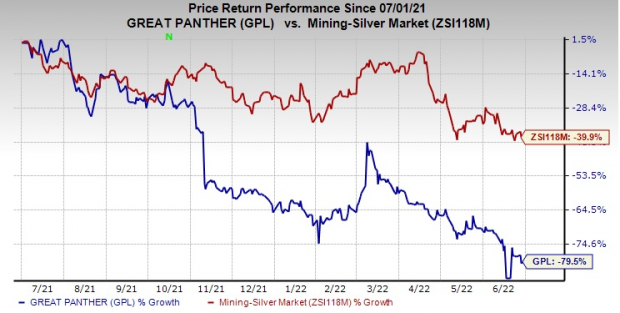

Share Price Performance

Image Source: Zacks Investment Research

The company’s shares have plunged 79.5% in a year compared with the

industry

’s decline of 39.9%.

Zacks Rank & Stocks to Consider

Great Panther currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Inc.

ATI

,

Nutrien Ltd

NTR

and

Albemarle Corporation

ALB

, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Allegheny has a projected earnings growth rate of 869.2% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 27.3% upward in the past 60 days.

Allegheny has a trailing four-quarter earnings surprise of 128.9%, on average. ATI has gained 6% in a year.

Nutrien has a projected earnings growth rate of 163.2% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 27.5% upward in the past 60 days.

Nutrien has a trailing four-quarter earnings surprise of 5.8%, on average. NTR has surged 34% in a year.

Albemarle has a projected earnings growth rate of 203.7% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 100.4% upward in the past 60 days.

Albemarle has a trailing four-quarter earnings surprise of 22.5%, on average. ALB has appreciated 23% in a year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report