Click here

to read the previous gold price update.

2021’s third quarter saw gold stabilize in the US$1,700 to US$1,827 per ounce range after six months of volatility.

The yellow metal entered July at US$1,787.30 and shed 1.68 percent by the end of September to sit at US$1,757.20.

A 7 percent decline in demand stemming from the

exchange-traded fund

(ETF) outflows outweighed recovery in other segments, specifically an 18 percent uptick in bar and coin demand year-over-year.

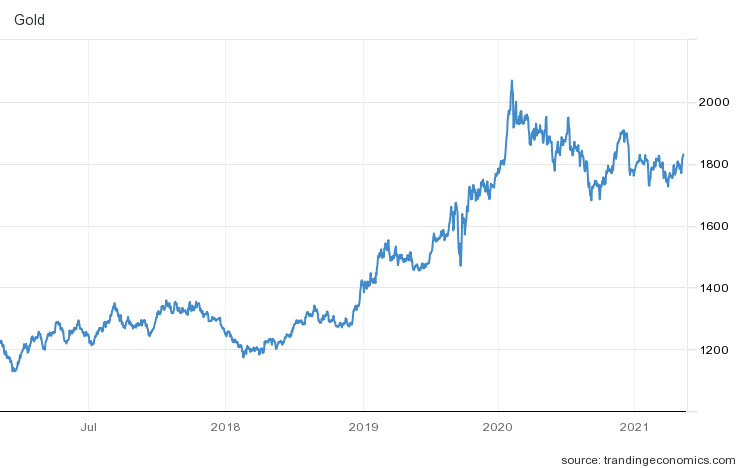

Although gold has slid south since reaching a year-to-date high of US$1,903 on May 28, the metal is still trading in historically high territory. Over the last five years, values have increased 43 percent.

Gold price performance, November 2016 to November 2021. Chart via

Trading Economics

.

Gold price update: Muted performance leads to flat prices

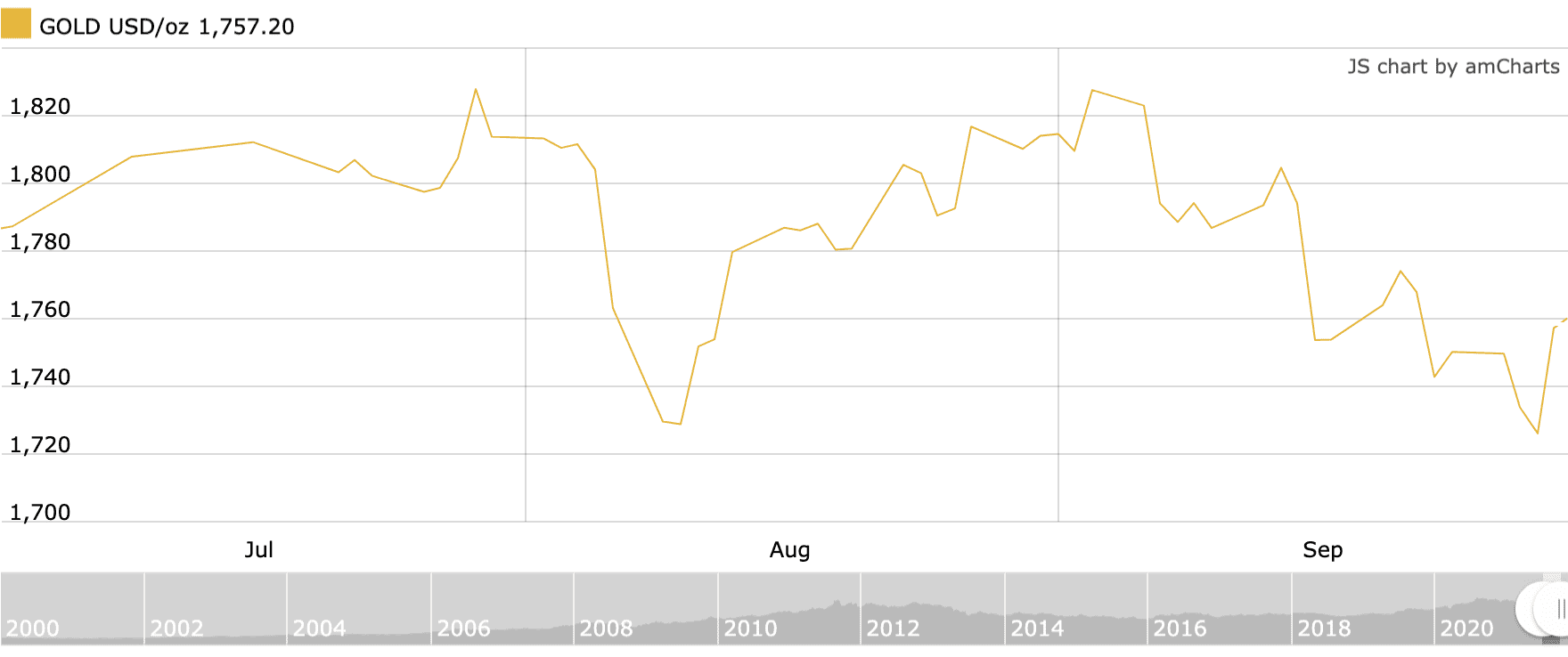

Gold’s muted performance throughout the third quarter has prompted many analysts to say the metal is undervalued. Year-over-year declines also seem disproportionately high because August 2020 saw gold reach an all-time high of US$2,068, while 2021’s Q3 high was US$1,827.

Gold price performance, Q3 2021 price performance. Chart via

Kitco

.

July was the only month out of the quarter to record an uptick (2.2 percent). In August, values trended flatly, and prices contracted by US$70 in September.

“Gold’s performance is consistent with its demand and supply dynamics and a macro environment of higher interest rates and risk-on investor appetite,” a Q3

World Gold Council (WGC) report

states.

Despite being par for the course according to the WGC, many analysts are of the belief that inflation has yet to benefit the price of gold, a factor that could see the yellow metal rally in the months ahead.

“I am surprised gold’s not over US$2,000 an ounce right now,” said Ross Beaty, chairman of Equinox Gold (TSX:

EQX

,NYSEAMERICAN:EQX), during a

September interview

.

Although he was disappointed in gold’s performance over the summer, he did point out that US$1,800 is still very good. However, with all the macroeconomic factors at play, he believes gold should be higher.

Listen to the full interview with Beaty above.

“We are not just threatening higher inflation, we are experiencing higher inflation, and inflation is always a bullish case for gold,” he said, noting that the US dollar and markets will be unable to sustain these current highs indefinitely, and are likely to “crack,” aiding in a gold price uptick.

Gold price update: ETF outflows drive declines

Declines in ETF holdings were another factor that weighed on gold’s ability to sustain price growth. Total gold demand for Q3 was 831 tonnes (t), a 7 percent year-over-year decline.

“This drop was almost exclusively driven by ETFs — which swung from very large inflows in Q3 2020 to modest outflows this year — overshadowing strength in other sectors of demand during the quarter,” the WGC report reads. “Small outflows from global gold ETFs (-27t) had a disproportionate impact on the year-over-year change in gold demand, given the hefty Q3’20 inflows of 274t.”

Even though investment demand appears to be a key short-term driver for the gold price, Juan Carlos Artigas, head of research at the WGC, explained it is less impactful on the longer-term price.

“Investment demand does tend to influence, generally, the significant price movements, but we’ve been able to show through our historical analyses that the gold price reflects the balance of demand and supply — and when I say demand, I mean of all sectors,” Artigas said.

“So, while in the short term, if you look at the performance in a day, in a week, in a month, most of the drivers of gold may be linked to investment demand and trading and so on, once you start to look at a slightly longer period, whether it is over a year, then the other (demand) sectors do contribute.”

The 7 percent Q3 dip in gold demand was offset by a supply contraction. While mine production has steadily increased since January — adding 5 percent by October — a 12 percent decline in recycling led to an overall 3 percent drop in total supply.

Although investment demand contracted, the other pertinent sectors saw growth in demand.

“Jewellery,

technology

and bar and coin were significantly higher than in 2020,” the WGC report states. “Modest central bank purchases were a solid improvement on the small net sale from Q3’20.”

Gold price update: Tailwinds ahead?

Gold’s lackluster Q3 performance is likely to be a launching point for higher prices in Q4 and beyond. The US Federal Reserve’s November announcement, which will see bond buying decrease in the coming months, could be the first catalyst to gold’s uptick.

“The good news is once we see some actual action in regard to Fed tightening, that typically marks a bottom in the gold price, and the

silver

price as well, because the speculators, having bought the rumor of Fed action, then sell the news,” Brien Lundin, editor of the Gold Newsletter, said during an

August interview

with the Investing News Network. “That releases some of the selling pressure, some of the shorting pressure on the metals. So that typically marks a bottom.”

Listen to Lundin discuss the

precious metals

market and what supercycles are ahead.

Following the November 3 decision from the Fed, which said it will begin reducing the monthly pace of its net asset purchases by US$10 billion for Treasury securities and US$5 billion for agency mortgage-backed securities, the gold price rallied above US$1,800.

Values rose from US$1,761 on November 3 to US$1,818 on November 5, a 3.19 percent increase.

“The long-term picture is good, I’m still very bullish and positive on that,” said Lundin. “But for gold its near-term future is much more uncertain than its long-term future. I think we can all be fairly confident that the gold price is going to be much higher two, three, four and five years down the road.”

Marc Lichtenfeld, chief income strategist at the Oxford Club, pointed out that gold’s price depression corresponds with upward momentum in the larger stock market.

“Other than the occasional big price decline that lasts a day or two, the market’s still in a broad uptrend and there’s kind of no reason to think it’s going to stop for awhile,”

said Lichtenfeld

.

“We had interest rates starting to move higher and then they plunged, keeping investors in stocks and making stocks really the only place to go for the immediate future.”

Hear Lichtenfeld’s thoughts on market dynamics and what will propel gold higher.

“I don’t see anything changing unless we do see some kind of dramatic event out in the world like we saw with COVID-19 or something,” Lichtenfeld said.

The role of gold as a hedge against uncertainty may come more into focus as the end of the year approaches and economies prepare to revise monetary policy. However, as the WGC’s Artigas explained, interest rates could counter some of that upside.

“Gold still can face headwinds from potentially higher interest rates,” he said. “The opportunity cost of holding gold is one of the drivers of performance, and especially in the short and the medium term, interest rates tend to influence gold’s behavior significantly, especially in a period where investors are looking to understand how central banks will behave.”

Artigas went on to say that central banks are integral players in the gold ecosystem and are an important factor in the long-term performance of the dual metal.

The third quarter saw central banks continue to be net buyers of gold for a 12th consecutive year, although there were a few months in recent years where the institutes were net sellers. According to the WGC, global reserves grew by 69 tonnes during Q2 and have added almost 400 tonnes year-to-date.

While analysts and market watchers are divided about which factors led to gold’s weak performance in Q3, the consensus is still that gold is positioned to profit from inflation and risk mitigation.

“A general malaise appeared to have taken hold in financial markets during Q3, particularly during September,” the WGC’s Q3 overview concludes.

“Seeing bonds and equities fall together (-4.7 percent and -0.9 percent respectively) runs counter to the experience investors have grown used to for over two decades. Should that continue with gold picking up steam, it could boost gold’s appeal as a risk hedge going forward.”

Don’t forget to follow us

@INN_Resource

for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.